- 12 Oct 2020

- By CME Group

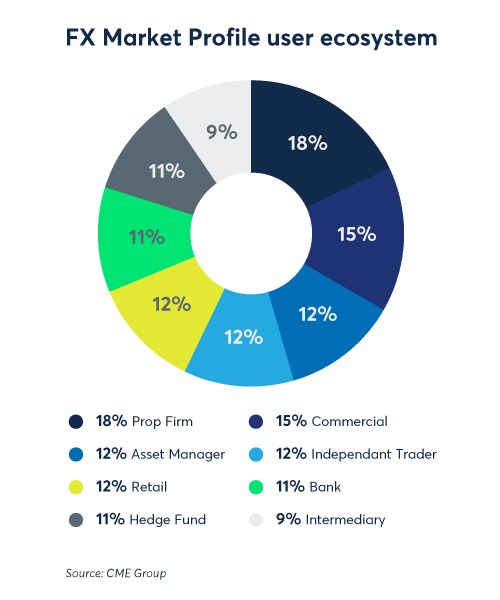

For the first time, we have brought CME Group’s distinct trading modalities of listed and spot FX together in one new tool, so that FX traders around the world can compare and analyze the complementary liquidity available in these markets. Below is a use case as to how a trader could use the tool:

The minimum price increment for CME’s Australian Dollar futures contract was reduced from one pip to 0.5 pips, effective starting November 23, 2020. Shortly afterwards, we used the new FX Market Profile tool to provide a snapshot analysis of the impact of this change. In the first days following the change, the average top-of-book bid-ask spread was 0.3 pips tighter. With more data, we can take another look at the impact on the futures market.

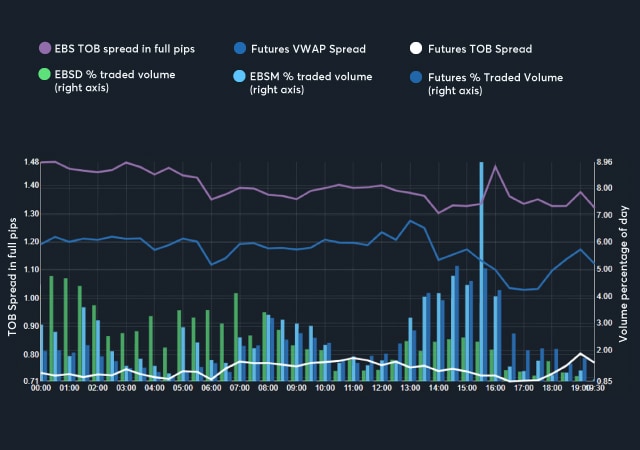

The chart of top-of-book spread and traded volume for December shows that the average bid-ask spread for AUD/USD futures – the white line in the chart – is averaging 0.75 pips.

We have brought CME Group’s distinct trading modalities of listed and spot FX together in one new tool, so that FX traders around the world can compare and analyze the complementary liquidity available in these markets.

The FXMP tool allows you to adjust the time period under review. Looking at the weekly development of the AUD/USD futures shows that the top-of-book bid-ask spread fell from an average of 1.15 pips prior to the MPI change, to 0.86 the following week, and has continued to tighten over time to an average of 0.68 pips in the week after Christmas – i.e. nearly 0.5 pips tighter than prior to the change.

Despite top-of-book order volumes declining in line with the tighter MPI, the VWAP spread – which indicates the overall futures bid-ask spread cost at the size available in the EBS cash market – has tightened by 0.3 pips over the period.

The FXMP tool also provides data on the distribution of the bid-ask spread. This shows that the median spread is now consistently 0.5 pips, with the market now rarely being wider than one pip. This demonstrates the depth of liquidity in the AUD/USD futures market and the substantial cost reduction made available by the MPI change.

FX in brief

View a discussion on the value of the FX Market Profile tool