User Help System

Managing ICC Credit Controls / Product Limits

Clearing Member, Execution firm, Clearing Firm Account administrators can use the Credit Controls function to manage ICC (CME Globex) / Spot FX product level credit controls and maximum long / short order submission limits.

Trader / Trader Risk Administrators / can use Credit Controls to search and view risk settings, which includes credit and maximum permissible long / short quantity limits.

Order handling:

- Credit limit checks utilize top of day trading activity; starts flat each trading day.

- Orders that are within limits are approved for execution.

- Orders are rejected if they contain restricted products, requested quantities exceed limits, originate from unregistered accounts or for products with unset limits.

- Options product limits are set independently of futures and are subject to overall credit limit.

- Active Delegated Intermediary (parent) accounts cannot be updated via upload.

Based on ICC Policy settings and product limits, rejected orders may require an authorized clearing / execution firm administrator to modify product limits or ICC policy settings.

- To manage ICC account credit controls:

- To set ICC product limits, search and select the account.

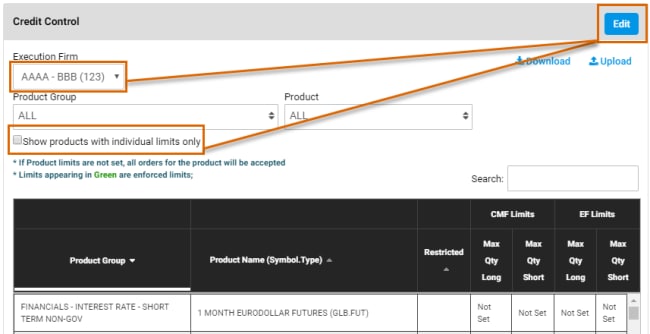

- Select the ICC (CME Globex) tab then select Edit.

- On the Credit Control pane that appears, select Edit, then select the Execution Firm to manage.

If individual product limits are set, results appear in the table below.

- To view and manage additional products, deselect Show products with individual limits only.

- For each product that will be authorized, specify the Max Qty Long / Max Qty Short.

For ICC (Globex ICC): Default Globex Admin Policy permits order submissions when product limits are Not Set. All accounts are limited to trading products within the overall firm Credit Limit; even when limits are not set.

- To finalize ICC Credit Control settings, select Save.

Additional functions: