User Help System

LC Alpha Report

1 Introduction

The LC Alpha Report dashboard allows clients to see at a glance what is the instantaneous added value of every LP that they trade with along with their reject rates and LP Hold times on orders, all compared to EBS Averages.

This dashboard is designed to assist the LC focus on problem areas where LPs quote non-differentiated pricing, or have high cost of rejects which are costing the LC in terms of execution efficiencies.

It also allows the LC to monitor LPs hold times (often associated with last look) and engage in conversations with the LPs to better manage their liquidity supply.

Another benefit is that we allow the LC to see an order by order breakdown of the full Transaction Cost Analysis (TCA). The data is exportable to Excel which shows next best prices available for each successful match as well as comparison to EBSM best liquidity at that point of time.

By default, LP Pass-through trades are excluded from Alpha calculation because Orders are routed to specific LPs bypassing any competitive price matching by EBS and so notional Gross Alpha value would be 0. There is an option to include LP Pass-through trades into the report.

Note: All report screen shots shown here are using hidden floor and institution codes, for illustration purposes only and to show functionality (actual Floor Codes and Institution codes are four character alphanumeric codes).

2 Configuration

Configuration of the views consists of the following:

- Selection of the groupings used to display data

- Setting filters to select trade data

- (Optionally) selecting additional data

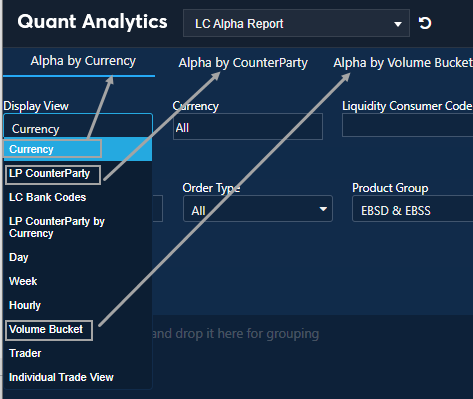

2.1 Display View Selection

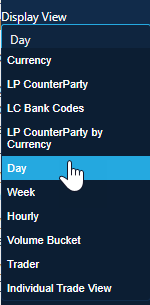

The Display Views determine how the trade data is grouped. Each of these groupings is detailed in Data Display. Options include:

- Currency

- LP CounterParty

- LC Bank Codes

- LP CounterParty by Currency

- Day

- Week

- Hourly

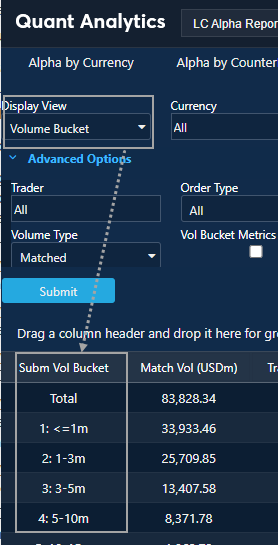

- Volume Bucket

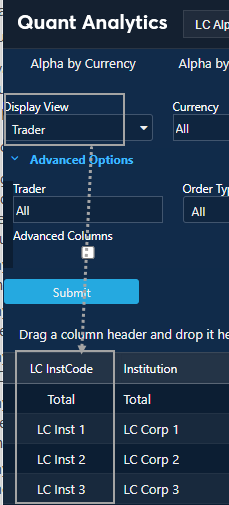

- Trader

- Individual Trade View

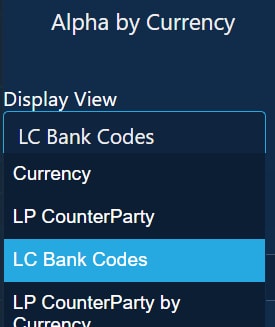

- To select views from the display view dropdown

- Click the arrow in the Currency box to see a list of view options. The default view is Currency.

- Scroll the list to choose a display option.

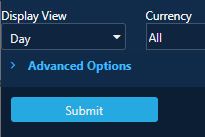

- Click Submit to confirm.

The data will display by the selected grouping.

- To use the Quick Display Views

Three of the most commonly used views can be accessed using the short-cut links.

- Click a Display View Quick link to quickly navigate to that specific view.

