- 21 Jun 2023

- By CME Group

- Topics: Equity Index

Equity Products Performance

|

Product Code |

Bloomberg Ticker |

May ADV |

YTD ADV* |

Open Interest |

|---|---|---|---|---|---|

Total |

6,064,807 |

6,734,711 |

10,939,405 |

||

S&P 500 |

|

|

3,750,664 |

4,374,718 |

8,778,947 |

Futures |

|

|

2,561,349 |

3,010,660 |

3,517,028 |

E-mini |

ES |

ESA Index |

1,581,981 |

1,812,239 |

2,450,957 |

Micro E-mini |

MES |

HWA Index |

931,988 |

1,144,122 |

401,997 |

BTIC |

EST |

STEA Index |

40,723 |

44,556 |

- |

BTIC+ |

ES1, ES2 |

ES1BTIC yyyymmdd Index |

- |

- |

- |

Dividend Future |

SDA, SDI |

ASDA, ISDA Index |

3,548 |

4,433 |

248,492 |

Total Return Futures |

TRI, CTR |

SRTA, CTIA Index |

2,419 |

4,033 |

403,411 |

TACO |

ESQ |

TQA Index |

149 |

285 |

- |

TACO+ |

EQ1 |

EQ1TACO yyyymmdd Index |

|

- |

- |

E-mini ESG |

ESG |

SLBA Index |

542 |

992 |

12,171 |

Options |

|

|

1,189,315 |

1,364,059 |

5,261,919 |

E-mini |

|

|

1,178,687 |

1,345,835 |

5,205,125 |

End-Of-Month |

EW |

SCA Index |

111,037 |

127,388 |

628,485 |

Quarterlies |

ES |

ESA Index |

128,286 |

127,970 |

1,928,400 |

Monday Weekly |

E1A-E5A |

IWWA Index |

113,471 |

130,333 |

177,986 |

Tuesday Weekly |

E1B-E5B |

IMBA Index |

137,672 |

118,141 |

108,769 |

Wednesday Weekly |

E1C-E5C |

IEWA Index |

139,647 |

142,972 |

121,071 |

Thursday Weekly |

E1D-E5D |

IMDA Index |

139,833 |

138,047 |

297,954 |

Weekly |

EW1 - EW4 |

1EA-4EA Index |

408,741 |

560,985 |

1,942,460 |

Micro E-mini |

|

|

10,628 |

18,223 |

56,794 |

NASDAQ |

|

|

1,617,123 |

1,794,233 |

650,041 |

Futures |

|

|

1,567,821 |

1,727,407 |

412,931 |

E-mini |

NQ |

NQA Index |

647,323 |

660,767 |

299,220 |

Micro E-mini |

MNQ |

HWB Index |

915,491 |

1,061,349 |

113,711 |

BTIC |

NQT |

QNTA Index |

5,007 |

5,291 |

- |

Options |

|

|

49,301 |

66,826 |

237,110 |

E-mini |

|

|

46,878 |

62,825 |

226,220 |

End-Of-Month |

QNE |

QNAA Index |

5,275 |

5,161 |

14,951 |

Quarterlies |

NQ |

NQA Index |

11,327 |

9,142 |

147,268 |

Monday Weekly |

Q1A-Q5A |

QNBA Index |

5,296 |

4,912 |

7,892 |

Tuesday Weekly |

Q1B-Q5B |

QETA Index |

6,262 |

4,067 |

1,444 |

Wednesday Weekly |

Q1C-Q5C |

QNCA Index |

5,856 |

6,090 |

3,311 |

Thursday Weekly |

Q1D-Q5D |

QHTA Index |

6,488 |

4,735 |

6,549 |

Weekly |

QN1 - QN4 |

1OA-4A Index |

6,374 |

28,718 |

52,798 |

Micro E-mini |

|

|

2423 |

4,001 |

10,890 |

DOW JONES |

|

|

278,472 |

311,565 |

128,527 |

Futures |

|

|

278,453 |

311,507 |

127,936 |

E-mini |

YM |

DMA Index |

164,661 |

178,150 |

96,614 |

Micro E-mini |

MYM |

HWI Index |

112,828 |

131,874 |

113,711 |

BTIC |

YMT |

YMTA Index |

965 |

1,484 |

- |

Options |

|

|

19 |

58 |

591 |

E-mini |

|

|

19 |

58 |

591 |

Russell 2000 |

|

|

297,759 |

