User Help System

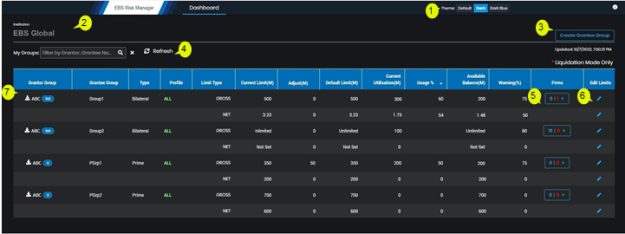

Dashboard

The Dashboard is the default screen that appears after accessing EBS Risk Management.

Users can view the Dashboard to monitor credit settings and Credit / Grantee Groups utilization throughout the trading day.

Using the inline editing feature, EBS Risk Admins can modify default and daily adjustment limits.

Navigating the Dashboard

Various features are available on the dashboard provide the user with the information needed to monitor the credit settings and Grantee Group utilization.

Details of each feature are presented below

Customize the look and feel of the Dashboard by selecting a theme.

The following options are available:

- Default

- Dark

- Dark Blue

The institution that each firm belongs to. Firms within the same institution may be in their own Grantor Group or may be in a Grantor Group with another firm within the same institution. The risk admin is associated to the Grantor Group that extends outbound credit to Grantee Groups.

Grantee Groups are the recipients of credit and are also referred to as Credit Groups.

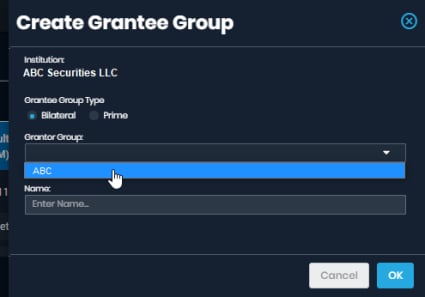

Bilateral Risk Admins can create Bilateral Grantee Groups comprised of other bilateral firms and Prime Risk Admins can create Prime Grantee Groups comprised of firms which have their credit parent in the Grantor Group.

- To create a Bilateral or Prime Grantee Group:

- Select Create Grantee Group (

).

). - From the panel that appears on the right side of the screen, select a Grantee Group Type (Bilateral / Prime).

If permissioned for both, the Grantor Group menu displays a list of Grantor Groups the user can manage, depending on the selected Grantee Group Type.

- Select a Grantor Group.

- Specify a name for the Grantee Group, which must be unique per Grantor Group, then select OK.

Note: Firms and limits may be added to the new Grantee Group in the Grantee Group Details screen.

Use the My Groups function to filter Dashboard data by specific Grantor or Grantee Groups.

The Dashboard displays all permissioned Grantor Groups, Grantee Groups their limits and trading exposure for the current trading day.

My Groups / Dashboard Filter:

- Close filter (

): to collapse the filter text box.

): to collapse the filter text box. - Magnifying glass(

): Expand / open the search field.

): Expand / open the search field. - Refresh (

): Manually refresh the dashboard.

): Manually refresh the dashboard. - Sort: The Dashboard sorts Grantee Groups based on the Usage (%) of the Gross Limit, by default.

Dashboard Columns:

- Grantor Group: Any permissioned Grantor Group for which the logged in user is permissioned.

The Unassigned  counter indicates firms that are not assigned to a Grantee Group or the No Credit Group.

counter indicates firms that are not assigned to a Grantee Group or the No Credit Group.

To assign firm(s) in the Unassigned Firms list to Grantee Groups, Click on a Grantee Group hyperlink or the Groups menu item.

- Grantee Group: The Grantee Group associated to the permissioned Grantor Group and will be linked for direct access to limit and credit group management.

- Type: Indicates whether the Grantee Group is Bilateral or Prime.

- Profile: Indicates whether the Credit profile of the Grantee Group is set as a one-pool (All) or two-pool (TWO) credit.

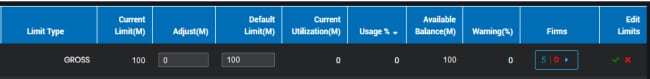

- Limit Type: Displays the Gross and Net limits for each credit pool.