The three main display views are:

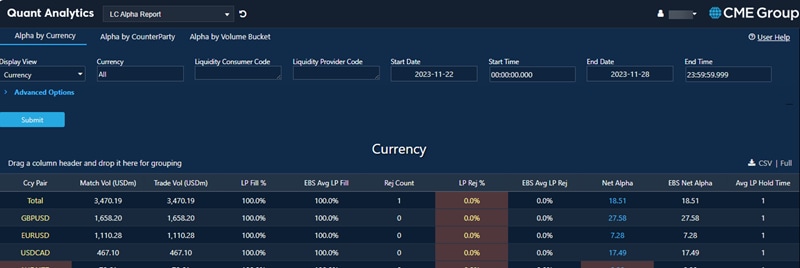

- Alpha by Currency (Display View: Currency)

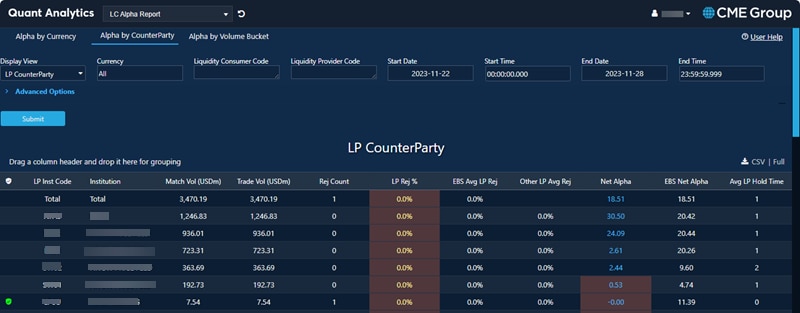

- Alpha by CounterParty (Display View: LP CounterParty)

- Alpha by Volume Bucket (Display View: Volume Bucket)

The active view is indicated by a blue line:

2.2 Data Selection

Each main display view has filters for selecting the data to be presented. Refer to the sections that follow for details.

2.2.1 Currency

Allows user to specify Currency for analysis, not case sensitive.

Shortcodes for groups of currencies are as follows:

- Default value is TOP10 – Top 10 EBS currency pairs (based on volume).

- ALL – will display the full list of currency pairs available on EBS.

- Individual Currency Pairs (Syms) – can enter single pairs (e.g. EURUSD) or multiple pairs, delimited by commas (e.g. EURUSD, USDJPY, USDCNH)

- Individual Currencies (Syms) - can enter single currencies (e.g AUD) and see all currencies with AUD in them, (e.g. AUDUSD, AUDJPY, AUDCAD, etc.)

- TOP5 – Top 5 EBS currency pairs

- NDF – will display NDF currency pairs

- Skandi or Scandi – will display all Scandi currencies, EM, LATAM, AEM for emerging markets

- Com – will display all commonwealth currencies.

2.2.2 Liquidity Consumer Code

Allows inclusion / exclusion (using “!”) of your individual LP Floor ID, or Institution code, or multiple IDs:

- Default is “”, meaning all

- Enter floor code or institution code; can be blank (does not need “ ”)

- Can use Wildcards, e.g. T*** to select all floors starting with T

- Can use Exclusion, e.g. !T*** to exclude all floors starting with T

- Can choose multiple Floors separated by a comma

- Floor codes are not case sensitive

- Only LP Codes are available

2.2.3 Liquidity Provider Code

Allows entry / or exclusion (using “!”) of individual Floor ID or institution, or multiple IDs:

- Default is “”, meaning all

- Allowed values follow same logic as for LC Code field

2.2.4 Start Date/Start Time

Specify dates and times for the data you want to see.