310,432 |

617,243 |

Futures |

|

|

290,859 |

302,126 |

568,489 |

E-mini |

RTY |

RTYA Index |

205,775 |

214,861 |

541,734 |

Micro E-mini |

M2K |

HWR Index |

80,506 |

83,090 |

26,755 |

BTIC |

RLT |

RLBA Index |

4,578 |

4,175 |

- |

Options |

|

|

6,900 |

8,307 |

25,948 |

E-mini |

|

|

6,900 |

8,307 |

25,948 |

S&P 400 - MIDCAP |

|

|

11,841 |

13,400 |

38,563 |

Futures |

|

|

11,841 |

13,400 |

38,563 |

E-mini |

ME |

FAA Index |

11,841 |

13,400 |

38,563 |

INTERNATIONAL |

|

|

36,679 |

11,551 |

#N/A |

Futures |

|

|

36,679 |

11,551 |

#N/A |

Nikkei 225 |

ENY, N1, NK |

YMEA, NXA, NHA Index |

36,669 |

11,546 |

76,545 |

Ibovespa |

IBV |

IBAA Index |

3 |

1 |

13 |

TOPIX |

TPY |

TPYA Index |

7 |

4 |

#N/A |

SECTORS |

|

|

9,869 |

3,900 |

188,431 |

Futures |

|

|

9,869 |

3,900 |

188,431 |

Comm. Srvcs. |

XAZ |

XASA Index |

366 |

46 |

8,310 |

Cons. Discr. |

XAY |

IXYA Index |

381 |

107 |

7,257 |

Cons. Staples |

XAP |

IXRA Index |

1,125 |

510 |

14,176 |

Energy |

XAE |

IXPA Index |

1,545 |

440 |

25,661 |

Financial |

XAF |

IXAA Index |

1,395 |

360 |

30,751 |

Health Care |

XAV |

IXCA Index |

825 |

230 |

18,412 |

Industrial |

XAI |

IXIA Index |

448 |

281 |

17,844 |

Materials |

XAB |

IXDA Index |

342 |

134 |

5,157 |

Real Estate |

XAR |

XARA Index |

120 |

212 |

6,832 |

Technology |

XAK |

IXTA Index |

649 |

204 |

13,360 |

Utilities |

XAU |

IXSA Index |

1,130 |

536 |

- |

Dow Jones Real Estate |

JR |

DJEA Index |

1,543 |

836 |

40,648 |

Nasdaq Biotech |

BQ |

DBA Index |

- |

6 |

23 |

FTSE |

|

|

- |

0 |

- |

Futures |

|

|

- |

0 |

- |

FTSE China 50 |

FT5 |

FCYA Index |

- |

0 |

- |

Russell 1000 |

|

|

564 |

337 |

24,548 |

Futures |

|

|

564 |

337 |

24,548 |

Russell 1000 |

RS1 |

RSYA Index |

90 |

138 |

7,531 |

Russell 1000 Growth |

RSG |

RGYA Index |

167 |

49 |

4,013 |

Russell 1000 Value |

RSV |

RVYA Index |

307 |

150 |

13,004 |

Cryptocurrency |

|

|

33,082 |

38,758 |

68,788 |

Futures |

|

|

31,023 |

36,657 |

35,642 |

Bitcoin |

BTC |

BTCA Curncy |

9,790 |

10,555 |

12,289 |

Micro Bitcoin |

MBT |

BMRA Curncy |

9,583 |

10,390 |

7,116 |

Ether |

ETH |

DCRA Curncy |

3,988 |

5,438 |

2,997 |

Micro Ether |

MET |

MERA Curncy |

7,663 |

10,274 |

13,240 |

Options |

|

|

2,058 |

2,101 |

33,146 |

Bitcoin |

BTC |

BTCA Curncy |

213 |

518 |

7,812 |

Micro Bitcoin |

WM |

BMRA Curncy |

246 |

558 |

5,395 |

Ether |

ETH |

DCRA Curncy |

116 |

71 |

1,731 |

Micro Ether |

VM |

MERA Curncy |

1,599 |

955 |

18,208 |

Other US Indices |

|

|

1,750 |

5,320 |

276,268 |

Futures |

|

|

2,491 |

5,111 |

108,071 |

Source: CME Group

*Through May 31, 2023

- Equity Index futures and options volume averaged 6.1M contracts per day in May 2023 (+8% vs. Apr-2023)

