User Help System

FX Spot Market Card

The FX Spot Market Card, Metals Market Card, and NDF Market Card are optimized for professional foreign exchange spot trading on the EBS Market Central Limit Order Book. The FX Spot Market Card provides visibility of EBS Best Dealable price and inventory, as well as an indication of market depth. Dealable prices are based on mutual credit between a trader's firm and other counterparties.

Displayed prices may be from multiple counterparties, but the number of counterparties participating in a price is not displayed. The active Price panel has a yellow background and using trading keys of EBS Keypad will result in trading action from Active panel (see Orders section). A white background indicates that the panel is not active.

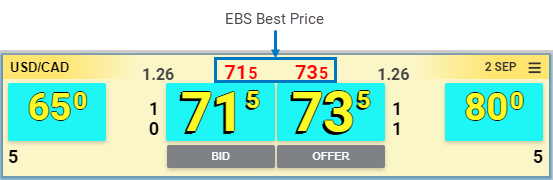

EBS Best Price

The EBS Best Price, shown in red on the Price Card header represents the single best price in the EBS Market for a given instrument pair, regardless of credit. The EBS Best Price is for display purposes only.

Price Tiles

Use price tiles to view Dealable prices and trade on them. Prices are calculated and presented based on the mutual credit with other counterparties and the card configuration.

Each price card has four spot price buttons. For each side of the market (Bid and Offer):

- Inner prices display Best Dealable Prices

- Outer Price display limit price for:

- specific Amount as configured by the user

- specific price range away from Dealable Best as configured by the user (inventory indicator underneath will display available amount at that range)

Best Dealable Prices

The spot price contains the following elements:

The Big Figure represents the first few digits in the price of an instrument based on historical market conventions

- For Bid - displayed in smaller font next to the upper left corner of the inner price tiles

- For Offer - displayed in smaller font next to the upper right corner of the inner price tiles

Pips:

- Pips represent more granular portion of the price based on historical market conventions for each instrument. Some instrument may have fractional pips at the end: e.g. half-pip, quarter of a pip, tenth of a pip.

- Pips display in an outlined yellow digits with shadow

- Traders own price displays in flat white digits (no shadow)

- Fractional pip (when it exists) displays in a small font located on the top right corner of the button

Note: Fractional pips may be hidden from display by selecting the Rounded: Whole Pip option in User Preferences > Market Card – Price Display Options.

Top of Book Inventory

Top of Book inventory indicators displayed to the sides of each of price tiles represent inventory expressed in millions available at the best dealable price. Display of the 2nd level can be disabled from User Settings.

Exact or Cumulative Amount

ToB Inventory displays as either an Exact or Cumulative amount.

Exact Amount

- Displays the liquidity available for at the Best Dealable price level

- When enabled 2nd inventory level displayed below primary ToB inventory indicator displays liquidity at the price level directly adjusted to top of book. 2nd level inventory value can be 0 if no liquidity exists at that price level.

- Lower Liquidity value displays the exact liquidity available for a price level which is 1 min increment away (pairs trading in halves - a half pip away, pairs trading in whole pip - 1 pip away)

Cumulative Amount

Cumulative Amount Inventory Display can be enabled for pairs which have fractional pips (halfs, tens). Visual indication for the "Cumulative Amount" configuration is visible: blue triangles pointing out towards each value.

- displays the aggregated liquidity from ToB price level the next whole pip price

- When enabled in Cumulative Amount mode 2nd inventory level displayed below primary ToB inventory indicator displays liquidity from nearest full pip to the top of book price to the next full pip.

Outside Prices

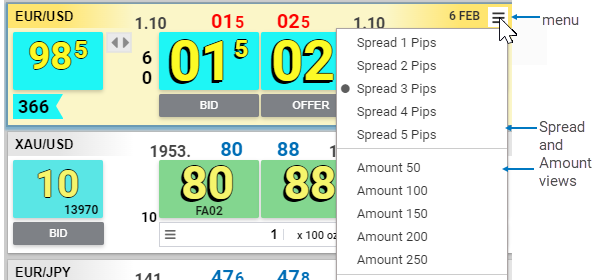

Use the menu button on the market card to change the views.

Amount View

- Select an Amount View from the menu.

- Hover over the Active price card to display the Amount spinners. Use the spinners to change the Amount views for the nearest Reg spot price. The displayed Reg price represents the price level in which the Amount can be satisfied.

Spread View

- Select a Spread View from the menu.

- Hover over the Active price card to display the Spread spinners. Use the spinners to change the spread view for the nearest Reg spot price. The displayed inventory represents the accumulated available amount from ToB price.

Value Date

Located on the left side of the menu button, the Value Date identifies the settlement date associated with today's trading for the Spot currency pair.

Note: To enable, manage, or disable Market Card Slippage settings, refer to Slippage Switch and Slippage Preferences. If trading NDF, Metals, and eFix refer to NDF Market Card, Metals Market Card, and eFix Card.

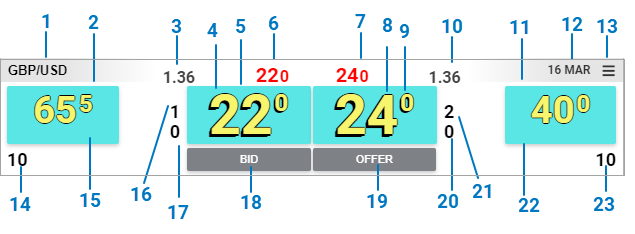

The FX Spot Market Card contains the following elements:

| Number | Description |

|---|---|

| 1 | Currency Pairs selection |

| 2 | Reg Bid spot price button (outside Bid button) |

| 3 | Best Dealable Bid spot price label big fig |

| 4 | Best Dealable Bid spot price button (inside Bid button) |

| 5 | Best Dealable Bid spot price label pips |

| 6 | Market ToB Bid spot price label pips |

| 7 | Market ToB Offer spot price label pips |

| 8 | Best Dealable Offer spot price label pips |

| 9 | Best Dealable Offer spot price button (inside Offer button) |

| 10 | Best Dealable Offer spot price label big fig |

| 11 | Reg Offer spot price button (outside spot button) |

| 12 | Value date label |

| 13 | Menu button |

| 14 | Amount View Bid size indicator |

| 15 | Reg Bid spot price label pips |

| 16 | Aggregated Bid Liquidity for ToB to next whole pip |

| 17 | Aggregated Bid Liquidity for 1 pip away from ToB next whole pip |

| 18 | BID button – triggers a BID form |

| 19 | OFFER button – triggers an OFFER form |

| 20 | Aggregated Offer Liquidity for 1 pip away from ToB next whole pip |

| 21 | Aggregated Offer Liquidity for ToB to next whole pip |

| 22 | Reg Offer spot price label pips |

| 23 | Amount View Offer size indicator |