- 10 Jun 2020

- By CME Group

Last quarter, we launched two new analytics tools – one which provides the only public price reference point for the swaps market – and one which converts listed FX options into OTC terms.

Watch how it works: CME FX Swap Rate Monitor

Take a look into the new FX Swap Rate Monitor to learn more about how you can identify potential areas of opportunity in your trading strategy.

Watch how it works: CME FX Options Vol Converter

For the first time ever, traders will be able to see CME listed FX futures and cash side-by-side with the innovative FX Market Profile tool. Optimize decision making and analyze when (and in what size) to trade futures or spot – by using this new interactive tool.

Follow the Roll

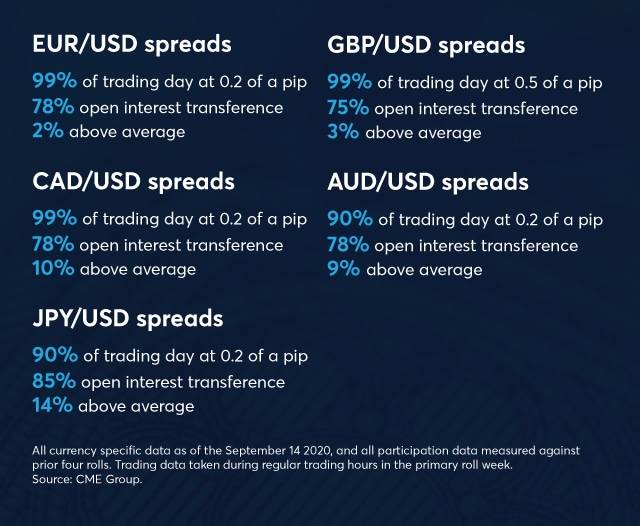

Watch the roll as it develops, using our Pace of the Roll tool to help you analyze your roll strategy.

Buy-side customers have benefitted from improved price discovery and meaningful cost reductions during the roll period, which was coupled with further use of calendar spreads by dealers as a capital- efficient complement to bilateral FX swaps. This led to an 18% increase in bank participation and a 25% increase in participation from asset managers and other non-member end users in EUR/USD calendar spreads.

FX Link – the only electronic alternative to a bilateral FX swap – saw September volume average $1.9B, following a strong July and August which averaged $1.7B in notional

On the rise again, despite the pandemic, the buy-side continues to express interest in our markets ‒ motivated by the capital efficiencies and cost reductions we offer.

Each quarter, we publish The FX Report, which assembles all of the key news, views, and stats the broking community needs to know.