- 22 Apr 2021

- By CME Group

Get the insights you need and the details you want by subscribing to our new complimentary newsletter created in partnership with Macro Hive ‒ the leading independent provider of global macro research and strategy.

Discover what’s occurring in our markets and the marketplace – with a focus on trade opportunities in FX options and in the FX swap market, using FX Link.

The euro tumbled over March but has since rallied over 1%. The good news is that it did not breach 1.1600 during its earlier weakening. That would have broken the lows seen in the last four months of 2020 and possibly opened up the downside. However, the euro remains down by over 2.5% in 2021. So, the jury is still out on the recent rally. In our view, the balance of risks in the near term is for further euro strength for two reasons.

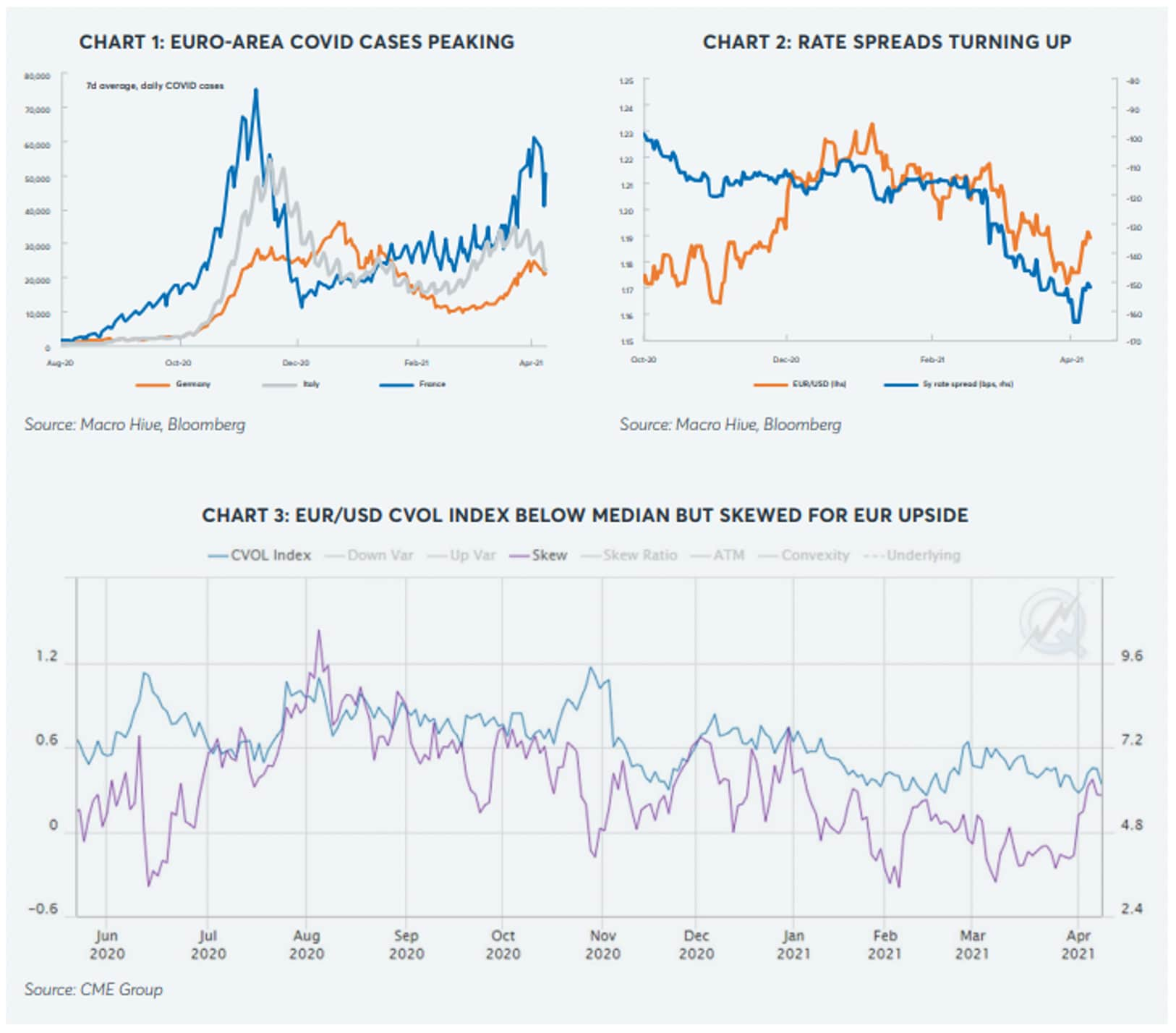

First, the latest wave of COVID-19 cases in the major euro-area countries appears to have peaked (Chart 1). This is likely due to increased lockdown measures. But also, the vaccination rate has started to pick up. In Germany, for example, at the start of March, authorities were vaccinating 200,000 people a day; today it is closer to 400,000 people. Moreover, the EU is expecting the vaccine supply to increase dramatically over Q2. An alleviation in COVID-19 risks should remove some downside pressure for the euro.

Second, US yields surged from mid-February to mid-March. This was largely driven by improving US growth expectations associated with large US fiscal stimuli. US economic data has also been strong, whether PMI or labor market data. However, the rate spreads between the euro area and the US appear to have troughed (Chart 2). This is partly due to better US growth being priced but also better-than-expected euro-area data even with higher COVID-19 cases. Together, these factors could see the euro trade back up to 1.2000 or even 1.2200 in coming weeks and months.

Positioning for Near-Term Euro Strength Through CME FX Options

EUR/USD implied volatility is below its average level for the past few years, according to the CME CVOL Index. However, the volatility skew has risen in favor of near-term strength (Chart 3). This suggests considering options spread trades as well as outright option trades for euro upside. We present two ideas (all priced on 12 April 2021 using indicative prices. Check the CME Vol Converter for equivalent OTC vols for these Listed Options):

- EUR/USD one-month call. We would buy a 1.1900 strike EUR/USD call (EUUK1: 7 May 2021 – roughly one month) for a premium of 0.0070 USD per EUR. The futures reference is 1.1899. The upside is unlimited, but if the euro were to trade to 1.2100, the option would have a 2.9 to 1 payoff. The breakeven would be 1.1970. The worst-case scenario of EUR/USD trading below 1.1900 would see a loss of the premium paid.

- EUR/USD one-month call spread. We would buy a 1.1900 strike EUR/USD call (EUUK1: 7 May 2021 – roughly one month) and sell a 1.2050 strike EUR/USD call (EUUK1: 7 May 2021) for a net premium of 0.0048 USD per EUR. This would reduce the option premium by 31% compared with the outright option stated above. The futures reference is 1.1899, and the high strike option is roughly 20-delta. The maximum payoff would be 0.0150 USD per EUR – equivalent to a 3.1 to 1 payoff. The breakeven would be 1.1948. The worst-case scenario of EUR/USD trading below 1.1900 would see a loss of the net premium paid.

Deciding between these two strategies would depend on the sharpness of any rebound in the euro. A rapid bounce reversing the declines seen in March would suggest favoring the first option strategy; otherwise, the latter may be preferable.

The opinions expressed in this report are those of Macro Hive and are considered market commentary. They are not intended to act as investment recommendations.

Subscribe to Macro Hive

Receive these reports directly in your inbox every other week – and be ready to move when the market does

Each quarter, we publish The FX Report, which assembles all of the key news, views, and stats the broking community needs to know.