User Help System

Slippage Switch and Slippage Preferences

Slippage is an additional price mark-up expressed in pips and applied on top of the specified order price. Applying slippage to an order price increases probability of a fill, however, under some circumstances it may result in an order getting filled at a worse price within the specified slippage range.

Turbo Slippage is intended to maximize fill probability in very fast-moving markets, and applies a multiplier to the normal slippage value.

With Slippage enabled, the Slippage Indicator displays on the Price card beside the name of the selected instrument.

This default value is set per product in User Preferences. Use the Slippage Switch at the top of the application to quickly switch slippage for all Orders Off or On, or enable Turbo mode.

When an order form is open, with Slippage enabled (On or Turbo), the Slippage field appears pre-populated with the default slippage for this instrument. This value can be adjusted before submitting an order.

Manage Slippage settings from two areas within User Preferences. In the Instruments tab, users can set the normal Buy/Sell Slippage per currency pair. Slippage is set in pips. For example, 1.5 translates into one-and-a-half pip.

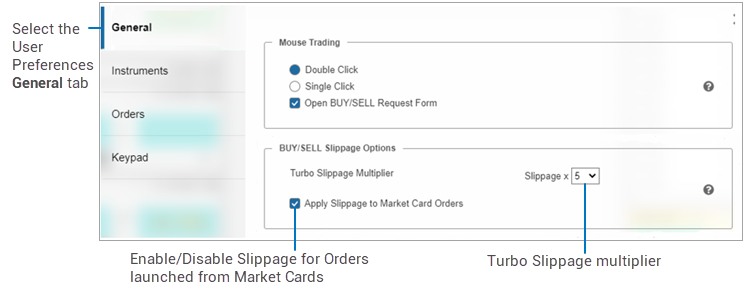

Use the General tab, under the BUY/SELL Slippage Options pane to set the Turbo Slippage Multiplier. The Turbo multiplier applies to all currency pairs.

In addition, slippage can be enabled or disabled for orders launched from Market Cards. If disabled, slippage will not be applied to EBS Market orders launched from Market Cards.

Note: Slippage will still apply to EBS Market orders launched from Mixed Liquidity Cards.