- 11 Jan 2016

- By Erik Norland

...farmers around the world should set their sights on pleasing potential new customers in Africa and India. China can no longer be relied on to increase demand over the long term.

In 1798, British economist Thomas Malthus published “An Essay on the Principle of Population” in which he argued that population grows geometrically while food supply, constrained by limited arable land, grows arithmetically. Therefore, he concluded, human population growth would eventually outstrip food supply, resulting in mass famine. “The superior power of population is repressed, and the actual population will be kept equal to the means of subsistence, by misery and vice.” Uplifting, no?

Thankfully, Malthus has been proven wrong the past 217 years. At the time of Malthus’s writing, the world’s population was slightly less than one billion (there were 968 million people in the world in 1800, according to the United Nations population database). There are 7.3 billion people today and, on average, much of this population is much better fed today than people were two centuries ago, or even in 1961 for that matter, when the Food and Agriculture Organization (FAO) of the United Nations began detailed research on the subject.

Although Malthus died in 1834, his ideas have been resurrected repeatedly. American biologist Paul Ehrlich’s 1968 book, The Population Bomb, and the Club of Rome’s 1972 book about its doomsday computer simulation (presumably run on punch cards and vacuum tubes), The Limits to Growth, were massive best sellers. Both predicted environmental catastrophe and mass starvation if something wasn’t done to limit population growth. Their predictions didn’t turn out any better than Malthus’s.

What happened instead was a miracle of innovation and productivity growth (two key variables that Malthusians always overlook) that has enabled the world to achieve three seemingly contradictory feats over the past half century:

- 1) More than double the world population from 3.1 billion to 7.3 billion (Figure 1)

- 2) Increase the amount of food per person (measured by calories) by over 30% (Figure 1)

- 3) Reduce the cost of food in real terms (Figures 2 and 3)

When one looks deeper into the details, the achievements are even more impressive. Since 1990, not only has calorie consumption risen per capita but the diversity of foods eaten has increased to include a lot more protein and vegetable oil as diets became less reliant on grains like wheat and rice (Figure 4).

While we celebrate Ehrlich and the Club of Rome’s 47th and 43rd year of being wrong, respectively, we should be aware that we will have to continue to grow the world’s food supply over the next quarter century as the global population is projected to increase by another 1.7 billion (or 23%) to around 9 billion by 2040. Moreover, there are many areas in the world, notably parts of Africa and India, where there is an enormous potential to increase calorie consumption per capita. This paper will explore how the potential for growth in food consumption varies across the world and where the greatest opportunities lie.

Total food consumption = average calories per capita x population.

Demographic trends are clear: the greatest potential for increased population is in Africa and India which pull up the world average. Growth in Latin America and in the United States will remain positive but slightly below the world average, while populations in China, Western Europe and Japan will grow slowly and, in some cases, decline (Figure 5).

In addition to being the fastest growing populations, Africa and India also have lower-than-average per capita calorie consumption. Low per capita calorie counts also imply the highest potential for growth. By contrast, countries like Germany and the United States have high per capital calorie counts. In some cases, notably Germany, high calorie counts are also compounded by projected declines in population and rapid aging. As such, India and Africa have the greatest potential for growth in food consumption while Germany and its Western European peers have the least. We expect below-average growth in China and Japan, and possibly in the United States and Brazil, depending on what happens with their per capita calorie consumption (Figure 6). Going (roughly) in order from greatest to least potential, this paper will discuss the future of food by region.

Africa is an enormously complex place to discuss and analyze. For starters, there is some debate over how many countries there are in the continent. There are differences in the nation-count even between the African Union and the United Nations. So, depending on one’s perspective, Africa has between 55 and 57 countries.

As varied and heterogeneous as Africa is, one thing is clear: the continent cradles an incredibly young population (Figure 7). If Africa is going to grow its population over the next 25 years from the current 1.15 billion to a projected 1.91 billion and feed them well, it will need to either grow or purchase an enormous amount of additional food, or some combination of the two. This will be no easy task. It will require that Africa overcome its three major developmental challenges:

- 1) Difficulty in generating an agricultural surplus.