- Equity Index open interest averaged 10.7M contracts per day for the month of May 2023 (+7% vs. Apr-2023)

Bitcoin futures and options: Institutional interest remains strong as investors continue to seek regulated venues and products to hedge rising market volatility and manage risk and exposure. Futures trading in May averaged 9.8K and open interest (OI) averaged 13.2K. Bitcoin options have traded over 130K since launch, average OI was 9.4K in May.

Micro Bitcoin futures: Since their launch in May 2021, Micro Bitcoin futures have traded nearly 8.5M contracts. The futures are 1/10 of a Bitcoin and settled to the CF Bitcoin Reference Rate. May average daily volume (ADV) was 9.6K and OI averaged 10K.

Micro Bitcoin and Micro Ether options: CME Group introduced options on Micro Bitcion futures and options on Micro Ether futures starting on March 28. The options are right-sized at 1/10th of their respective tokens. Over 559K contracts have traded since launch across the various expiries with trades submitted from EMEA, APAC, and North America. New expiries are now available. Enjoy greater precision and versatility in managing short-term bitcoin and ether risk with the expansion of weekly options expiries across our Cryptocurrency options suite. Learn more here:

Ether futures: CME Group launched Ether futures in February 2021. The contract is cash-settled and based on the regulated CME CF Ether-Dollar Reference Rate. Over 3M CME Ether futures contracts have traded since launch (equivalent to 151M Ether). May ADV was 4K and open interest averaged 3.3K.

Ether options: Launched on September 2022, Ether options offer another way to efficiently manage Ether exposure at a 50x multiplier. Over 8.8K contracts have traded since launch, equivalent to over 441K Ether. May ADV was a record 116 (+47% vs. Apr-23), with open interest averaging a record 2.2K. Learn more here:

Micro Ether futures: Since Micro Ether futures launched in December 2021, nearly 6.2M contracts have traded. ADV in May was 7.7K and OI averaged 15.5K. Sized at 1/10 of one Ether, the contract provides an efficient, cost-effective way to manage exposure to one of the largest cryptocurrencies by market capitalization. Enjoy the same features of the larger Ether futures (ETH) at a fraction of the size, settled to the regulated CME CF Ether-Dollar Reference Rate.

Bitcoin Euro and Ether Euro futures: CME Group launched Bitcoin Euro and Ether Euro futures in August 2022. The contracts are designed to match that of their U.S.-denominated counterparts at 5 Bitcoin or 50 Ether per contract. The contracts will settle to the respective CME CF Bitcoin-Euro Reference Rate (BTCEUR_RR) and CME CF Ether-Euro Reference Rate (ETHEUR_RR). Learn more here:

Micro E-mini futures: Over 2.1B Micro E-mini Equity Index futures contracts have traded since their launch. Combined ADV in May was 2M (+8% vs. Apr-23). Now trade Micro E-mini S&P MidCap 400 and SmallCap 600 futures, launched on March 20. Learn more here:

Micro E-mini options: CME Group launched Micro E-mini Options on the S&P 500 and Nasdaq-100 indices in 2020. Micro E-mini Nasdaq-100 options continue to gain ground against their Micro E-mini S&P 500 options counterpart in terms of volume contribution. Since launch, nearly 7.6M contracts have traded, with May ADV being 18.5K (+13% vs. Apr-23).

Now enjoy greater precision and versatility in managing short-term exposure with the introduction of Micro E-mini S&P 500 and Nasdaq-100 Monday, Tuesday, Wednesday, and Thursday options launched February 13. These new contracts complement the existing Friday weekly, end-of-month options, and quarterly options on Micro E-mini S&P 500 and Nasdaq-100 futures. Learn more here:

