User Help System

Run Analysis

Run analysis for margining, combining portfolios and optimization to generate reports for an IRS portfolio. Functionality for these options is split between the Portfolio section and Trade Grid of the Rates Calculator screen.

Report Generation Options

Margin, combine or optimize portfolios:

Viewing Reports

To view generated reports, select the report icon adjacent to the report (![]() ), or select Report and navigate to the corresponding report tab.

), or select Report and navigate to the corresponding report tab.

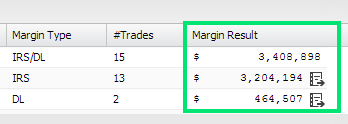

Margin Portfolios

Margin portfolios from the Portfolio section or the Trade Grid.

Note:From the Rates Calculator, Futures & Options-only portfolios cannot be margined if they contain any futures in the OTC Sequestered account (if Margin Type is SEQ or SEG-SEQ).

Note: Reports generated from the Portfolio section can also be scheduled.

- To margin a portfolio from the Portfolio section:

- Check the box adjacent to the portfolio to margin.

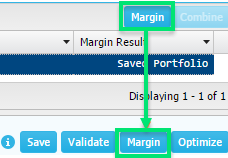

- Select Margin in the Portfolio menu. Portfolio is margined. Margin result amount displays in the Margin Result column of the Portfolio section and the Margin field of the Trade Grid.

- To margin a portfolio from the Trade Grid:

- Load trades into the Trade Grid, then validate pending trade submission.

- Select Margin. Portfolio is margined. Margin result amount displays in the Margin Result field of the Portfolio section.

- To view reports, access the individual report screen. For example, view IRS/SEG reports in Reports -> IRS.

Combine Portfolios

Combine multiple portfolios that contain an IRS or DL Margin Type (like DL/SEG with an IRS) to create a combined portfolio with margin result.

Note: Portfolios that consist of Futures and Options ONLY (margin types: SEG, SEQ, SEG-SEQ) are not eligible to be combined with other portfolios via "Combine Selected" option.

- To combine portfolios:

- Load a portfolio that contains IRS trades or a delta ladder (this includes aggregate portfolios that contain IRS and DL margin types).

- Check the box adjacent to each margined portfolio to combine. The Combine button becomes active.

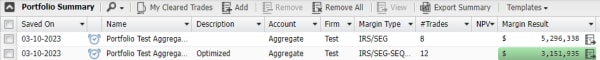

- Select Combine. A new portfolio is created and a margin result is generated for the portfolio.

Optimize Portfolios

Selecting Optimize triggers margin optimization and calculates the allocation of user defined futures (trades provided in the upload) to move into an OTC sequestered account to minimize portfolio risk

Portfolios generated from the provided futures and option portfolio following optimization:

- Optimized portfolio (Portfolio type + -OPT): Optimization of the current portfolio. Description field in the Portfolio Summary is assigned "Optimized."

- Original portfolio is margined with recommended futures.

Note: See Portfolio Type Options to see portfolio types that may or may not be optimized.

- To optimize a portfolio:

- Load trades into the Trade Grid.

- Select Optimize in the Trade Grid. Optimization portfolios are created.