User Help System

Creating FX Link (Spot FX) Account

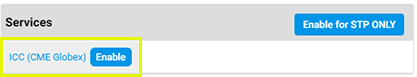

The following instructions illustrate the process to create a clearing account, entitled for Inline Credit Controls (ICC) and used for Spot FX (FX Link).

After creating a ICC enabled account, FX Link (Spot FX) require a Central FX Prime Broker to use Entity Risk Manager to associate (link) a trading firm with the CME Globex Executing firm(s).

Account Creation Overview:

- Clearing Account Settings: Clearing Firm, unique account number, relationships to entities, additional account configuration.

- Execution Firm(s): Entity authorized to use the account for order submission (trade).

The Execution Firm ID is three alphanumeric characters. Sometimes this is the same as the Clearing Firm ID. Executing Firm ID is also called: Execution Firm, Executing Firm, CME Globex API, CME Globex API ID, Trading Member Firm (TMF), Trading Firm and Badge Firm.

- Credit Controls: Set account level product trading limits.

For additional FX Link (Spot FX) configuration, go to Entity Risk Management.

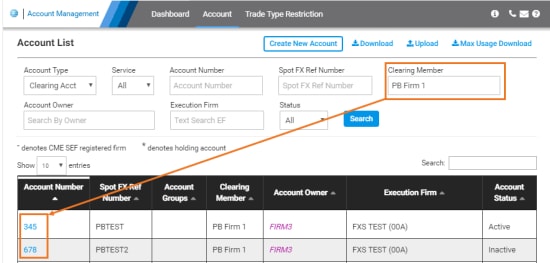

- From Account Management Service, perform an account search.

If the account does not exist, select Create New Account.

- On the page that appears, specify Clearing Account Settings.

Note: Required fields are indicated by a red asterisk (*).

The Clearing Account Settings pane includes a button  to minimize its appearance.

to minimize its appearance.

Example: ICC (CME Globex) and Spot FX enabled accounts do not require Market / Product / Broker permissions.

If an authorized Spot FX Prime Broker Firm is selected, the field name also updates. Prime Broker firms assume financial and performance responsibility for all transactions executed through them and cleared by CME Clearing whether it is for the account of a customer, member, or their own account.

The alphanumeric identifier for CME ClearPort or CME Globex accounts.

- CME ClearPort: Up to 20 characters.

- CME Globex: Up to 12 characters.

Do not use the following special characters in the first, second or last position.

|

@ |

at |

|

% |

percent |

|

^ |

caret |

|

& |

ampersand |

|

( |

left parentheses |

|

) |

right parentheses |

|

_ |

underscore |

|

= |

equal |

|

{ |

left brace |

|

} |

right brace |

|

[ |

left bracket |

|

] |

right bracket |

|

| |

vertical bar |

|

\ |

backslash |

|

: |

colon |

|

; |

semi colon |

|

" |

double quote |

|

' |

single quote |

|

< |

less than |

|

> |

greater than |

|

, |

comma |

|

. |

period |

|

space |

User specified identification details

The Trading firm owner of this account. Available if the clearing account is designated as Delegated Intermediary (DI); specify by the clearing member firm. Additional details are inherited from Trading Account Owner.

DI (parent) accounts cannot be updated via Bulk upload.

Enter the name in the field; available choices appear based on the partially entered name.

For DI and sub-accounts: If an asset manager firm is assigned to the clearing account, trading sub-accounts cannot be created and the DI selection will not be available.

Indicates whether the account represents customer segregated funds or house funds.

CTI1 - An individual member trading for her or her own account, CTI2 - A member firm trading for its proprietary account, CTI3 - A member firm trading for another member, CTI4 - All others individuals.

Enables the account for the CME Portfolio Margining program for futures

Specified by the clearing member firm administrator.

For CME ClearPort, this enables multiple customer accounts to aggregate trades for cross-account margin offsets for OTC trades.

To assign accounts to a margin account, ensure that:

Accounts are associated with the same Clearing Member Firm, beneficial owner.

CME ClearPort service is enabled for the accounts.

For non CME ClearPort accounts, the margin account is Self, which assigns the same account number as the owner.

Spot FX

- Specify Execution Firm(s)* details.

As you type, matching execution firms appear in a list; select to add.

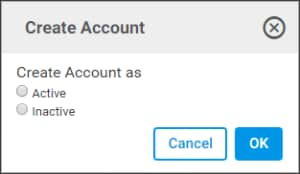

- Select Create, then specify whether to create as Active or .

- To complete account creation and activation, view Entity Risk Management - Spot FX instructions to view details on linking Trading Firms and setting Spot FX Credit Controls (via ICC).

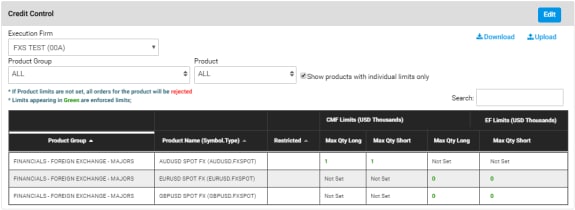

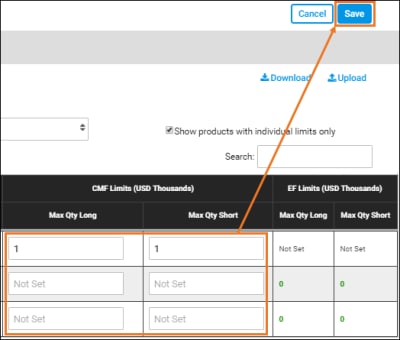

Managing Spot FX (FX Link) Account-Level Credit Controls

Clearing Member firm administrators can use the Credit Controls function to manage Spot FX (FX Link) account level credit controls, for FX Basis spread transactions.

Limits are enforced as top day net contract equivalent position for each product, with ability to set long and short net limits.

To enforce CME Globex limits, the notional limit values are converted to the futures contract quantity equivalent, which is the platform trading increment for both legs.

- To manage account credit controls:

Users can specify the Currency, Credit Limit, Maximum Quantity Long / Short Limits (product quantity limits are not required for CME ClearPort).

- From the Account List page, perform a search for a Spot FX (FX Link) account, then select the authorized account.

- On the Account details page - Credit Controls pane, select Edit.

- Show all products with unique limits: Filter the Product list to products that have user specified limits.

- Show all products tradable in this account: View all authorized products, via Market Types - Available Products.

Note: For Globex ICC only: Default value is Not Set, which uses the Globex Admin Policy settings to determine order entry and trading permission.

Admin Settings - Unset Limit Rule: When limits are not set (by either Clearing Member or Execution Firm) for the specified account, the account is limited to trading products within the overall firm limit.

- To finalize, select Save.

Additional Services: