- 18 Apr 2022

- By CME Group

Equity Index futures and options had a record quarter in Q1, with multiple all-time highs across the E-mini and Micro E-mini product suite and an overall 30% increase in average daily volume vs. Q1 2021.

- Micro E-mini Nasdaq-100 futures ADV – 1.6M contracts

- Micro E-mini S&P 500 futures ADV – 1.37M contracts

- Micro E-mini Dow Jones futures ADV – 234K contracts

- E-mini Nasdaq-100 futures ADV – 734K contracts

- E-mini Russell 2000 futures ADV – 266.5K contracts

- E-mini S&P 500 options ADV – 1.1M contracts

Escalating geopolitical tension plus the looming Fed policy change created uncertainty in the equity market; different segments of the equity market reacted differently based on prior performance. Tech stocks were at all-time highs while small caps lagged the rest of the market last year.

The Mar/Jun roll cost decreased from the Q4 2021 roll of +50bps to -9bps, and while not as cheap as the Q1 2020 roll cost of -33bps, this is substantially cheaper than the Q1 YoY trend where the Q1 2021 roll cost was at +33bps. The running four-quarter moving average continues to cheapen (+44bps), further warranting attention on implied financing heading into Q2.

Source: CME Group

Micro Ether futures (MET), launched in December 2021, provide a cost-effective, precise way to manage ether exposure. The futures are 1/10 of one ether and share the same features as the larger Ether futures, settling to the CME CF Ether-Dollar Reference Rate. Nearly 1.4M contracts have traded since launch, with an ADV of 19.1K contracts in Q1 2022.

Ether futures (ETH) have traded 1.2M contracts (60.5M equivalent ether) since their launch over a year ago. Q1 2022 ADV was a record quarter with ADV over 5.1K contracts (+1% vs. Q4 21) and average open interest at 3.6K contracts.

Micro Bitcoin futures (MBT) had another successful quarter with an ADV of 19.8K contracts and OI averaging 21.3K. Large open interest holders (LOIH) have averaged 119 in Q1 22 and 34% of volume is traded during non-U.S. hours.

Bitcoin futures (BTC) Q1 2022 ADV was 8.8K contracts and open interest averaged 10.9K contracts. LOIHs have averaged 81 in Q1 22, further indicating strong institutional interest.

New Cryptocurrency benchmarks On April 25, CME Group, in partnership with CF Benchmarks, will launch Reference Rates and Real-Time Indices on 11 more cryptocurrencies.

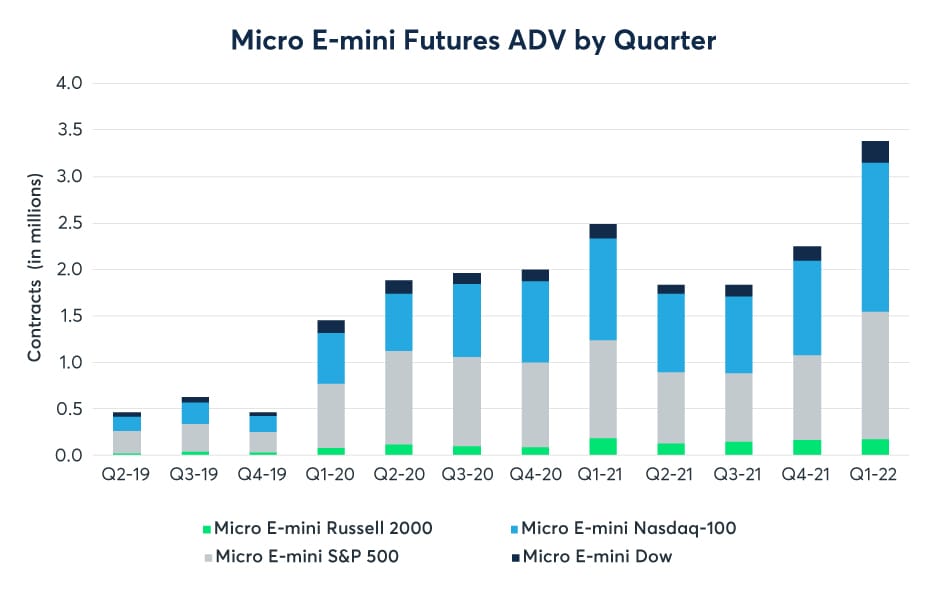

Average daily volume across all four Micro E-mini futures reached a record 3.4M contracts in Q1 2022, +51% vs. Q4 21. Micro E-mini Nasdaq-100 futures continued to out-trade other indices with an ADV of 1.6M contracts, sustaining the tech lean.

Source: CME Group

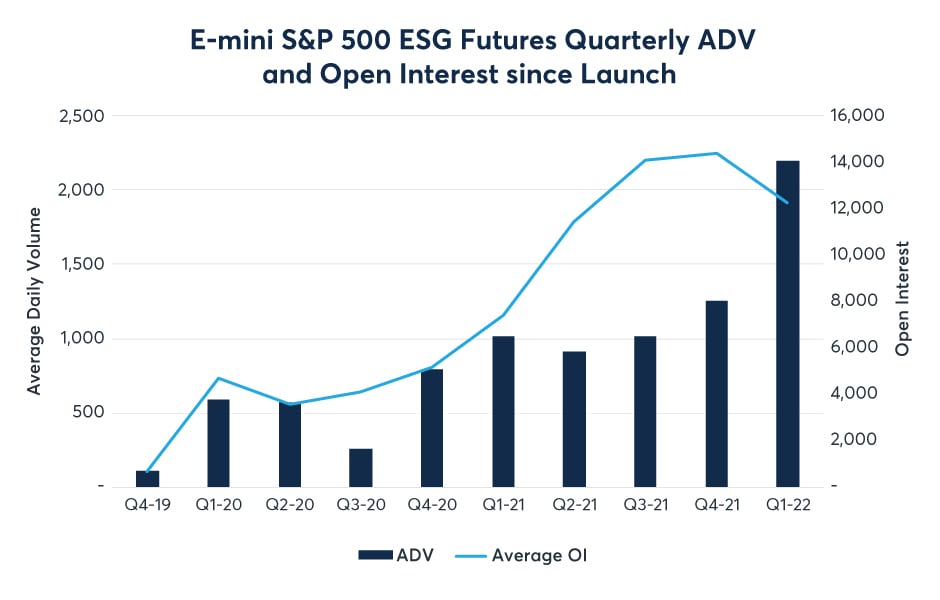

E-mini S&P 500 ESG futures experienced significant growth in Q1 22 with a record ADV of 2.2K contracts (+75% vs. Q4 21) and OI averaging 12.3K contracts. E-mini S&P 500 ESG futures are the most liquid ESG futures in the world, over 5% of volume traded occurs during non-U.S. hours.

Source: CME Group

E-mini S&P Europe 350 ESG futures have traded nearly 3.1K contracts since their launch in May 2021. The futures are cash-settled to the S&P Europe 350 ESG Index, a Pan-European index covering developed markets across over 15 different countries, based on the same ESG index methodology as the one applied to S&P 500 ESG index.

Clients continue to optimize traditional OTC portfolios in light of upcoming UMR exposure and use Adjusted Interest Rate (AIR) Total Return futures as a capital- and margin-efficient alternative to an equity swap.

S&P 500 AIR Total Return futures rADV in Q1 2022 reached a record 4K contracts (+97% vs. Q4 21) and average OI of 174.8K contracts (+19% vs. Q4 21). Clients continue to increase their use as a listed alternative to OTC as UMR deadlines approach.

Source: CME Group

Achieve capital-efficient total return equity index swap exposure with AIR Total Return futures on Nasdaq-100, Russell 1000, Russell 2000, DJIA, and FTSE 100 Indices.

All data accurate of March 31, 2022 unless otherwise indicated.

Equity Index futures:

- Volume: 6.8M ADV (+24% vs. Q1 21)

- Open interest: 4.6M contracts per day (-1% vs. Q1 21)

Equity Index options on futures:

- Volume: 1.2M ADV (+81% vs. Q1 21)

- Open interest: 4.8M contracts per day (+54% vs. Q1 21)

Futures |

Q1 22 ADV (vs. Q1 21) |

|---|---|

ES |

2.0M (8%) |

NQ |

734K (21%) |

YM |

241K (18%) |

RTY |

266K (20%) |

NIY & NKD |

52K (23%) |

BTC |

9K (-35%) |

Take a deep dive into the growth, role, and rules for using Equity Index blocks and EFRPs at CME Group.

Tune in to a discussion with experts from CME Group, Neuberger Berman, Jane Street, and Wedbush Futures discussing the latest challenges and opportunities in the crypto derivatives market.

Learn how trading AIR Total Return futures calendar spreads can help investors isolate the financing spread differential for equity financing level trades.

- Growth in E-mini options: Trading in E-mini options across the major Equity indices reached record highs during Q1 2022. E-mini S&P 500 options, E-mini Nasdaq-100, and E-mini Russell 2000 options have quarterly ADVs of 1.1M contracts, 39.7K contracts, and 8.3K contracts, respectively.

Learn more - E-mini S&P 500 (ES) options blocks: Participation in ES options blocks continues to grow, allowing market participants to execute large trades with greater efficiency. Over 10M ES options blocks have traded, with Q1 2022 ADV at 67K contracts.

Sign up for ES options block alerts - E-mini Nasdaq-100 (NQ) options blocks: : NQ options became block eligible starting January 24, with a minimum block threshold of 60 contracts. Over 2.7K contracts have traded since eligibility.

Learn more - Micro E-mini options: Similar to their E-mini counterparts, Micro E-mini S&P 500 and Micro E-mini Nasdaq-100 options Q1 2022 ADV reached a record combined ADV of 17K contracts.

Find out more - Micro Cryptocurrency options: Launched on March 28, options on Micro Bitcoin and Micro Ether futures are right-sized at 1/10 of their respective underlying cryptocurrencies. Combined week one trading volume exceeded 20K contracts with trades from EMEA, APAC, and North America.

Learn more