- 19 Jul 2023

- By CME Group

- Topics: Equity Index

Volatility receded through the quarter as the Regional Bank crisis slowly passed and the equity market broke out to the upside in June. Going into the quarter-end, the inflow was primarily focused around the technology sector and in particular AI related stocks, which saw outsized gains.

The Q2 2023 equity roll (Jun/Sep) implied financing spread to Three-Month SOFR increased further to +36bps vs. +26 bps in Q1-23. The roll was up from the Q2-22 roll of +7bps. The running four-quarter moving average is at an average of +24bps.

Note: Three-Month SOFR has replaced Three-Month Libor as the reference.

S&P 500 AIR Total Return futures ADV in Q2 2023 reached 4.2K contracts and average OI was a record 331K, with a record OI of 367K on June 16. Clients continue to increase their use as a centrally cleared listed alternative to OTC as UMR impacts investors more broadly after Phase 6 in September 2022.

Achieve capital-efficient total return equity index swap exposure with AIR Total Return futures on Nasdaq-100, Russell 1000, Russell 2000, and DJIA Indices.

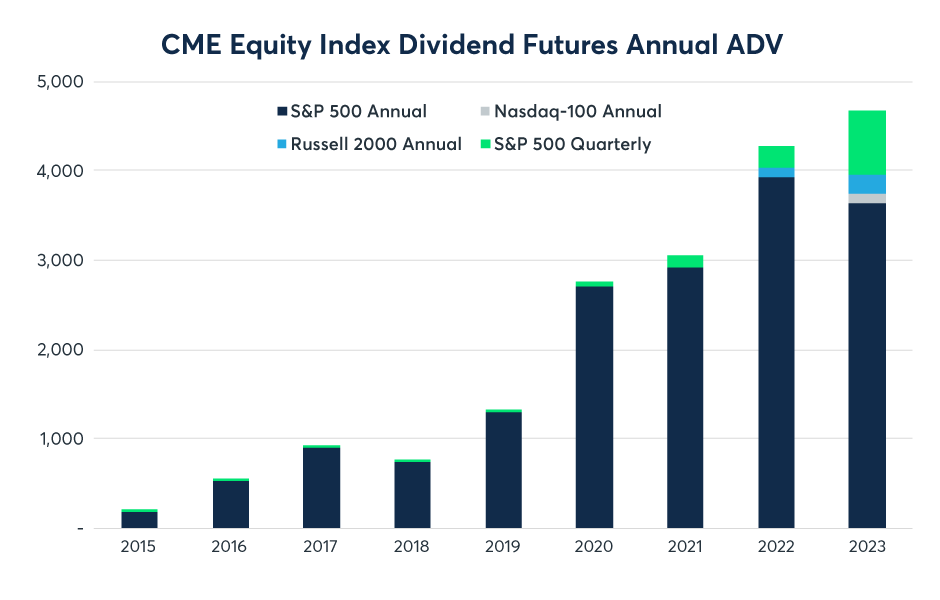

CME Dividend futures combined Q2 ADV was 4.1K contracts, and OI averaged 270K (+21% vs. Q1 2023). Over 61.5K contracts have traded since the launch of CME Annual Dividend Index futures on Nasdaq-100 and Russell 2000 in early 2022.

CME Equity Sectors futures ADV in Q2-23 reached 17.5K contracts, with a daily record of 283.4K contracts traded on June 12. OI was a record average of 227.3K (+1% vs. Q1-23) throughout the quarter. The market has embraced derived block functionality introduced last year, with nearly 271K contracts traded since launch across the various sector products.

Basis Trade at Index Close (BTIC) transactions on E-mini S&P 500 futures continue to trade near record highs, Q2-23 ADV was 47K contracts ($10B). Utilize BTIC transactions to bridge between cash index close and the futures market daily or use BTIC+ days in advance.

