User Help System

Create New Account

Use the Account function to search, create and manage clearing and trading accounts (including trading sub-accounts).

The following instructions illustrate the process to create an account.

Account Creation Overview

- Create New Account button

- Trading Account / Trading Sub-Account (if applicable)

- Select Service:

- CME Direct (CME Globex), CME ClearPort/Platform:

- Market Type Permissions

- Product Permissions

- Broker & Dual-Sided Submitter Permissions

- Credit Controls

- Inline Credit Controls (CME Globex), includes Spot FX+: Execution Firm(s), Credit Controls

- Straight-Through Processing

- Save and Activate account (or create as Inactive to finish later)

- To Create an Account:

Before creating a new account, perform an account search to ensure it doesn't exist.

Clearing members assume financial and performance responsibility for all transactions executed through them and cleared by CME Clearing whether it is for the account of a customer, member, or their own account.

The alphanumeric identifier for the account that is unique at the firm.

- CME ClearPort: Up to 20 characters.

- CME Globex (CME Direct or ICC): Up to 12 characters.

If more than 12 characters are entered, CME Globex service will not be available for selection.

The following special characters (including position) in the account number may restrict services from selection.

|

Special Character |

Description |

Available |

Restricted |

|

! |

exclamation |

ClearPort |

first: CME Direct, ICC (CME Globex) |

|

# |

number/hash |

ClearPort |

first: CME Direct, ICC (CME Globex) |

|

$ |

dollar |

first: ClearPort/Platform, 2nd through last: all |

first: CME Direct, ICC (CME Globex) |

|

+ |

plus |

2nd through last: all |

first: CME Direct, ICC (CME Globex) |

|

& |

ampersand |

2nd through last: CME Direct, ICC (CME Globex) |

first: all, any: ClearPort |

|

* |

asterisk |

first: ClearPort |

CME Direct, ICC (CME Globex) |

|

= |

equal |

CME Direct, ICC (CME Globex) |

ClearPort |

|

^ |

caret |

||

|

( |

left parentheses |

||

|

) |

right parentheses |

||

|

_ |

underscore |

||

|

@ |

at |

||

|

% |

percent |

||

|

{ |

left brace |

||

|

} |

right brace |

||

|

[ |

left bracket |

||

|

] |

right bracket |

||

|

| |

vertical bar |

||

|

\ |

backslash |

||

|

: |

colon |

||

|

; |

semi colon |

||

|

" |

double quote |

||

|

' |

single quote |

||

|

< |

less than |

||

|

> |

greater than |

||

|

, |

comma |

||

|

. |

period |

User specified identification details.

The Trading firm or LEI owner of this account.

If the clearing account is designated as Delegated Intermediary (DI); specify by the clearing member firm. Additional details are inherited from Trading Account Owner.

DI (parent) accounts cannot be updated via Bulk upload.

Enter the name in the field; available choices appear based on the partially entered name.

For DI and sub-accounts: If an asset manager firm is assigned to the clearing account, trading sub-accounts cannot be created and the DI selection will not be available.

Required when shown.

Appears when a dynamic (not registered) owner firm is specified.

Indicates whether the account represents customer segregated funds or house funds.

CTI1 - An individual member trading for her or her own account, CTI2 - A member firm trading for its proprietary account, CTI3 - A member firm trading for another member, CTI4 - All other individuals.

Enables the account for the Portfolio Margining program for futures.

Specified by the clearing member firm administrator, instead of Asset Manager.

Enables customer accounts to aggregate trades to calculate OTC trade cross-account margin offsets. The Margin Owner field specifies the registered owner firm.

- SELF: Non-CME ClearPort accounts use Self, which assigns the same account number as the owner.

- Specify Margin Account: Associate accounts with clearing member, beneficial owner, designated margin account.

- Margin multiple accounts to same owner firm: For CME ClearPort accounts only, multiple accounts, with different Owner Firms, can use the same Margin Account.

The accounts must be associated with the same Clearing Member and the Owner Firms for both accounts must use the same LEI.

For detailed instructions by service, refer to:

- For Step 1: Setup, Enter the iLink Session ID(s) to enable.

The iLink Session ID (also known as SenderComp) obtained from Global Account Management is used for in-house brokerage purposes, is submitted with trades, and associated with Clearing Member firms that appear with the selection.

Clearing Firms can assign a default iLink Session ID / SenderComp for in-house Broker entities.

Note: If an iLink Session ID is not selected, a dialog appears and must be acknowledged before proceeding with account setup.

- None: Submitting orders for this Market Type, including all Products is restricted.

- Specific: Requires selection of (step 3) product permissions.

- All: Enable order submission for all products in the selected market type.

Note: Specific and All, requires setting credit and long / short quantity limits (step 5); configured with the Credit Controls function.

- (If Specific was selected for at least one product in the previous step), select Step 3: Product Permissions.

From the Available Products, add products (Add  / Add All

/ Add All  ) the account can trade.

) the account can trade.

To find a specific product, enter the symbol or name (including partial) in the search field.

or, Remove:  / Remove All:

/ Remove All:  from the Selected Products list.

from the Selected Products list.

- For Step 4: Broker & Dual-Sided Submitter Permissions, specify firms authorized to operate and submit orders for this account.

- Currency - Select the currency denomination.

- Credit Limit (required) - The entered amount is denominated by millions in the selected currency.

- Max Qty Long / Short - The default is unlimited. Pending entries are indicated by green.

Additional Options

- Permissible Products - Show all products tradable in this account / Show Products with individual limits - Show products with specific limits.

- Set All Unset Limits to Zero: Enters 0 for all Max Qty fields not already entered.

- Search - Filter to products that match the entered symbol and/or name.

Additional Information

- Margin Usage - Amount (of the RAV limit) used.

- Remaining Margin - Of the total available RAV limit.

- % Margin Used - Margin Usage expressed as a percentage of RAV limit.

- Max Margin Usage - Maximum utilization for the day. View available credit to determine if action is necessary.

- Export Max Margin Usage Report(

) - View historical Max Margin usage and end of day RAV limits.

) - View historical Max Margin usage and end of day RAV limits.

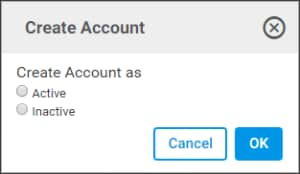

- Select Save, then finalize account creation by creating as Active or Inactive.

Note: To activate the account later, search for the inactive account, go to the Account Settings page, then select Activate.

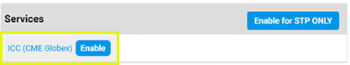

ICC (CME Globex)

- For Step 1: Setup, Specify the Execution Firm(s)* to associate with the account.

As you type, matching execution firms appear in a list; select to add.

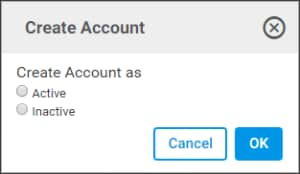

- Select Create, then specify whether to create as Active or .

Note: To activate the account later, search for the inactive account, go to the Account Settings page, then select Activate.

- To complete account creation, go to Managing ICC Credit Controls and set Clearing Member and Execution Firm product limits.

ICC (CME Globex) does not require Market / Product / Broker & Dual-Sided Submitter permissions.

- ICC order management uses firm-wide policy settings to manage maximum allowable product limits.

To manage order handling from unregistered accounts or for products with unset limits go to Entity Risk Management - Policy & Threshold Settings.

Spot FX

- Specify Execution Firm(s)*.

As you type, matching execution firms appear in a list.

- Select Enable, then specify whether to create as Active or .

Note: To activate the account later, search for the inactive account, go to the Account Settings page, then select Activate.

- To complete account creation and activation, view Entity Risk Management - Spot FX+ instructions to view details on linking Trading Firms and setting Spot FX Credit Controls (via ICC).

Spot FX+ does not require Market / Product / Broker & Dual-Sided Submitter permissions.