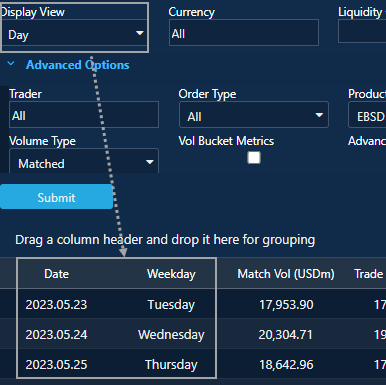

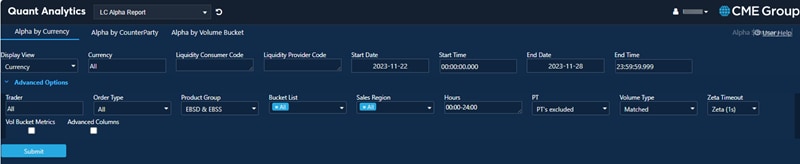

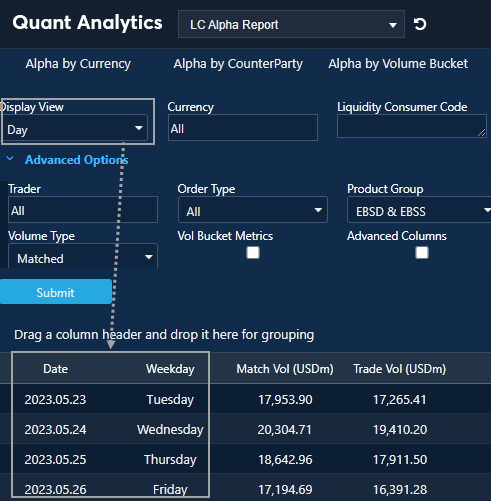

2.2.5 >Advanced Options

Clicking on this allows the user to see more advanced views and features.

Expanded View

2.2.6 Trader

Allows selection of Single or Multiple Trader ID.

2.2.7 Order Type

Allows selection of Single Ticket / Sweep or both from drop down.

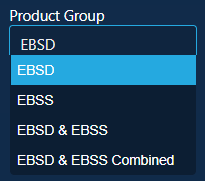

2.2.8 Product Group

Allows user to select trading style:

- EBSD (EBS Direct – disclosed relationship trading)

- EBSS (EBS Select – non-disclosed relationship trading)

Click in Product Group field to display and select options. By default, both EBSD, EBSS are selected.

2.2.9 Bucket List

The volume buckets for the size of individual orders included in the report:

- All

- 1: <=1m

- 2: 1-3m

- 3: 3-5m

- 4: 5-10m

- 5: 10-15m

- 6: 15-20m

- 7: 20-30m

- 8: 30-50m

- 9: 50m

2.2.10 Sale Region

- All

- Americas

- Asia & Oceania

- Japan

- EMEA

2.2.11 Hours

Reports trades occurring within these hours only. Start Date + Start Time and End Date + End Time determine the start and end of the overall reporting period. Determines the hours for each day within the reporting period for which trades will be reported.

2.2.12 PT

Allows user to specify if LP Pass-through orders which bypass EBS matching logic are included into average Alpha calculations. For all LP Pass-through orders Alpha is set to ‘0’. By default LP Pass-through orders are excluded when calculating average Alpha values.

2.2.13 Volume Type

Allows user to switch the volume base against which metrics are calculated. Two options are available:

- Matched (default): volume submitted by LC which was matched to LP quote

- Submitted: all volume submitted by LC to EBS, including any which was not matched to any LPs

2.2.14 Zeta Calculation Timeout

The delay used to calculate zeta values (see Total Zeta (USD) column).

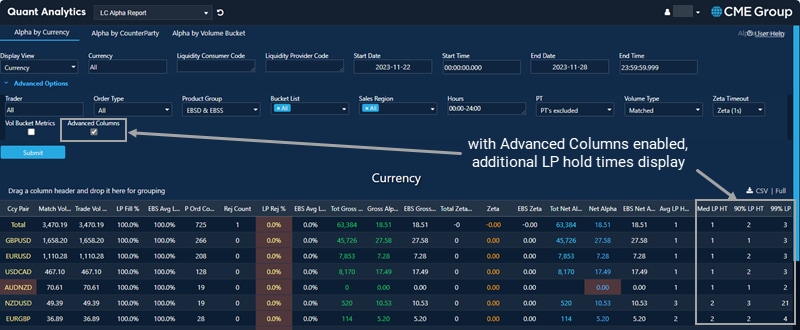

2.3 Advanced Columns

Allows user to view more columns of data including additional LP hold time data.

- Check to activate, then press Submit. See Advanced Columns for more information.