- Current Limit (M): The limit, in millions, displays the start of day credit limit value, which is determined by the Default limit at the start of each trading day.

The Current Limit value is view only.

- Adjust (M): An increase or decrease amount to the Current Limit made for the current trading day only.

Selecting the Edit Limits icon will allow modifications for this field. Adjustments may be positive or negative values.

- Default Limit (M): The default daily limit set for the Grantee Group.

If no Current Limit exists for the Grantee Group, the value entered for Default Limit will immediately become the Current Limit.

If a Current Limit exists and the Default Limit is modified, the modified Default Limit will become the Current Limit at the start of the next trading day.

Selecting the Edit Limits icon will allow modification of this field.

- Current Utilization: The credit exposure based on the trades (bilateral credit utilization) or orders and trades (prime credit utilization) for the current trading day.

- Usage (%): The percentage of exposure for each credit limit.

Usage % = Current Utilization / (Current Limit + Adjustment)

- Available Balance (M): The amount of credit remaining for the credit limit.

- Warning%: Configurable percentage of credit usage against a credit limit that will trigger an email and/or message alerts when the percentage is breached.

Breaches of Warning percentage will generate one alert per trading day unless a limit adjustment is made.

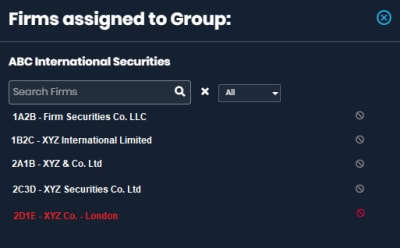

- Firms: A widget will display the number of firms in the Grantee Group and the number of firms that are blocked. A Risk Admin user will have the ability to select this widget and unblock firms in the Grantee Group.

- Edit Limits: Available to Risk Admins to modify limits on the Dashboard.

Click the Firms widget to view a list of firms that are part of a Grantee Group, view, block ( ), unblock (

), unblock (![]() ) firms.

) firms.

Firms with a red icon (![]() ) are blocked.

) are blocked.

Firms can also be unblocked.

Firm Widget functions:

- Filter: All firms in the Grantee Group appear by default. Select the drop-down menu to filter by All / Blocked / Unblocked status.

- Count

- The value in blue (e.g. 6) indicates firms in the Grantee Group.

- The value in red (e.g. 2) indicates blocked firms.

- Search: Search for a specific firm.

Select the widget to open a panel on the right side of the screen to view a list of firms in Grantee Groups.

EBS Risk Admin users can view and block firms in a Grantee Group.

- To block a firm, select the block (

) icon.

) icon.

When a bilateral firm is blocked, it will prevent any firm in the Grantor Group, and their Prime Customer (PC) / Prime of Prime Customer (PoPC) credit child firms, from trading with the blocked firm.

When a PC or PoPC firm is block directly, it will prevent the blocked firm from trading and the firm’s working orders will be canceled.

Blocked firms are indicated by a red icon (![]() ).

).

EBS Risk Admins can access the Dashboard to monitor limit usage and edit limits.

- In the Edit Limits column, select the pencil

icon for the Grantee Group Limit Type, then edit the Adjust and/or Default Limit fields.

icon for the Grantee Group Limit Type, then edit the Adjust and/or Default Limit fields.

- To update the Daily Adjust and/or the Default limit value(s), select the respective editable box and enter a new limit value.

The Adjustment value adds to the Current limit and is effective immediately when saved.

This Adjustment value remains throughout the current trading day and will reset to zero (0) at the start of the next trading day.

A brand new Default limit, where one previously did not exist, will become the Current Limit and take effect immediately.

A modified Default Limit will become the Current Limit and take effect at the start of the next trading day.

- Save limit updates by selecting the check (

) icon or cancel any changes by selecting the cancel (

) icon or cancel any changes by selecting the cancel ( ) icon (Edit Limits column).

) icon (Edit Limits column).

EBS users can select the ![]() (download) icon to download the Credit Limit report as a comma separated value (CSV) format file.

(download) icon to download the Credit Limit report as a comma separated value (CSV) format file.

This report contains limits and utilization information for each Grantee Group.