E-mini Nasdaq-100 Futures Contract vs FANGs

The Advantages of Trading Nasdaq-100 Futures vs. FANGs

FACTOID: After losing nearly 75% of its value during the technology stock bear market in 2000-01, the Nasdaq-100 Index slowly made its way back to all-time highs. Traders have taken note too as the E-mini Nasdaq-100 futures now trade about $60 billion a day* in notional volume (*YTD May 2018).Since the birth of the internet, and with the recent meteoric rise of mobile devices, the technology sector has been a closely watched and heavily invested segment of the marketplace.

And in the last few years in particular, the FANG stocks, comprised of Facebook, Amazon, Netflix and Google, have been the most talked about stocks in the exciting tech sector. All the FANG members are fast growing, large-cap tech issues that have brought extraordinary gains for investors. Money flows have been great into the four stocks.

As the chart (Figure 1) below shows, FANGs also correlate very highly with the Nasdaq-100 Index, allowing traders to spread or hedge FANGs versus E-mini Nasdaq-100 futures. Correlations are around .85 to .92 over time.

FIGURE 1

Source: Bloomberg

But, as popular as the FANGs have become, the E-mini Nasdaq-100 futures (ticker symbol: NQ) have garnered far more interest and transactional volume. In fact, the critical mass in the Nasdaq-100 futures dwarfs all the FANG stocks together.

The Nasdaq-100 Index is a capitalization-weighted index of the top 100 non-financial issues (it includes technology, telecom, biotech and wholesale/retail trade) listed on the Nasdaq stock market. The FANG stocks occupy several of the top 10 spots in the index. It should be noted here that some folks include Apple with the FANGs and sometimes refer to them as FAANGs. But for our purposes, Apple will be left out of these comparisons. The NQ futures contract was launched in June of 1999, enjoyed near instant success and now trades over $60 billion each day in notional value. Figure 2 below compares the average daily dollar volumes of the FANG stocks individually and collectively, as well as the QQQ (Nasdaq-100 Tracking Stock) with the NQ futures. The results overwhelming show the amount of money flowing into the futures dwarfs that of the FANG members and the QQQ added together.

FIGURE 2: COMPARING NASDAQ-100 FUTURES WITH FANGS AND NASDAQ-100 ETF

Source: CME Group Education Team

Given that stocks and ETFs trade in shares and futures trade in contracts, we normalized trade activity by using average daily dollar (or notional amount) value for each issue. While FANG stocks have good activity, as does the QQQ ETF, NQ futures are the clear winner by a substantial margin. Turnover in the NQ is over $63 billion compared with $17.0 billion in the FANGs and $25 billion in the FANGs and the QQQ together. This is testimony to the numerous advantages of trading NQ futures over FANGs and the Nasdaq-100 ETF.

Moreover, E-mini Nasdaq-100 futures enjoy more than just unparalleled activity compared with the competition. Traders with short-term gains in futures also enjoy tax benefits through the IRS 60/40 rule allowing them to be taxed at a far less onerous rate.

Another key reason why futures trade far more than FANGs and the Nasdaq-100 ETF is because of capital efficiencies. Capital is precious to traders and investors. The less you can use, the better. It is always good to have cash on hand as opportunities arise.

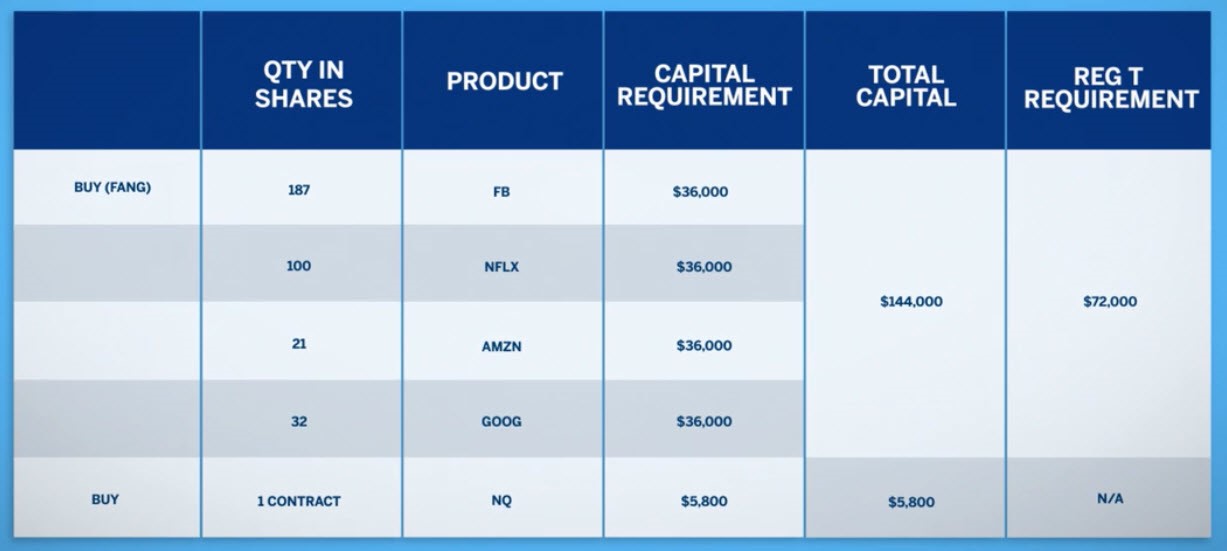

FIGURE 3: CAPITAL EFFICIENCIES IN E-MINI NASDAQ-100 FUTURES VERSUS FANG STOCKS

Figure 3 compares the capital required to purchase $36,000 of each FANG stock. Why $36,000? The notional or dollar amount of the E-mini Nasdaq-100 futures is about $144,000. Consideration must be given to the fact that the FANG stocks trade at vastly differing prices hence, we split each stock into $36,000 increments hence, equaling the value of the futures contract. Now, Reg T margin for stocks stipulates that you put down 50% of the transaction amount and borrow the rest at the broker loan rate. Hence $18,000 per FANG stock times four or $72,000 of capital would be required.

By comparison, to purchase one NQ futures contract a performance bond margin of $5,800 is required—substantially less than the $72,000 required to purchase the four FANGs on margin.

Too, with the underlying Nasdaq-100 being a basket of 100 names, the futures provide you with FANGs exposure as well as the 96 other components in the index. This gives you a broader based portfolio in the event of a decline in FANG stocks.

As popular as Facebook, Amazon, Netflix and Google have become, the evidence is overwhelming as to why the NQ futures notional trading volume dwarfs that of the FANGs and the Nasdaq-100 ETF by a substantial margin. And it is because of this critical mass and liquidity that institutional and active retail users prefer the NQ futures over other ways of gaining tech exposure. In addition, it is likely that many investors are using the E-mini Nasdaq-100 futures as a way to hedge a portfolio of stocks containing the various FANG stocks. Given all the advantages of the futures, it is an efficient way to hedge against adverse price movements.

*margin is as of 6/15/18…margins are subject to change at anytime

Test your knowledge

ACCREDITED COURSE

Did you know that CME Institute classes can fulfill CFA and GARP continuing education requirements? Every CME Institute course can be self-reported in your CFA online CE tracker and select classes can be used for GARP credits. See which of our classes qualify for GARP credits here.

What did you think of this course?

To help us improve our education materials, please provide your feedback.