- 13 Jan 2021

- By CME Group

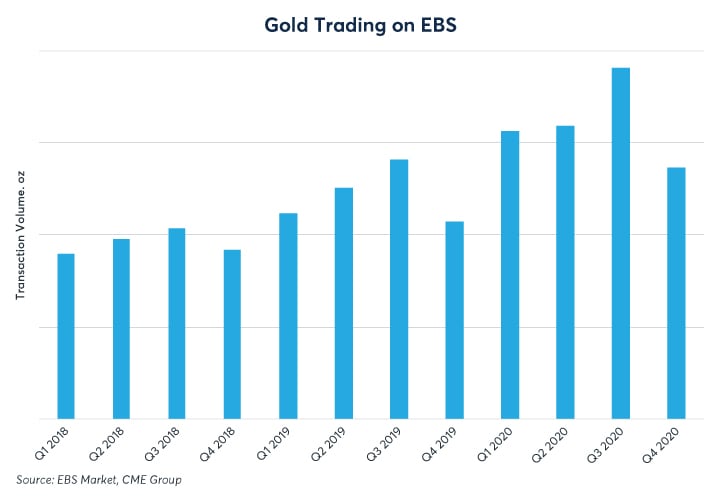

Higher volatility and record price levels have been a feature of the precious metals markets in 2020. EBS markets for spot metals together with CME Group’s futures markets provided a valuable tool for traders over the year.

The price of gold climbed above $2,000 per ounce in August, prompted by falling bond yields and an increased money supply feeding inflation expectations. EBS trading activity responded accordingly.

Other precious metals also saw increased activity on EBS in 2020. In Q1, the start of the COVID-19 crisis prompted concerns about the industrial demand for silver and PGMs, which in turn lead to heightened volatility. Following this burst of activity, volumes for palladium have been subdued across all platforms. Whereas the platinum market on EBS saw sustained activity for the remainder of the year, with volume being more than double what was seen in both the previous two years.

Subscribe to the quarterly COMEX Metals Update

CME Group’s metals futures and options contracts are among the most liquid markets in the asset class and have also responded to 2020’s extraordinary trading conditions.

Can COVID-19 "infect" a currency? CME Group Chief Economist Blu Putnam shows what happens to a country's currency during a wave of COVID-19 and how currencies recover.

Watch video

Read an analysis of how the currencies of eight major commodity-exporting nations, from Australia to Brazil to South Africa, performed during the year of the virus.

Silver rallied more than gold during the summer amid the Fed's massive quantitative easing, narrowing their extreme price ratio.