- 2) Difficulty in generating a capital surplus.

- 3) Political fragmentation.

Unlike the United States, Europe, China, India and Southeast Asia, Africa is not blessed with an abundance of arable land. With the Sahara Desert to the north, jungles in the middle and another desert in Southwest Africa, the remaining land suitable for crops is rather limited. It also seems that for much of the continent, it’s either too much rain or too little. This makes generating an agricultural surplus a challenge. As such, while there is a great potential to improve crop yields on the continent, for Africa to feed another 750 million people over the next quarter century it will have to import some portion of the additional food needed. This is a huge opportunity for farmers in Europe and the United States who have a direct interest in Africa’s growth and prosperity, and for global agribusinesses, to the extent that it can help boost Africa’s “domestic” food production sustainably.

Developing a capital surplus that would allow Africans to import food has also eluded most of the countries on the continent. Often overlooked as a developmental issue, access to waterborne transportation is crucial to the accumulation of capital. The reason is simple. Waterborne transportation is vastly more energy efficient and less costly than any other form transport including rail, which itself is more efficient than moving goods by road or air.

While many people may like to attribute the prosperity of the United States and Western Europe to their democratic political systems and market-based economies, they overlook the importance of abundant arable farmland, river systems and deep water ports. The United States and Canada, for example, share the Great Lakes and Saint Lawrence Seaway which allow for deep water ports like Chicago, Cleveland, Detroit, Duluth, Montreal and Toronto to exist deep within the North American continent. Additionally, the United States has many other river systems, including the most important Mississippi River and its associated rivers (the Ohio and Missouri being the most important tributaries), as well as many smaller river systems including the Chesapeake/Potomac/Susquehanna, Delaware, Hudson and Columbia rivers. The United States also invested early in additional infrastructure to connect these river systems, including the Erie Canal, which links the Hudson with the Great Lakes; the Delaware Canal which links the Chesapeake system with the Delaware River; the canal that links Chicago and the Great Lakes to the Mississippi, as well as the improvements made by the Tennessee Valley Authority in the South. Lastly, the United States also has the intercostal waterway along the Gulf Coast and the Eastern Seaboard and numerous deep water ports on all three coasts.

Similarly, Europe has many deep water ports such as Athens, Barcelona, Bordeaux, Copenhagen, Edinburgh, Le Havre, Lisbon, Marseille, Naples, and navigable rivers including the Danube, Elbe, Garonne, Thames, Rhine and the Rhone. This facilitated the early development of commerce within Europe and with the rest of the world.

Africa is much more challenged in this regard. It has three major rivers, namely the Congo, the Niger and the Nile but none of which are fully navigable. The Congo River, which is the largest as measured by the volume of water flow, runs into rapids between Kinshasa and Brazzaville and the Atlantic Ocean. Moreover, like the Amazon in Brazil, it flows largely through jungles. The jungle limits the agricultural productivity of the land near the river while the rapids between Kinshasa/Brazzaville (the two large cities on the river and the respective capitals of the two Congos) and the ocean limit the potential for international commerce. The Niger River is broad and sandy and not especially navigable. Meanwhile, the Nile runs into a series of rapids (cataracts) and is damned at Aswan, limiting its transportation value. Lastly, while Africa does have some deep water ports (Cape Town, Dakar, Lagos, Luanda, Mombasa), their numbers are relatively small compared to the continent’s vast coastline, the length of which far exceeds that of the United States or Western Europe.

If Africa is to develop to its potential, it will need to improve its infrastructure by, for example, constructing canals that bypass rapids, dredging rivers to make them more navigable, improve port facilities and invest in rail transportation, which is the next best form of moving goods from a cost perspective. None of these will be easy given Africa’s other major issue: political fragmentation.