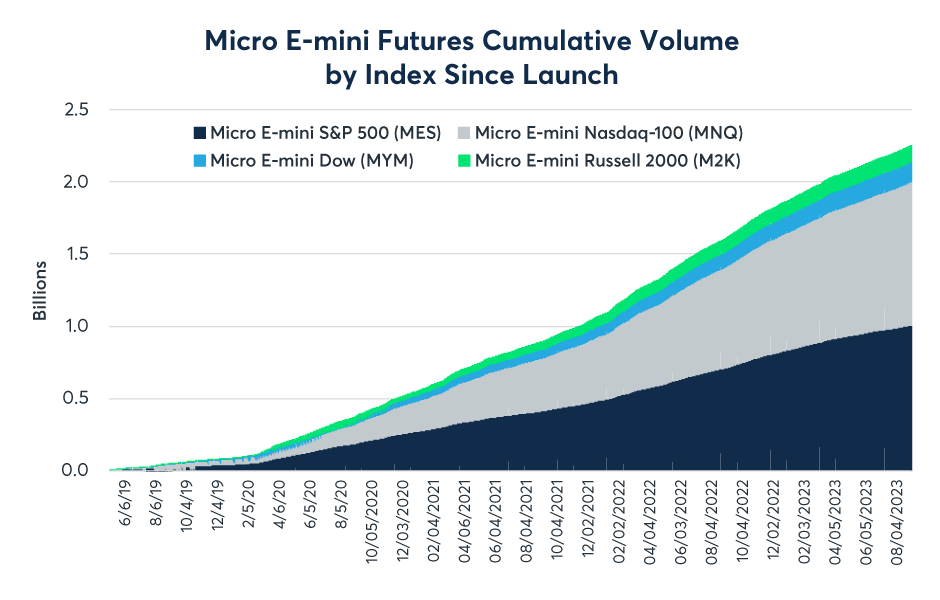

ADV across all four Micro E-mini futures was 2M contracts in Q2-23 and total volume reached over 2.2B contracts since launch. Trading activity and liquidity continue to strengthen in Micro E-mini S&P 500 futures, OI reached more than 10 consecutive records, culminating in a high of over 491K contracts.

Micro E-mini S&P MidCap 400 and SmallCap 600 futures are now trading. From small-cap to large-cap, you can expand your equity strategies with CME Group's suite of micro-sized equity contracts.

Commodity Index futures and swaps continue to gain momentum in 2023. ADV in Q2-23 was 7.6K (+32% vs. Q2-22). Notional OI grew to $4.3B in Q2, up 21% versus Q2-22. Participants continue to look to CME Group's cleared product offering due to its capital (margin offset, fees) and operational efficiencies (MDE handling via BTIC) as discussed in the recent webinar with Bloomberg.

Japanese equities broke away toward the end of the quarter reaching new highs. June saw an ADV of 45.2K contracts and 11.9K contracts in yen- and USD-denominated Nikkei225 futures, levels not seen since March 2020 and March 2022. Nikkei225 futures Q2-23 ADV was 39K contracts (+15% vs. Q1-23) with average OI reaching more than 66.9K contracts (+26% vs. Q1-23). Year-to-date, 53% of Nikkei trading occurred during non-U.S. hours.

USD TOPIX launched the first dollar denominated contract, which complements the existing Yen denominated TOPIX futures and provides new quanto spreading opportunities.

Volatility in the cryptocurrency market began to increase towards the end of the quarter along with the price of Bitcoin and Ether. Clients continued to use the trusted cryptocurrency suite at CME Group to efficiently and effectively manage risk/exposure. Increased client demand for hedging tools led to higher volume, and open interest across our cryptocurrency F&O offerings.

Bitcoin futures (BTC) institutional interest continued to increase throughout the quarter as investors sought regulated venues/products to hedge rising market volatility and manage risk/exposure. Q2-23 ADV was over 10.6K contracts and OI averaged 14.3K contracts up 23% compared to Q2-22. The number of LOIHs averaged a record 107 in Q2-23.

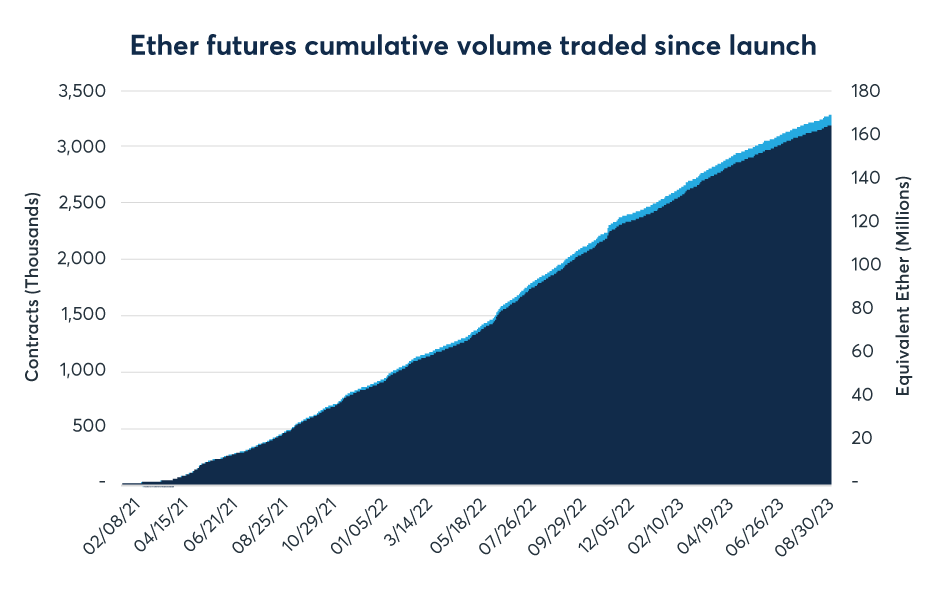

Ether futures (ETH) Over 3.1M contracts (156M equivalent Ether) have traded since launch just over two years ago. LOIHs averaged 62 throughout the quarter, up 35% compared to Q2-22. Options on Ether futures have now traded over 10K contracts since their September 2022 launch. OI reached a record 2.6K on June 30.

Micro Bitcoin and Ether futures (MBT & MET)

Provide precise, cost-effective tools to manage cryptocurrency risk. Micro Bitcoin and Ether futures Q2-23 ADV was a combined 21K (+6% vs. Q1-23). MET OI averaged 16K contracts while MBT OI averaged 10K. Since their respective launches, over 8.7M MBT contracts have traded and over 6.4M MET contracts have traded.

Ether/Bitcoin Ratio futures coming July 31 now capture the relative value of Ether and Bitcoin in a single trade. The new contract will be cash-settled based on the settlement prices of the corresponding futures contracts. Similar to inter-commodity spreads, ratio futures can help maintain price alignment between the two underlying contracts, potentially improving the bid-ask spreads for the outright contracts.

*Pending regulatory review

All data accurate of June 30, 2023 unless otherwise indicated.

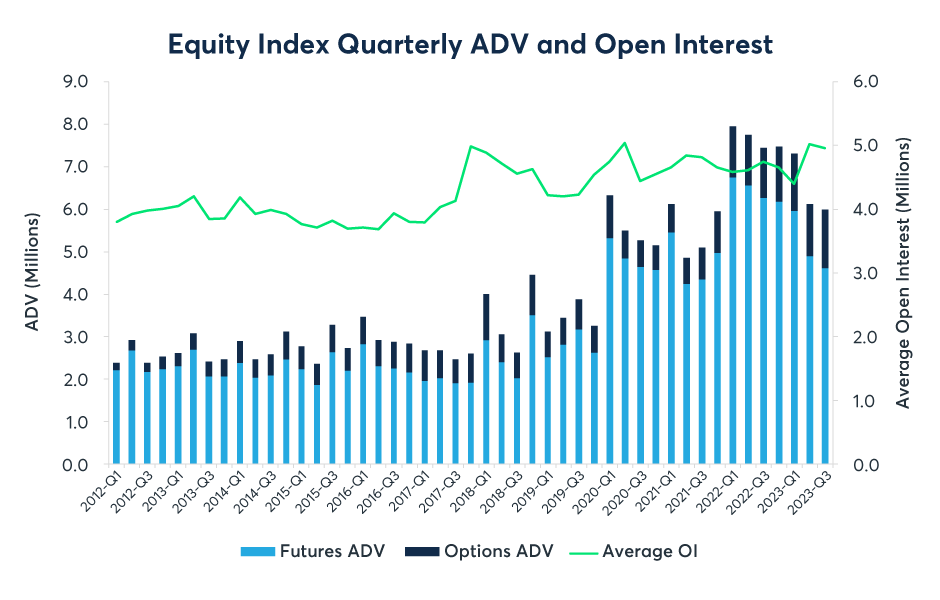

Equity Index futures:

Volume: 5M ADV

Open interest: 5M contracts per day (+14% vs. Q1-23)

Equity Index options on futures:

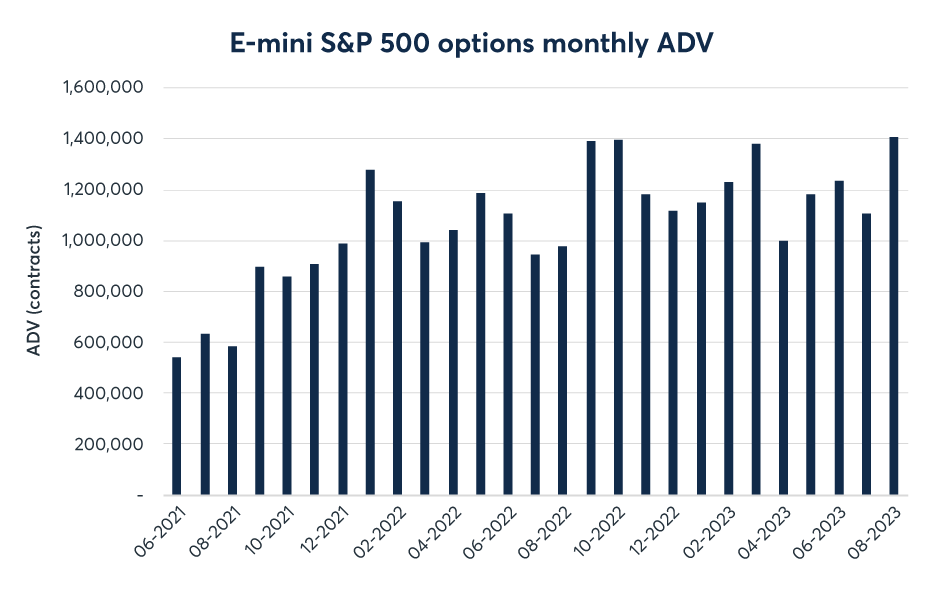

Volume: 1.2M ADV (+4% vs. Q1-23)

