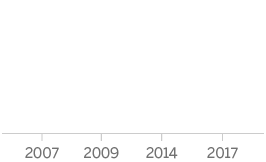

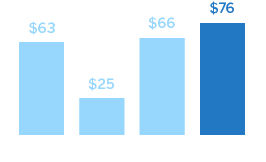

Investment professionals need ways to offer their clients — be they individuals or institutions — the right balance between risk and reward. CME Group helps them manage risk and capitalize on opportunities across major markets worldwide, where the total value of equity investments has reached more than $70 trillion. That’s an increase in value of more than 160% since the 2009 low of $27 trillion.

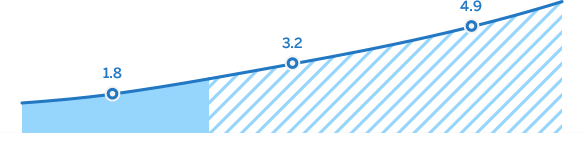

In terms of Purchasing Power Parity, the size of the world economy in 2040 is expected to be 260% of that in 2013.

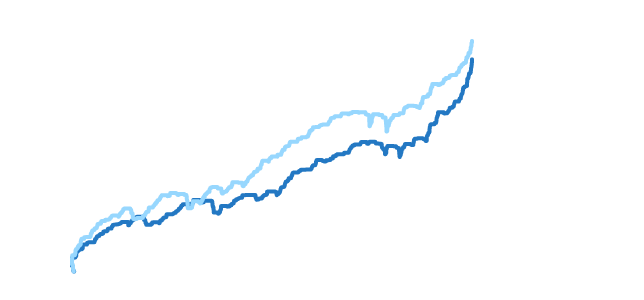

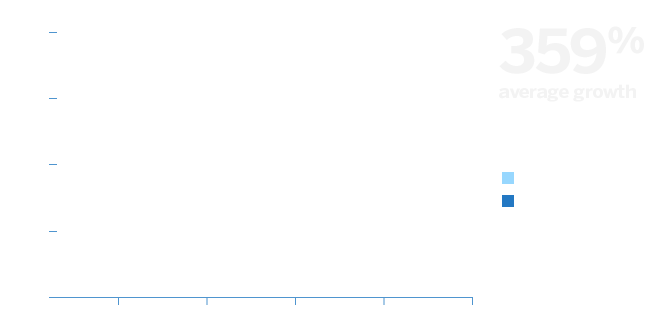

Based on a comparison of index values on 2/23/09 and 1/17/18 the average growth has risen to 359%.

Concurrently, presumed growth in both the global middle class and global equity markets is creating new investment opportunities all the time. Be it an employee planning for retirement or a university managing its endowment, long-term security is key for individuals, businesses, institutions and governments whose progress relies on returns.

A forward-thinking mindset is key to investing in today’s unpredictable economic environment. At CME Group, we give investment professionals and portfolio managers the products they need to effectively manage inherent price risks and plan the future of their funds — helping those they serve benefit from these vital markets.

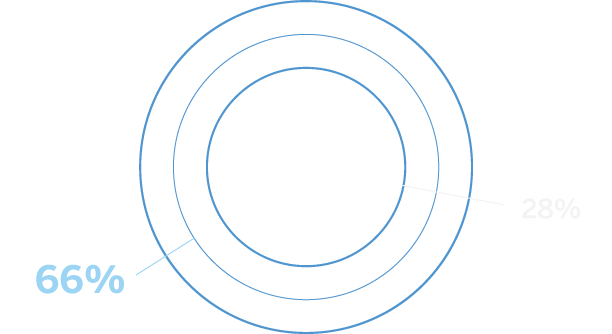

Asia will represent 66% of the global middle-class population and 59% of middle-class consumption by 2030, up from 28% and 23%, respectively, in 2009.

Meanwhile, European and American middle classes will shrink from 50% of the global total to just 22%.

Where the world comes to manage risk.

As the world’s leading derivatives marketplace, CME Group offers the widest range of global benchmark products across all major asset classes, including futures and options based on interest rates, equity indexes, foreign exchange, energy, agricultural products and metals.