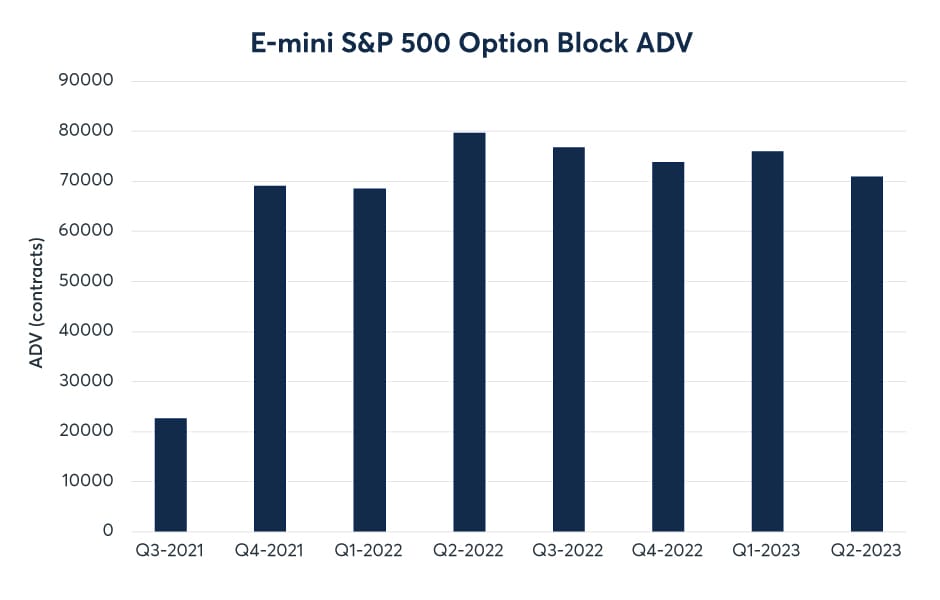

E-mini S&P 500 option blocks: The participation in ES options blocks continues to grow, allowing market participants to execute large trades with greater efficiency. Over 32M ES options blocks have traded since launch, with May ADV at 83.1K contracts (+46% vs. Apr-23).

NQ options became block eligible starting January 2022, with a minimum block threshold of 60 contracts. Over 24.2K contracts have traded since eligibility.

AIR Total Return futures: Launched Sep 2020, S&P 500 AIR TRFs offer clients a listed alternative to trading OTC swaps. Client adoption continues to gain momentum as the UMR deadlines approach. ADV in May was 2.6K and OI averaged a record 331.5K (+6% vs. Apr-23) for the month. Open Interest broke 350K at the end of May, while Russell 2000 AIR TRF is seeing increased trading.

Dividend futures: CME Dividend futures combined May ADV was 4K. S&P 500 Annual Dividend Index futures May ADV was 2.9K. Nearly 59K contracts have traded since the launch of CME Annual Dividend Index futures on Nasdaq-100 and Russell 2000 in early 2022.

Equity Sector futures: CME Equity Sectors futures May ADV was 10K and the average OI was 216K. The market has embraced derived block functionality introduced last year, with nearly 200K contracts traded since launch across the various sector products.

TOPIX futures: Launched in November 2022, USD-denominated TOPIX Index futures provide market participants a new way to capture benchmark Japanese equity exposure while minimizing FX risk. This is the first USD-denominated TOPIX futures contract, which complements the existing yen-denominated TOPIX contract and provides trading opportunities in different currencies. Achieve capital efficient exposure by saving on potential margin offsets against other Equity Index futures at CME Group. Traders can utilize the dynamic quanto spreading opportunities between the yen- and USD-denominated TOPIX contracts created by the JPY/USD exchange rate. Access trading through outrights electronically on CME Globex, capture the certainty of the close using Basis Trade at Index Close (BTIC), or bilaterally negotiate EFP transactions. Learn more here:

Equity Index Products

Explore CME Group's suite of Equity Index products on U.S. and International Indices, Select Sectors, and Options on Futures.

Article: The Russell 2000 Reconstitution - Because Markets Changes

Read about how the 2023 Russell rebalance may impact the broader market and multiple ways to hedge risk.

Webinar: Navigating Opportunities in Commodity Index Trading

Tune into CME Group's webinar to get insights on the commodity market and how investors are allocating Commodity Index products into their portfolio.

Select the right U.S. Equity Index

Discover expert insights and analysis to help you choose the most suitable U.S. equity index for your investment goals.

Explore the benefits of short-dated options

CME Group has recently seen growing interest in shorter-dated options trading, particularly in maturities with less than one week until expiration. Get more insights into this trend and how short-dated contracts can impact your trading strategies.