European colonization and its aftermath was a mess. During the 19th Century, European powers (Belgium, France, Germany, Great Britain and Portugal with occasional participation from Italy and Spain) carved up the continent with little respect for existing tribal or political boundaries. As such, when decolonization came during the 1950s, 1960s and 1970s, many of the new “nations” had boundaries that cut across ethnic lines, contributing to the challenges of governance. Moreover, unlike the United States and Canada where two friendly governments administer vast areas, Africa is quite fractious with 55-57 governments, making policy coordination and infrastructure development difficult.

As such, while Africa has enormous potential to increase its per capita food consumption, the fractured nature of Africa’s political system will make achieving this a challenge. Even so, its young demographics make it the single-most promising export market for farmers in the rest of the world over the next quarter century.

After Africa, the next most promising potential export market for the world’s famers is India. India’s green revolution has allowed it to meet the needs of its population with mostly domestic production –an amazing accomplishment given the scale of population growth: from 450 million in 1961 to over 1.1 billion today. India’s population will likely grow another 30% or so between now and 2040. Moreover, India may be hitting the limits of its potential growth in domestic food production –the country is crowded and arable land is already heavily used. As such, we would not be surprised with India buying increasingly large amounts of food from the world market –potentially great news for farmers in Europe and the Americas. What is also promising about India is its relatively low calorie count per person. This means that not only will population growth likely boost food consumption, but there is also great potential for increased per capita consumption. Like Africa, India holds out the possibility of being a perfect storm of increased food demand.

Compared to most of the world, India has an unusual diet: Indians eat almost no meat (Figure 8). That said, per capita meat consumption has been growing by about 21% since 1991. This isn’t as fast as the growth in per person consumption of produce (+74%), dairy and eggs (+50%), and vegetable oil (+32%) (Figure 9). Compounding these gains with India’s population growth has produced some truly stellar gains in total calorie consumption.

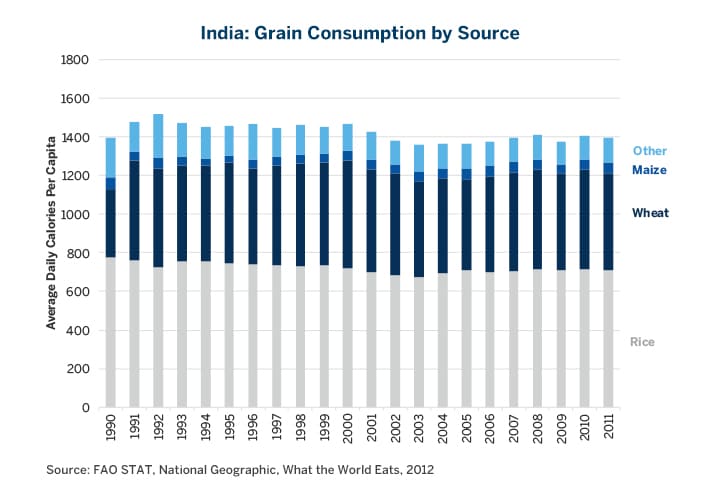

Another unusual feature of India’s diet is its grain breakdown. India consumes a great deal of rice and wheat but almost no corn (Figure 10). While grain consumption per capita tends to stagnate as countries grow wealthier, total Indian grain consumption should be expected to grow by another 30% over the next 25 years, in line with expected population growth. India represents an opportunity for corn exporters to introduce their crop into India’s diet as well as an opportunity for rice and wheat exporters to supplement India’s domestic supply, which might not be able to keep pace with population growth. The greatest opportunity for growth, however, might be for vegetable oils like palm and soybean, crops that people typically consume more of as they grow wealthier. India is also a great opportunity for those raising pulses like peas, chickpeas and lentils.

