- 18 Nov 2022

- By CME Group

Monitor risk expectations in real-time on 27 futures products and six aggregate markets with the CME Group Volatility Index (CVOL™), a robust measure of 30-day implied volatility derived from the world's most actively traded options on futures.

How to access:

- Real-time accessibility is available through CME Group Market Data via Google Cloud Platform and CME Direct

- A 15-minute delayed version of the Live Streaming CVOL is available via the CVOL homepage

Use Case: Soybean CVOL Reacts to WASDE

On October 12, the U.S. Department of Agriculture released the World Agricultural Supply and Demand report (WASDE) at 12:00 p.m. EST. The report for Soybean yield missed to the downside resulting in Soybean futures rising 16 cents. Using Soybean CVOL (SVL), market participants can see how the price reacted to the upside and volatility decreased following the report. Live streaming CVOL gives market participants the ability to instantly see implied volatility reactions enabling intra-day option trading based on market conditions.

Source: CME Group

Class III Milk options continue to pile on open interest (OI) with September setting an all-time high average open interest of 106K contracts. The dairy complex, specifically Class III Milk, continues to increase open interest since 2008. The dairy complex has one of the highest uses of options to manage price risk.

Source: CME Group

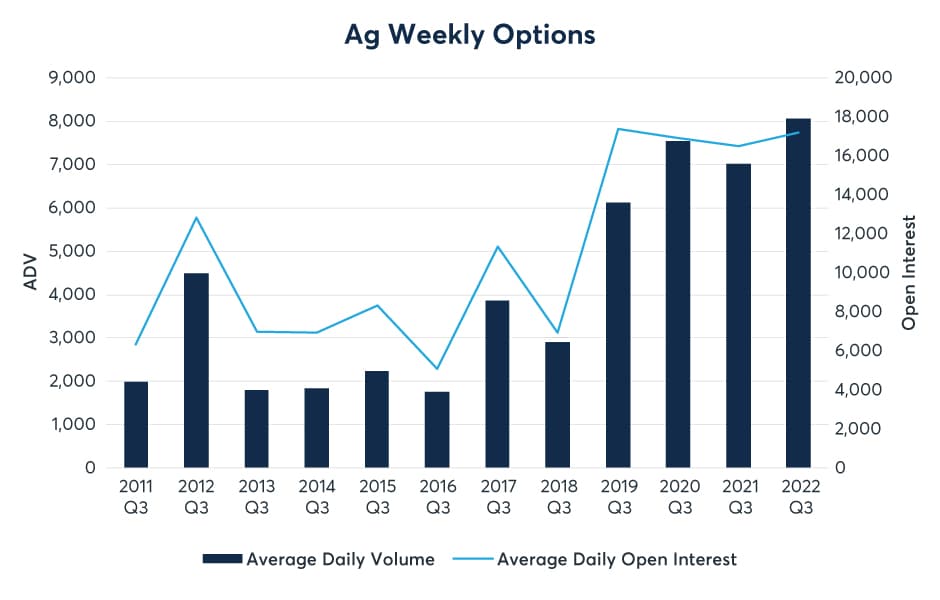

Weekly options set a Q3 ADV record with over 8K contracts trading per day. Soybean meal and SRW wheat helped set the record as market participants expanded use within the Ag complex outside of corn.

Short-Dated Crop options continues to see record-high adjusted daily volume (ADV) and OI as participants turn to low premiums and flexible risk management.

Source: CME Group

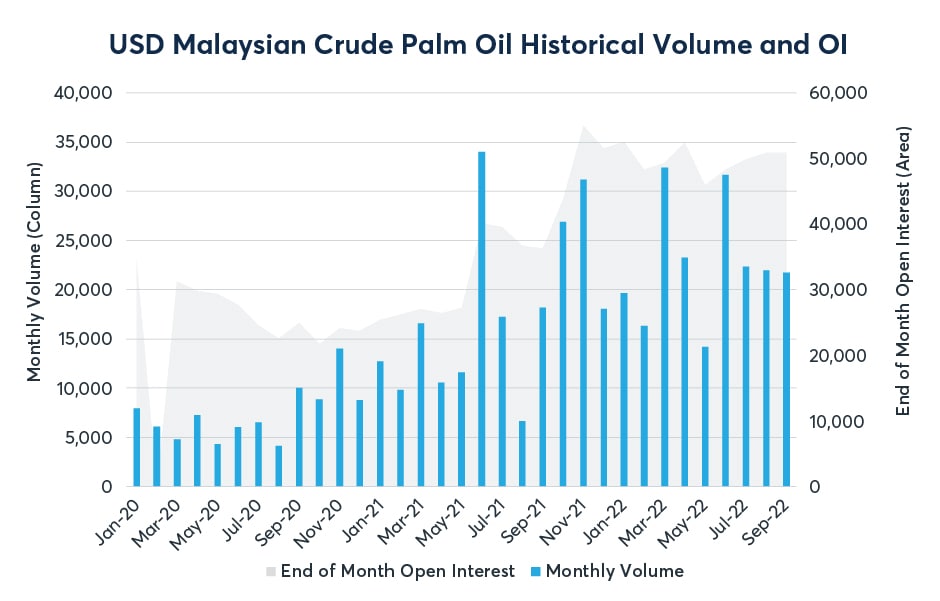

Q3 was the fourth best quarter for adjusted daily volume (ADV) for Palm Oil products and the second best quarter for open interest (OI).

Both Q1 and Q2 ranked as the top four quarters on record, making 2022 one of the most active periods in the history of CME Palm Oil products, as the marketplace capitalizes on tools for efficient risk management.

Source: CME Group

Stay on top of all ag-related news by following the CME Group Agriculture Showcase page on LinkedIn or by following CME Group on Twitter.

View the current version and an archive of the Ag Update online at cmegroup.com/education/ag-update.html

Grão Direto, the largest digital platform for grain trading in Latin America, is working with CME Group and Google Cloud to connect in real-time to CME Group Market Data, which allows them to accelerate the development of their solutions for their clients.

Pork Cutout futures and options offers a way to manage risk further down the U.S. hog supply chain with the cutout.

Lumber futures and options provides risk management opportunities on Chicago-delivered lumber with an updated contract built to reflect prices at this key location, one truck load at a time.

Canadian Wheat futures is the only futures contract available representing the globally vital FOB Vancouver export market for hard wheat.

Low carbon fuels drive vegetable price volatility

The Soybean-Corn Ratio in 2022

Cash-Settled Canadian Wheat (Platts) futures

Seasonality in Hogs vs. Pork: More Than Just Grilling Season

Fertilizer Supply Shocks Continue to Define Market

A Tale of Two Markets: Why the Future Looks Different for Hogs and Cattle

Rich Excell brings more than 30 years of experience with a new series focused on commodity options.

Stay up to date on the latest shifts occurring across Agriculture markets by subscribing to the following reports.

Ag Options Review monthly report covers significant volume, open interest, and skew, which are analyzed to help option traders navigate dynamic Ag option markets.

Monthly Fertilizer Report summarizes volume and open interest across our diverse fertilizer suite.

Grain and Oilseed Market Overview daily trade data for Grain and Oilseed futures and options detailing volume and open interest across maturities, strikes, and non-standard options.

Palm Oil Monthly Update is a monthly report that keeps you informed with important data on price volatility, inter-commodity spreads, and more.

Stay up to date on the latest shifts occurring across Agriculture markets by subscribing to the following reports.

Sign up for the latest global events and educational webinars.

Watch the Spread Trading Techniques webinar series.

Watch the Grain and Oilseed Markets (Part 3) webinar.