3 Data Display

3.1 Data Columns

3.1.1 Data Columns Common to Alpha Display Views

The table below displays columns of data are shared by the three primary views except for Individual Trade View. For additional metrics, refer to the Advanced Columns section.

| Column | Metric | Description |

|---|---|---|

| Match Vol (USD m) |

Matched Volume |

The volume has been matched by EBS and sent to LPs as proposed trades. |

| Trade Vol (USD m) |

Traded Volume |

The volume you have traded with your LPs in total and by selected display view. |

| LP Fill % | LP FIll Percentage | The percentage of your matched volume which was filled by LPs. This is how successful your are filling your matched orders with your LPs. |

| EBS Avg LP Fill % | EBS Average LP Fill Percentage | The EBS Average LP Fill ratio based on your blend of Currencies and Volumes matched to LPs. This is how successful most LCs are across whole EBS system in getting their matched orders filled with their LPs for similar trades to you. Is your experience better or worse than for most? |

| Rej Count | Count of Rejects | The number of times Trade Proposals have been rejected by LPs. This is how many times in the selected time your trade attempts were rejected by LP. |

| LP Rej % | LP Reject Percentage | The percentage of matched Trades volume which has been rejected by specific LP. What is the proportion of your trade volume this LP has Rejected? The three highest reject ratios are highlighted. |

| EBS Avg LP Rej | EBS Average LP Reject | The EBS Average Ratio of LPs rejecting proposed Trades based on your blend of Currencies and Volumes matched by EBS. What is the proportion of Rejected trades for other LCs? This is based on similar trade attempts to the ones sent by you. Are you being Rejected more or less than most LCs? |

| Net Alpha | Net Alpha (USD per mil) | Average benefit per million of matched volume gained from having better prices from LP at time of match and offset by cost of rejects. This is how much you benefit from having specific LPs in the mix (taking into account both the price and cost of rejects) proportionate to all of your orders which got matched on EBS System. The three lowest Net Alpha values are highlighted. |

| EBS Net Alpha |

EBS Net Alpha (USD per mil) |

Average benefit of better pricing for completed trades at time of match offset by Cost of Rejects on EBS system based on your blend of Currencies and Volumes. This is how much having specific LPs in the mix (taking into account both pricing and cost of rejects) benefits most LCs proportionate to their matched volume and based on similar trades to you. Do you benefit from your mix more or less than others given your overall trading activity on the system? |

| LP Hold Times |

LP Hold times (ms) |

Average time in milliseconds it takes LPs to respond to Trade Proposals from you. |

3.1.2 Advanced Columns

These are the data columns that display when the Advanced Columns options is selected.

| Column | Metric | Description |

|---|---|---|

| P Ord Count |

Parent Order Count |

This is the count of submitted parent orders, involved in at least one match with an LP. |

| Tot Gross Alpha (USD) | Total Gross Alpha | Total benefit of better price from LP at time of match. This is based on difference between dealt price and your EBS Direct VWAP price at the time of the match if specific LP was excluded from the price stack. If EBS Market VWAP price at the same time is better, then this value is used instead. This is how much you gain by having specific LP providing you with better price of your completed trades. |

| Gross Alpha | Gross Alpha (USD per mil) | Benefit of better pricing from completed trades per million of matched volume. This is how much you gain per million traded by having specific LP providing you with better price. |

| EBS Gross Alpha | EBS Gross Alpha (USD per mil) | Average benefit of better pricing for completed trades on EBS system based on your blend of Currencies and volumes. This is how much better pricing from LPs benefits most LCs proportionate to their matched volume and based on similar trades to you. Do you benefit more or less than others given your overall trading activity on the system? |

| Total Zeta (USD) |

Total Zeta (USD) |

Total Cost of Rejects by LPs. This is based on average trade price of any of your deals in same direction and currency pair within Zeta timeout seconds after rejected trade attempt and up to the amount of rejected trade. If no deals took place or total amount of deals is less than reject amount, then movement of EBS True Rate at Zeta timeout seconds after the reject is used to allocate the cost. This is total your cost of all LP Rejects. |

| Zeta |

Match Vol Zeta (USD per mil) |

Cost of Rejects per million of Matched Volume. This is how much LP Rejects cost you proportionate to all of your orders which got matched on EBS System. |

| EBS Zeta | EBS Match Vol Zeta (USD per mil) | Average cost of Rejects per million of Matched Volume on EBS system based on your blend of Currencies and Volumes. This is how much LP Rejects costs to most LCs proportionate to their matched volume and based on similar trades to you. Do Rejects cost you more or less than they do for others given your overall trading activity on the system? |