China has been the dream country for commodity exporters. Over the past quarter century, the Chinese economy has been an almost continual source of increased demand for energy, metals and agricultural goods. At least in so far as agricultural goods are concerned, that story is about to end, for one reason: demographics. In 2015, China’s demographics look almost identical to Japan’s circa 1990 (Figures 11 & 12). Despite the end to the one-child policy, China’s population will probably not grow by much.

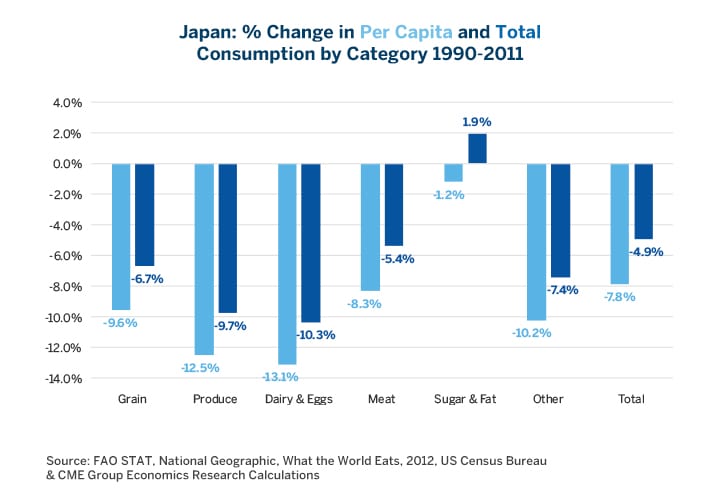

During the past twenty years as Japan’s population aged, its economic growth stalled and its per person calorie count declined. China in 2015 is a much different entity than Japan was in 1990, but in addition to the deep and unyielding demographic facts, there are other superficial similarities. Japan in 1990 had a bursting debt bubble, with an overleveraged private sector and banking system. Things in China aren’t as dramatic in 2015 as they were in Japan in 1990. Nevertheless, what happened in Japan offers us at least some insight as to China’s future (Figures 13, 14, 15 and 16).

Happily for farmers everywhere, Japan is not the only model for China’s future. Germany offers another perspective. Like Japan, Germany has an aging population that will likely be in outright decline between now and 2040 (Figure 17). The demographics are a bit different. Germany has a massive baby boomer generation that is getting ready to retire – far larger than in Japan or China relative to the size of its population. That baby boomer generation ate healthily for the past 25 years (or at least increased its per capita calorie consumption in any case) (Figures 18 and 19).

If China was to grow its calorie consumption to German levels by 2040, it would mean an additional 15% growth in total food demand even if population growth is zero. On the other hand, if it turns out like Japan, that would mean about an 8% total decline. Which route China follows matters to farmers everywhere. The Japan path would mean about a 2% decline in world food demand, all else being equal. The German path would translate into an about 3-4% increase in world food consumption. The bad news for farmers is that China’s demographics resemble Japan in 1990 more closely than they do Germany’s from the same period. As for Germany, its per capita food consumption is likely to decline as baby boomers, born between 1955 and 1970 (a bit later than the U.S. wave) get set to retire.

This is why farmers around the world should set their sights on pleasing potential new customers in Africa and India. China can no longer be relied on to increase demand over the long term. Moreover, China is beset by a number of short-to-intermediate term woes, including high levels of private sector debt and an overvalued currency that might also stall growth in food demand in the near term.

All examples in this report are hypothetical interpretations of situations and are used for explanation purposes only. The views in this report reflect solely those of the author and not necessarily those of CME Group or its affiliated institutions. This report and the information herein should not be considered investment advice or the results of actual market experience.

About the Author

Erik Norland is Executive Director and Senior Economist of CME Group. He is responsible for generating economic analysis on global financial markets by identifying emerging trends, evaluating economic factors and forecasting their impact on CME Group and the company’s business strategy, and upon those who trade in its various markets. He is also one of CME Group’s spokespeople on global economic, financial and geopolitical conditions.

View more reports from Erik Norland, Executive Director and Senior Economist of CME Group.

View this article in PDF format.