Year after year, season after season, our global population increases and food producers have to stretch their resources to keep pace. Farmers, ranchers, producers, processors are being asked to deliver in a world where supply must meet unprecedented demand. CME Group helps these key agricultural players manage the risks they face every day and fulfill the needs of a growing population.

Nine billion people. That’s a big number, and one that’s bound to affect what we pay for food in the future. But it’s just one of a number of other factors.

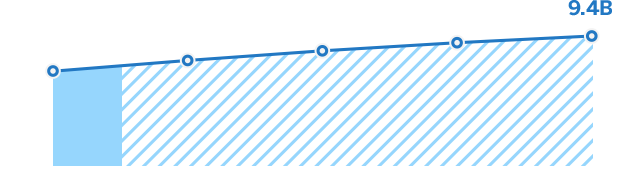

COST BREAKDOWN:

86%

- Food Processing

- Packaging

- Retail Trade

- Food Services

- Energy and Transportation

- Finance

- Weather

- Population/Demand

- Other

14%

- Commodities

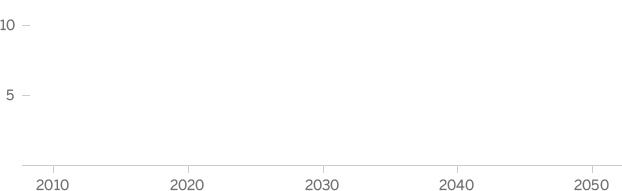

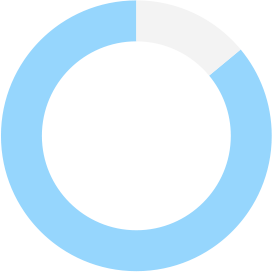

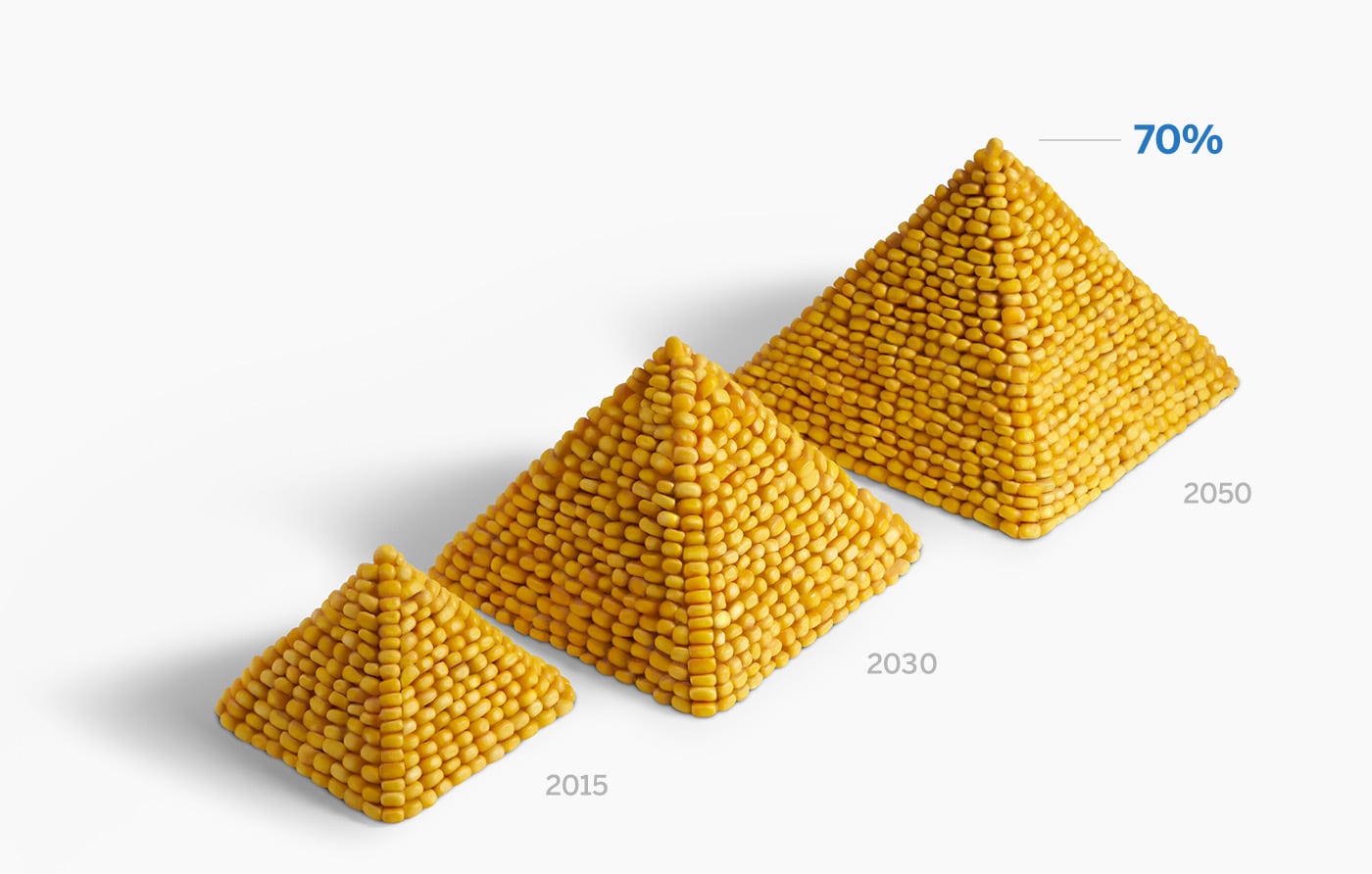

By 2030, feeding everyone will require 50% more food. By 2050, when population is estimated to reach nine billion, that number goes up to 70%.

Decision makers at the forefront of agriculture confront difficult choices every day. The results of these choices will determine businesses’ ability to rise to the challenges presented by a world population that’s marching toward nine billion.

Food production plays an essential role in the global economy. As population growth explodes worldwide, solidifying that role becomes increasingly important. Offering the widest range of agricultural futures and options on futures of any exchange, CME Group allows farmers, ranchers, producers, processors, distributors, packagers, wholesalers and retailers to meet the challenges they see and plan for the ones they don’t.

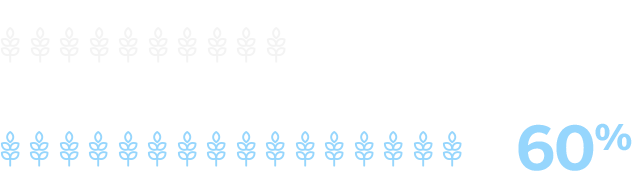

In agricultural products alone, production must climb 60% over current levels to meet global demand by 2050:

Cereal production must increase by 940 million metric tons to reach 3 billion metric tons

Meat production must increase by 196 million metric tons to reach 455 million metric tons

Oil-bearing crops must increase by 133 million metric tons to reach 282 million metric tons

Where the world comes to manage risk.

As the world’s leading derivatives marketplace, CME Group offers the widest range of global benchmark products across all major asset classes, including futures and options based on interest rates, equity indexes, foreign exchange, energy, agricultural products and metals.