Open interest: 5.2M contracts per day (+8% vs. Q1-23)

| Futures | Q2 2023 ADV |

|---|---|

| ES | 1.8M |

| NQ | 658K |

| YM | 164K |

| RTY | 223K |

| NIY & NKD | 40K |

Tune into CME Group's webinar to get insights on the commodity market and how investors are allocating Commodity Index products into their portfolio.

Discover expert insights and analysis to help you choose the most suitable U.S. equity index for your investment goals.

CME Group has recently seen growing interest in shorter-dated options trading, particularly in maturities with less than one week until expiration.

While equity indices are often highly correlated, periods of dispersion still occur. See how a hedge fund might capitalize on this trend.

Equity Index options blocks

Participation in E-mini S&P 500 (ES) options blocks continues to grow, allowing market participants to execute large trades with greater efficiency. Nearly 35M ES options blocks have traded, with Q2 ADV at a record 87K contracts. E-mini Nasdaq-100 (NQ) options blocks have traded over 39K contracts since their January 2022 launch.

Sign up for Equity ES options block alerts

ES options:

ADV in E-mini S&P 500 (ES) options traded an average 1.14M contracts, up 4% vs. Q2-2022. During Asian and European trading hours, CME Group is the leading venue for risk transfer for S&P 500 options, as daily volume for ES options averaged over 170K contracts in Q2-23.

NQ options:

E-mini Nasdaq-100 options are trading at record highs with Q2-23 ADV at 62.2K (+23% vs. Q1-23). Thirteen percent of options volume traded during the quarter occurred during non-U.S. hours.

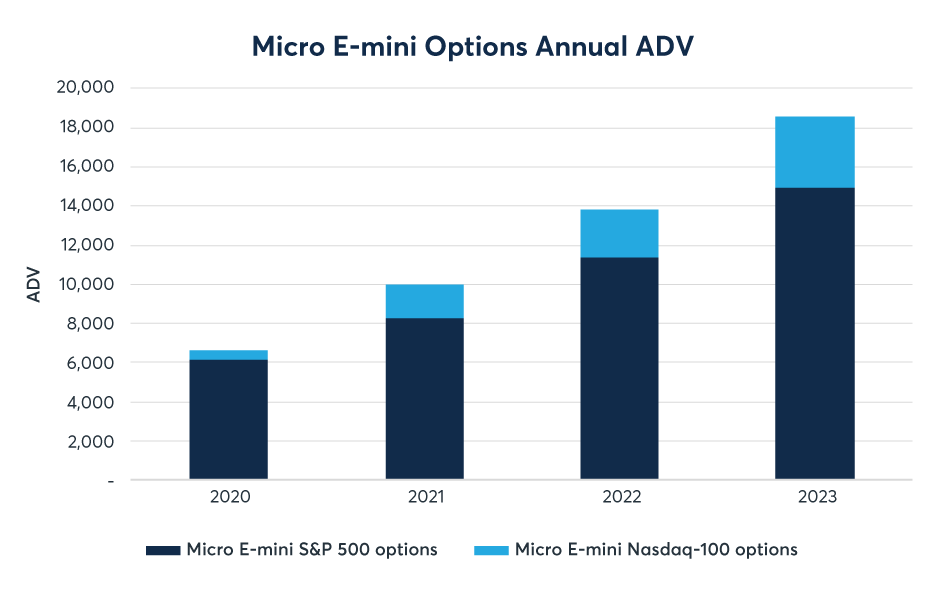

Micro E-mini options:![]()

Micro E-mini S&P 500 and Micro E-mini Nasdaq-100 options Q2-23 ADV was 17.8K (+39% vs. Q2-22).

Cryptocurrency options

A record 421 Ether options were traded May 5 and OI reached a record 2.6K on June 30. Over 10K Ether options have traded since their September 2022 launch. Bitcoin options had a record average OI of 9.9K in Q2 (+12% vs. Q1-23). Over 600k Micro Cryptocurrency options have traded since their March 2022 launch.

Micro Cryptocurrency options

Now available across our Cryptocurrency options suite. Since the expanded offering was introduced on May 22, 2023, more than 20K contracts have traded.