User Help System

Instruments Preferences

Use the Instruments tab to specify preferences (e.g. Max Order Size, Price Input, Slippage) for each instrument.

Search Bar

Use the Search bar to search for a specific instrument in the table. The search tool uses predictive search that populates as you type. The instruments in the table are filtered incrementally as you enter text in the search.

Instrument Table

Use the Instrument Table to view available instruments by name, type and Maximum Order Sizes, based on the selected Search filters. Click a specific row to select a record. Any change to a parameter in this tab is applied to the selected Instrument. Parameters include Pair (Instrument), Type (Security Type), and Max Order Size (max order size in Millions).

Preferences Applicable to All Cards and Market Segments

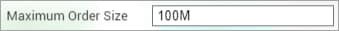

Maximum Order Size

Use this setting to configure a maximum order size. An error will display when inputting a trade quantity for an order that is greater than the Maximum Order Size. This feature is a safety mechanism to avoid "Fat Fingers" (unintentionally inputting a very large quantity).

Maximum Order Size Configurations

- Field Input uses digits only (0-9)

- Value must be:

- >= Best Dealable Trade Size

- >= Regular Trade Size

- When the input value is not valid then:

- The input field is outlined in red

- The invalid value is not saved

- When focus shifts from the field, if no valid value is available, the system uses the last valid value

- When the Maximum Order Size input value is valid:

- The new value applies to the Active instrument throughout the system (regardless of market segment, Price Card Type, Order Type, Form etc...)

- The new value is persisted

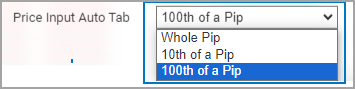

Price Input Auto Tab

Use this setting to configure how the cursor navigates (tab) to the next field in the sequence when inputting pips in the price input field for instruments with pip decimal.

Select from the dropdown menu:

- Whole Pip - The cursor moves to the next field automatically after the last whole pip digit is entered. Any decimal pip (if required) is padded with zeros ("0" or "00")

- 10th of a Pip - The cursor moves to the next field automatically after tenth of a pip digit is entered. For Quarter Pip instruments last digit (100th of pip precision) will be automatically entered as 0 or 5 based on entered decimal (0, 2, 5, 7) producing quarter pip increments of 00, 25, 50, and 75.

- 100th of Pip -Available for quarter-of-a-pip instruments only. The cursor moves to the next field automatically after all of the price digits (including last digit of the Quarter Pip price) are entered.

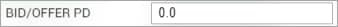

BID/OFFER PD

Use Pip Discretion (PD) functionality to add aggressive elements into passive Bids and Offers. Aggressive action will be triggered when opposite side price moves within the specified PD range of a passive order price. Outstanding balance on the passive order will be automatically reduced.

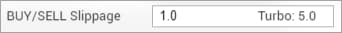

BUY/SELL Slippage and Turbo Slippage

Slippage and Turbo slippage are two different mark-ups applied to BUY/SELL orders.

Turbo slippage value for each instrument is derived from specified Slippage and Turbo Multiplier values and is displayed as a read-only value. Users select a generic Turbo multiplier that the Slippage for each instrument is multiplied by.

When an instrument has different pip increments for Direct and Market, then the lowest granular value is applied. See Slippage Switch Preferences for more details.

FX Spot: Market Options

The following parameters can be configured for FX Spot: Market Card, Metals: Market Card, and NDF Market Card:

- Best Dealable Trade Size (inner price)

- Outer Price (regular price)

- IOC (Immediate or Cancel) or FOK (Fill Or Kill) can be set as the default BUY/SELL order type for all pairs on EBS Market

FX Spot: Mixed Liquidity Card Options

The following parameters can be configured for FX Spot: Mixed Liquidity and Metals: Mixed Liquidity cards:

- Volume Ladder Sizes

- Use the Maximum Order Size Override to set a separate maximum order size for the Mixed Liquidity card. This allows for a higher maximum order size when trading via Market Cards while preventing large sized trades via EBS Direct.

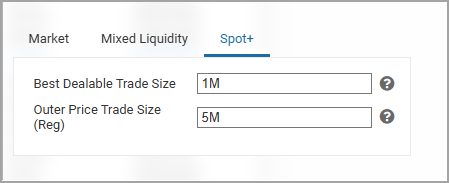

FX Spot +

The following parameters can be configured for FX Spot + currency pairs - EUR/USD, GBP/USD, AUD/USD, NZD/USD, USD/JPY, USD/CAD, USD/CHF, and USD/MXN:

- Best Dealable Trade Size

- Outer Price Trade Size (reg)