User Help System

Credit Controls

Clearing Member and Execution firm administrators can use the Credit Controls function to manage CME Globex, CME ClearPort and CME Direct account level credit (preferred currency and maximum credit limit) and order submission (maximum permissible long / short) limits, for a product group and individual products.

Trader / Trader Risk Administrators can use Credit Controls to view and manage risk settings, including credit and long / short quantity limits.

Order handling:

- Credit limit checks utilize top of day trading activity; starts flat each trading day.

- Orders that are within limits are approved for execution.

- CME Globex trades, submitted using CME Direct, can be viewed in Firmsoft.

- Orders are rejected if they contain restricted products or requested quantities exceed limits.

- Margin rates and intra-commodity spread credits are used to determine credit usage, by product and type of trade.

- Completed orders are viewable in Front-End Clearing (FEC+).

- Options product limits are set independently of futures and are subject to overall credit limit.

Rejected order handling: An authorized clearing / execution firm administrator must increase the limit and / or configure additional products.

Available functions:

- Managing Account Credit Controls

- Calculating / Setting Option Limits

- Account Credit Control Models

- CME ClearPort Product Position Limit Checking

Managing Account Credit Controls

- To manage account credit controls:

Users can specify the Currency, Credit Limit, Maximum Quantity Long / Short Limits (product quantity limits are not required for CME ClearPort).

- After selecting a Service and specifying Markets, Products and Brokers & Dual-Sided Submitters, go to the Credit Controls page; available for CME Direct (CME Globex) and ClearPort Clearing.

- Specify the Currency and Credit Limit (CME Direct) / RAV Limit (CME ClearPort) and product limits (Maximum quantity long / short).

Margin rates and intra-commodity spread credits are used to determine credit usage, remaining credit and percent used; by product and type of trade.

For option limits the system uses the (futures equivalent) most restrictive of credit), product permissions, long/short product limits.

- CME Direct - Credit Controls: Credit Limit is required.

- CME ClearPort - Credit Controls: RAV Limit is required.

Note: To assist in limits setting, select  to view the maximum margin usage for the past three months.

to view the maximum margin usage for the past three months.

- Inline Credit Controls (ICC): (optional) Specify product level Clearing and / or Execution Firm position limits.

See also: ClearPort Product Position Limit Checking

- For the Permissible Products field, select from available options:

- Show all products with unique limits: Filter the Product list to products that have user specified limits.

- Show all products tradable in this account: View all authorized products, via Market Types - Available Products.

Note: For Globex ICC only: Default value is Not Set, which uses the Globex Admin Policy settings to determine order entry and trading permission.

Admin Settings - Unset Limit Rule: When limits are not set (by either Clearing Member or Execution Firm) for the specified account, the account is limited to trading products within the overall firm Credit Limit.

Additional considerations: See also: Calculating option limits.

- To finalize Credit Control settings, select Save.

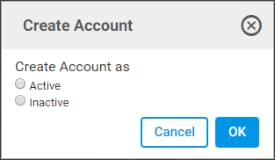

- (For new / pending accounts) On the account creation dialog that appears, select an account creation option:

Create Account as:

- Active: Finalize credit controls and activate the account. Additional configuration, for other applications / services, may be necessary.

- Inactive: Finalize credit controls, but do not activate the account. Additional configuration can be performed or the account configuration can be used as the basis for additional related accounts (via the Account Copy function).

Note: To activate the account later, search and select the inactive account.

From the Account Settings page, select Activate.

Additional Options:

- Manage Spot FX Credit Controls

- Calculating / Setting Option Limits

- Account Credit Control Models

- Product Position Limit Checking

- Futures Products

- General

- Option Products

Additional Resources: