- 22 Apr 2021

- By CME Group

Follow the roll

Use our Pace of the Roll tool, to watch the roll evolve in real time – before, during, and after the contracts roll off.

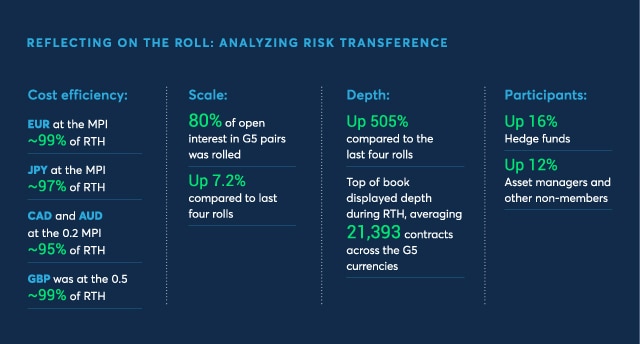

Our goal for the roll is to ensure participants can transfer their positions cost efficiently- measured through bid-offer spread, depth of book and open interest transference.

The March roll period was characterized by further improvements in the overall quality of liquidity and improved roll efficiency, evidenced by increased transference of open interest across four of the G5 pairs.

In November 2020, we reduced the minimum price increment in AUD/USD outrights from one tick (1.0) to half a tick (0.5). This MPI reduction was implemented to further enhance price discovery and lower the cost of trading for current and potential end-users in AUD FX futures.

The increased use of blocks and EFRPs, ex-pit transactions, are a growing trend in our markets that enables participants to access our liquidity and gain the capital and credit efficiencies of our markets, whilst operating like they do in the OTC market – negotiating deals privately with their chosen counterparties.

In Q1 2021, we spoke to four major institutions about why they have increased use of this trading modality

Lee Spicer, BNP Paribas, Global Head F&O High Touch Execution

"With changes in UMRs, we have seen a growing appetite to trade listed FX futures, especially via block markets, which offer additional liquidity to the centralized order books that is more synonymous with existing spot and forward markets.”

Richard Condon, Morgan Stanley, Head of Hedge Fund Sales

"The evolution of EFRPs and relevant use cases amongst institutional investors have expanded exponentially. The value proposition in the FX space is clear – FX EFRPs present an opportunity to pair dynamic OTC execution strategies along with high quality market making, and then wrapping the result in a cleared product.”

Rafael Sogorb Diaz, Santander, European Head of ETD and Equity Structured Product Sales

"As portfolio managers continue to increase their exposure to FX listed derivatives, usage of blocks / EFRPs in order to implement their investment strategies plays a key role.”

Chris Callander, Societe Generale, Head of FX Futures Sales and Trading

"Over the last five years we’ve seen the FX futures ecosystem develop materially, both in terms of the sophistication of existing customers as well as a variety of new participants entering the marketplace.”

Read the full article to understand more of the factors driving these institutions’ decision making – and how our recent rule change, to standardize our block reporting times across our whole futures complex – is only accelerating this trend.

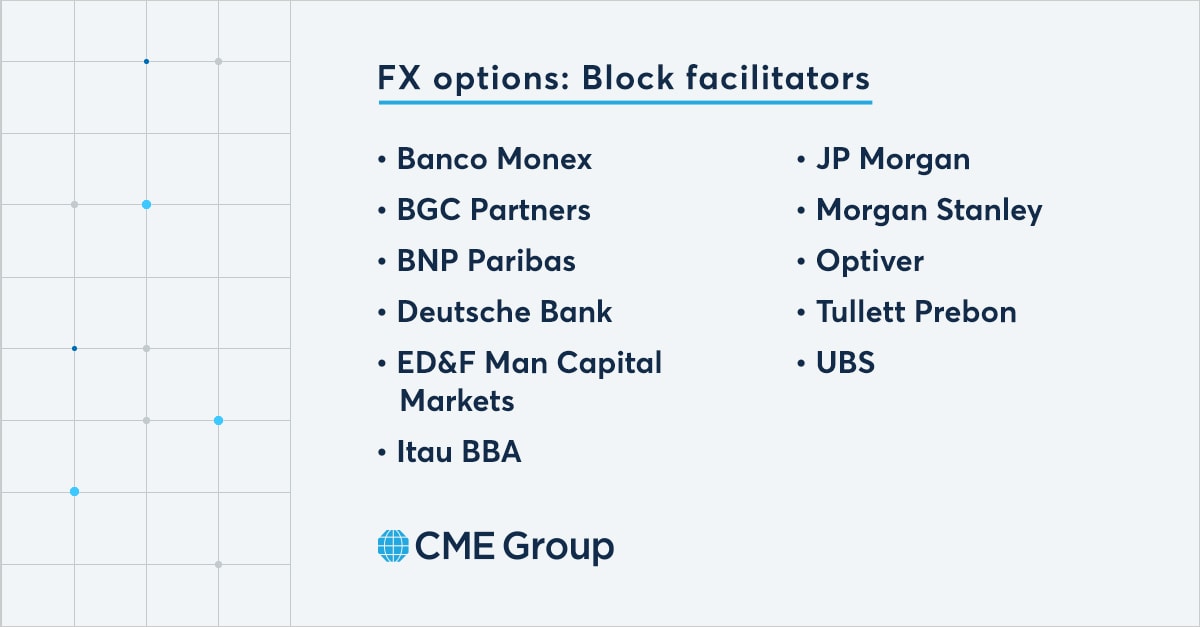

Blocks are available in futures and options and are facilitated by a number of institutions in specific currencies, time zones, and products.

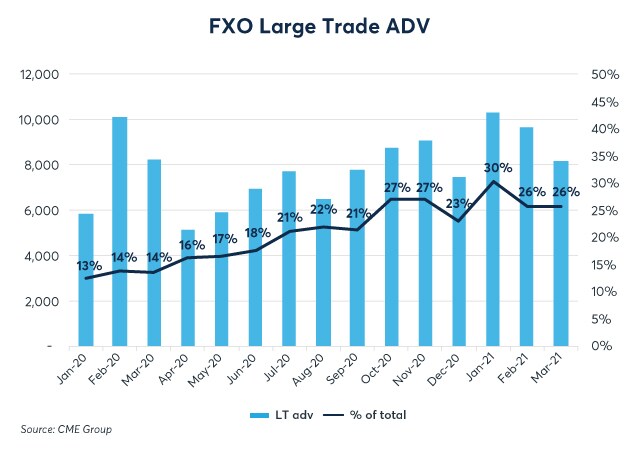

Whether trading a $2.6 billion Australian dollar put bilaterally as a block, or a $500 million Japanese yen put electronically in the central limit order book, the CME listed option market provides the execution choice and liquidity you need to succeed. Over the past year, more clients have optimized their execution as we have seen a surge in large trades.

Get involved and benefit from a 50% discount in fees until June 30

Subscribe to Block Alerts

Know when blocks are going through our markets – see when our markets are being utilized for larger size transactions – browse blocks.

Metals Market Profile: Coming soon

Gold and Silver are coming to the Market Profile across listed and cash.

Metals News subscribers will get an email when Gold and Silver go live.

Now, the only tool which brings CME Group’s distinct trading modalities of listed and spot FX together in one screen is evolving – based on market demand – with new enhancements live in Q2.

Existing functionality enabled detailed top of book liquidity analysis, providing a powerful view of our markets – including the cost efficiencies delivered by the Q4 tick cut in AUD FX futures.

The new enhancements going live this quarter will enable customers to:

Analyze more currencies:

The existing offering of 11 currency pairs is being augmented with an additional eight currency pairs, including SEK, NOK, BRL, and EUR cross-rates.

Monitor the liquidity in a cleared alternative to bilateral FX swaps:

FX Link, which provides an additional pool of firm liquidity and price discovery for FX swaps, will now be added to the FXMP tool alongside outright FX futures – enabling customers to monitor and analyze the liquidity available to them in both products side-by-side along with OTC spot FX from EBS Market.

Explore the depth of the order book and actual volumes being traded: Customers will now be able to determine how many levels of the order book they wish to analyze – from top of book through 10 levels deep – so that they can explore a wider range of liquidity available to them. The tool will also show the actual volumes being traded in FX futures so customers can see when the market is most active, illustrating the liquidity available to transact at size in the listed FX marketplace.

Chart historical plots:

In addition to viewing the average liquidity available over a defined period, customers will now be able to chart a historical view to see how liquidity has changed and performed over defined periods.

Each quarter, we publish The FX Report, which assembles all of the key news, views, and stats the broking community needs to know.