Timera Energy Chart of the Month

December 2024 highlights

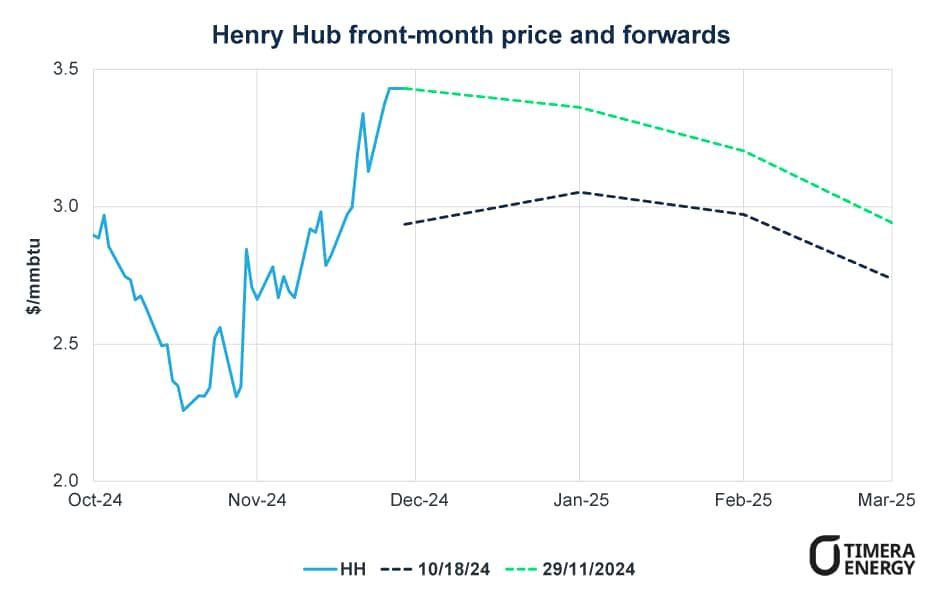

- Henry Hub front-month futures increased sharply from lows of $2.30/mmbtu in late October to above $3.40/ mmbtu at the end of November.

- Key drivers include cold weather increasing gas consumption alongside a slight drop in dry gas production.

- These dynamics are in parallel with the European gas market, where cold weather and higher demand have prompted a significant increase in TTF, despite high storage levels at the start of winter.

Henry Hub price volatility climbs across Q4

Henry Hub front-month prices rose by over $1/mmbtu in almost one month across November, reflecting increased demand as colder weather hits the US, and domestic production declines.

Domestic dry gas production averaged 102.4 bcf/d in November 2024, down from 104.7 bcf/d in the same period a year earlier, according to the U.S. Energy Information Administration (EIA).

This reduced rate of production comes in response to storage inventories overhanging from last year’s mild winter, leaving 3.9 Tcf in underground storage onNovember 22. 2024, 5% higher than the 10 year average. This excess from the previous winter dulled prices in early 2024 and dampened volatility in the latter half of the year, providing a buffer to brief periods in summer months of strong domestic gas burn.

More recently, prices have been dragged upward by forecasts signalling a much colder winter relative to recent years, with December contract prices reaching $0.5/mmbtu higher than forward prices from the start of the rally. The supply side risk of reduced production coupling with this increased winter demand tells a similar story to the recent rally in European TTF prices, where uncertainty around the loss of piped volumes through Ukraine has driven upside risk.

With new additional feed gas demand from Plaquemines and Corpus Christi LNG export terminals ramping up to begin commissioning in late December, upside risk is now firmly in the mind of market participants. A tightening U.S. domestic market could become an increasingly important driver of global prices as demand from LNG feed gas increases and as the country becomes more dependent on gas-fired generation.

timera-energy.com

+44 (0) 207 965 4541

info@timera-energy.com

The contents of this document is for informational purposes only, should not be considered as investment or trading advice, and is not an offer to sell or a solicitation to buy any futures contract, option, security, or derivative including foreign exchange.

© Timera Energy 2024 | Registered in England and Wales No 6728502

Stay in the know

Get monthly analysis of natural gas trends and events from Timera, a leading industry consultant – courtesy of CME Group.

Already have an account? Log in

By clicking above, you are subscribing and agreeing to receive the specified content. I understand that I can unsubscribe at any time.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

The opinions and statements contained in the commentary on this page do not constitute an offer or a solicitation, or a recommendation to implement or liquidate an investment or to carry out any other transaction. It should not be used as a basis for any investment decision or other decision. Any investment decision should be based on appropriate professional advice specific to your needs. This content has been produced by Timera Energy. CME Group has not had any input into the content and neither CME Group nor its affiliates shall be responsible or liable for the same.

CME GROUP DOES NOT REPRESENT THAT ANY MATERIAL OR INFORMATION CONTAINED HEREIN IS APPROPRIATE FOR USE OR PERMITTED IN ANY JURISDICTION OR COUNTRY WHERE SUCH USE OR DISTRIBUTION WOULD BE CONTRARY TO ANY APPLICABLE LAW OR REGULATION.