- 28 Jul 2021

- By CME Group

Follow the roll

Use our Pace of the Roll tool, to watch the roll evolve in real time – before, during, and after the contracts roll off.

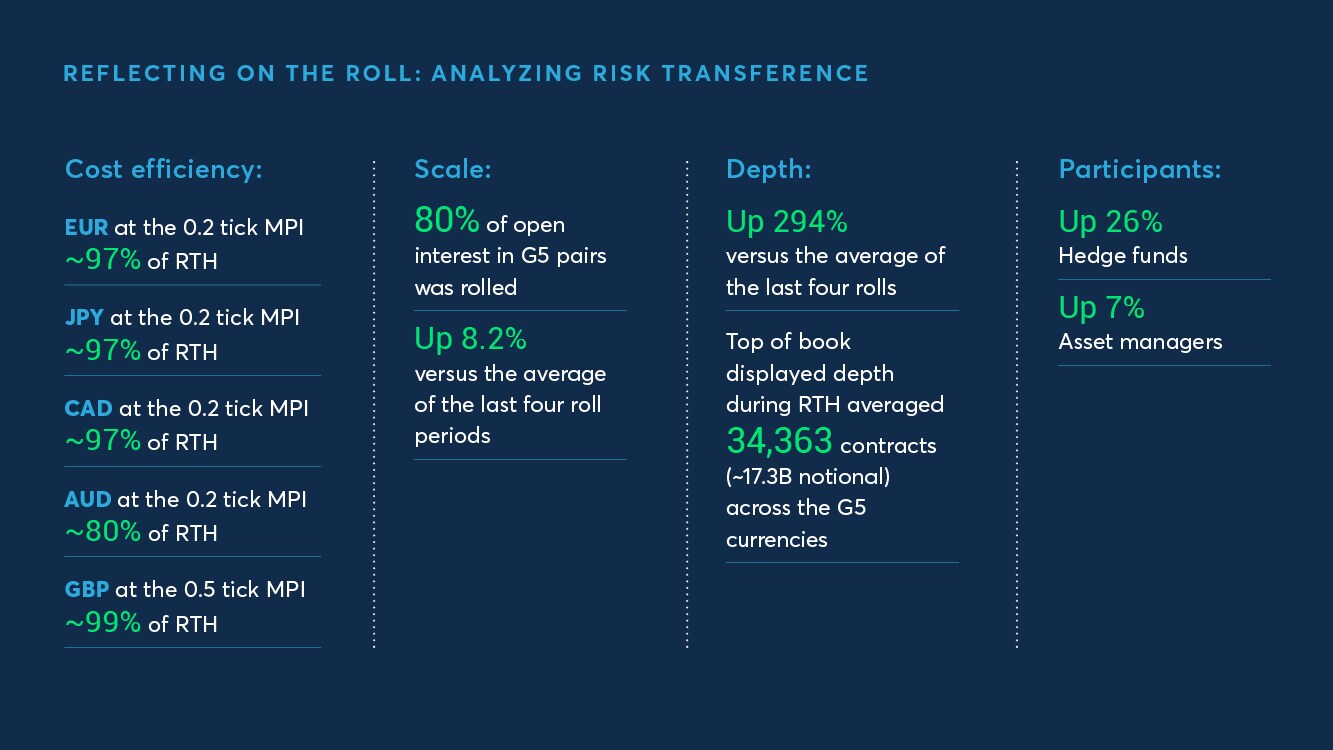

The quarterly roll is critical for customers wishing to migrate open interest, and our intent is to enable a deep and liquid order book that is cost effective for efficient risk transference.

The June roll of FX futures was characterized by substantial improvements in the overall quality of liquidity and improved roll efficiency, as evidenced by increased book depth and increased transference of open interest across all G5 pairs.

Get real-time block alerts sent to your inbox or mobile device. Choose to view block trades in only G10, emerging market, or cross rate currencies, across the entire FX complex, or with correlated asset classes.

CME FX futures and options prices are visible on your Bloomberg terminal using the following Security Identifiers.

| Currency | Futures / Options | Bloomberg Security Identifier |

|---|---|---|

| Australian Dollar | Futures | ADA <Curncy> |

| Australian Dollar | Options | ADmyC <Curncy> |

| British Pound | Futures | BPA <Curncy> |

| British Pound | Options | BPmyC <Curncy> |

| Canadian Dollar | Futures | CDA <Curncy> |

| Canadian Dollar | Options | CDmyC <Curncy> |

| Euro | Futures | ECA <Curncy> |

| Euro | Options | ECmyC <Curncy> |

| Euro / British Pound | Futures | RPA <Curncy> |

| Euro / British Pound | Options | RPmyC <Curncy> |

| Euro / Swiss Franc | Futures | RFA <Curncy> |

| Euro / Swiss Franc | Options | RFmyC <Curncy> |

| Japanese Yen | Futures | JYA <Curncy> |

| Japanese Yen | Options | JYmyC <Curncy> |

| Mexican Peso | Futures | PEA <Curncy> |

| Mexican Peso | Options | PEmyC <Curncy> |

| New Zealand Dollar | Futures | NVA <Curncy> |

| New Zealand Dollar | Options | NVmyC <Curncy> |

| Swiss Franc | Futures | SFA <Curncy> |

| Swiss Franc | Options | SFmyC <Curncy> |

CME FX futures have long represented one of the largest primary markets for price discovery, but the last two years have seen increased adoption of end user customers across both the hedge fund and asset management communities.

Average daily volume YTD 2021 is $74.5B, with open interest at $200B, and during the June roll period we saw ~$1.1T trade – with hedge fund activity up 34% and asset manager activity up 16% versus the average of the last four roll periods.

This adoption of cleared liquidity comes as a complement the OTC market with access to differentiated and cleared liquidity.

Overarching differentiators:

- Removal of counterparty credit risk

- Freed up bilateral credit lines and ability to access liquidity without need for ISDAs

- Access to a differentiated liquidity pool with very diverse LPs

- Alternative to FX prime broker

- Ability to trade passively / use algos, but also to trade on a relationship basis for large trades

Regulatory tailwinds:

- MiFID – best execution easily evidenced by trading in a CLOB

- UMR mitigation – listed FX can help with both the AANA and ongoing initial margin requirements

- G-SIB / SA-CCR – capital efficiencies of futures

Each quarter, we publish The FX Report, which assembles all of the key news, views, and stats the broking community needs to know.