Energy producers are working to power a fast-moving world. CME Group helps them navigate the risks of volatile oil and natural gas markets. Developing nations are demanding ready access to the energy sources they need to sustain their new levels of economic vitality, challenging what current global resources can realistically deliver.

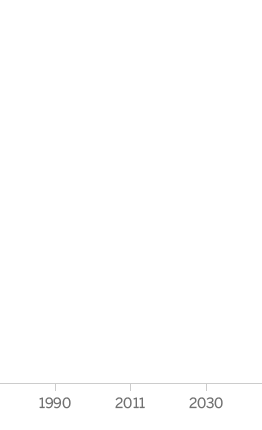

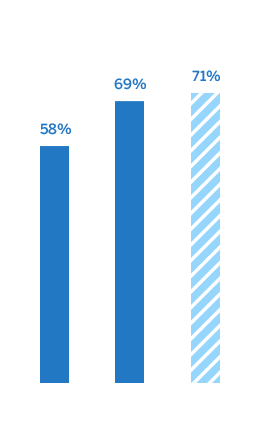

Global energy production by non-OECD* countries

* The Organisation for Economic

Co-operation and Development

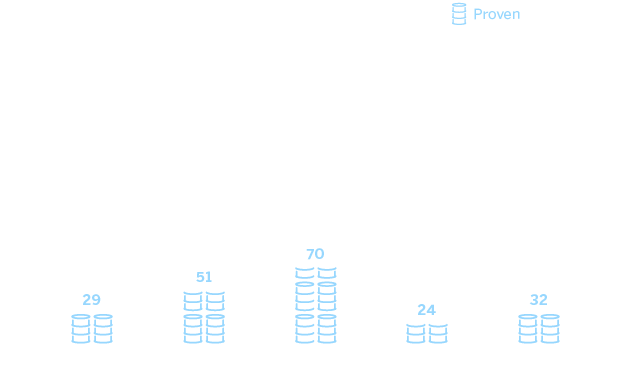

Thanks to technological advancements, the U.S. now has more recoverable oil than any other nation.

In addition to steadily climbing consumption, developing nations continue to account for more and more of the world’s energy production. Meanwhile, in North America, a boom in domestic crude oil production moved the region past Saudi Arabia in 2014, while new extraction technologies have North America on the cusp of taking the lead in global gas production.

By 2040, the developing world will account for 65 percent of the world’s energy consumption.

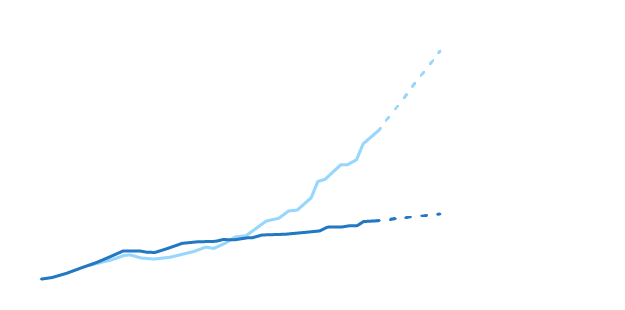

In China, for instance, projections have oil production and consumption both trending upward. However, the pace of consumption is expected to far surpass production, to the tune of more than 11,000 barrels a day by 2020.

To power the energy markets of tomorrow, producers must not only be aware of the risks ahead, but also face them head-on. CME Group plays a central role in helping market participants around the world balance the ongoing dynamics of supply and demand as they face these dramatic and broad-reaching changes.

Where the world comes to manage risk.

As the world’s leading derivatives marketplace, CME Group offers the widest range of global benchmark products across all major asset classes, including futures and options based on interest rates, equity indexes, foreign exchange, energy, agricultural products and metals.