| Tot Net Alpha (USD) |

Total Net Alpha (USD) |

Total benefit gained from having better prices from LP at time of match and offset by Cost of Reject. This is how much you benefit from having LP price in the mix taking into account both the price quality and cost of rejects. |

| EBS Avg Hold Times |

EBS Average Hold Times |

Average time in milliseconds (across the whole system) it takes LPs to respond to Trade Proposals for similar trades. |

| Avg LP Hold Time | Average LP Hold Time | LP Hold Times: average time in milliseconds it takes LPs to respond to proposals from you |

| Med LP HT | Median LP Hold Time | LP Hold Times: median time in milliseconds it takes LPs to respond to proposals from you |

| 90% LP HT | 90% percentile LP Hold Time | LP Hold Times: 90th percentile time in milliseconds it takes LPs to respond to proposals from you |

| 99% LP HT | 99% percentile LP Hold Time | LP Hold Times: 99th percentile time in milliseconds it takes LPs to respond to proposals from you |

| Acc LP HT | Average LP hold time for filled trades | LP Hold Times: average time in milliseconds it takes LPs to accept proposals from you |

| Rej LP HT | Average LP hold time for rejected trades | LP Hold Times: average time in milliseconds it takes LPs to reject proposals from you |

3.2 Display Views

3.2.1 Display View: Currency

Default view is by Currency. This view displays information about the individual client and how they compare to the market, in general, in different Currency Pairs they traded. Default sort order is descending by Matched Volume. Users can drill down Floor-by-Floor view by Institution codes that they have access to.

Clients can drill down by one or more LPs by inputting their code into the LP code box selected (client can be empty or populated).

3.2.2 Display View: LP CounterParty

Shows metrics per Liquidity Provider Institution Code.

This view displays information per counterparty and how each counterparty compares to the market in general. Default sort order is descending by Matched Volume. This view only allows you to see data by “Matched” volume.

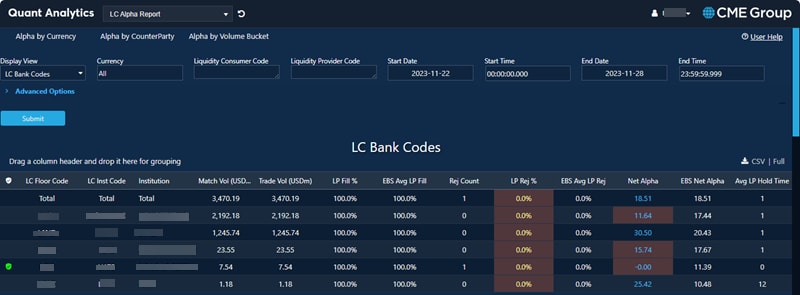

3.2.3 Display View: LC Bank Codes

Users can see breakdown of their own floors when using LC Bank Codes view.

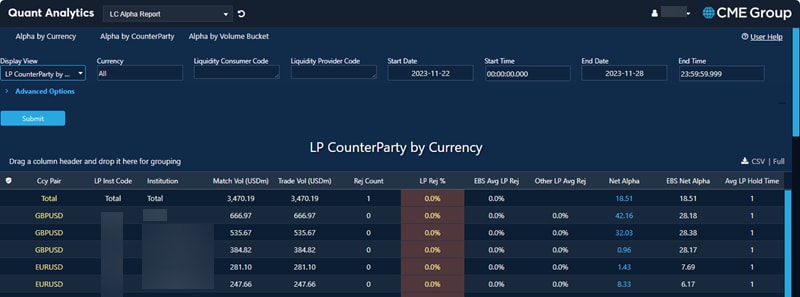

3.2.4 Display View: LP CounterParty by Currency

This view presents metrics per counterparty per currency. Default sort order is by descending Matched Volume.

This view only allows you to see data by “Matched” volume. The columns are the same as in the CounterParty View with the addition of the Currency column.

| Column | Description |

|---|---|

| LP Inst Code | An Institution code is a single EBS code applied to multiple floors. Colored user icons represent user activity on Quant Analytics dashboards for corresponding counterparty; Green: Users have logged in within past 30 days; Orange: User has logged in within the past 90 days; Red: User has not logged in (but has an account); Grey: Non disclosed LP – we do not disclose NQA activity for non-disclosed codes; No Icon: LP does not have NQA account |

| Institution |

Institution Code trading name. This could be masked for institution trading via EBS Select. |

| Other LP Avg Rej |

Other LP’s Average Reject %: this indicates what other LPs average Reject ratio is for similar set of trades. |

3.2.5 Display View: Day

Shows data aggregated by the Day.

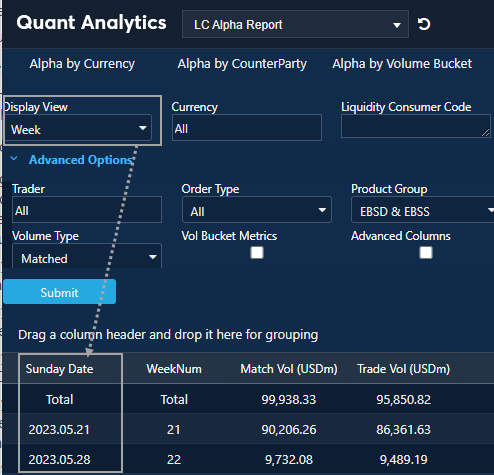

3.2.6 Display View: Week

Shows data aggregated by week.

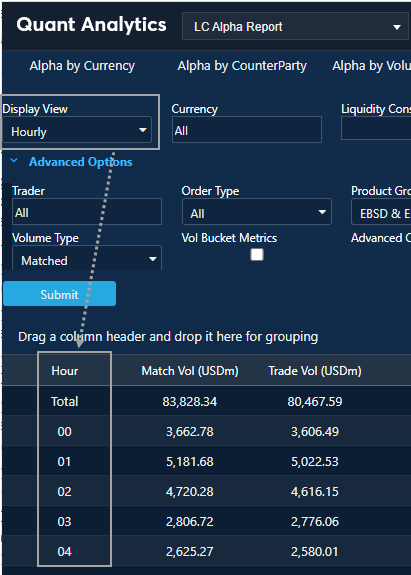

3.2.7 Display View: Hourly

Shows data aggregated by hour of the day.

3.2.8 Display View: Volume Bucket

This View groups metrics by Size (USD) of the LC Parent order which was Submitted to EBS (including any un-matched volume).

This view does allow you to switch between “Matched” or “Submitted” Volume base.

The default sort order is by Volume Bucket. Other columns are the same as in the Currency view with exception of Vol Bucket column.

3.2.9 Display View: Trader

Produces report like LC Bank code view but further split by Trader ID.

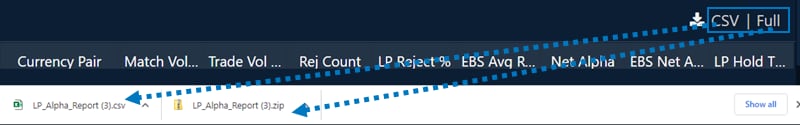

3.2.10 Display View: Individual Trade View

Produces a trade by trade view, which natively shows 6000 rows, but can be fully exported to CSV (up to 1 million rows); shows all details for deeper custom analysis.

4 Other Features

4.1 Export Data

Export analytic results by going to the right corner above data table and clicking either CSV or Full (for a complete data set).

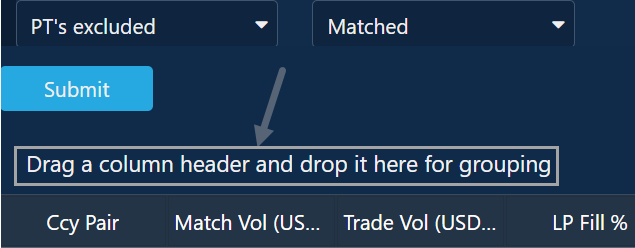

4.2 Drag a column header and drop it here for grouping

Group data by dragging column headings to the top of the chart.

5 Calculation Methodology

Only ESP flow is included while RFQ is excluded.

Orders submitted to the system are analyzed first by being matched to each LP and identifying the subsequent Filled or Reject outcomes for each matched Order.

We start by calculating Gross Alpha value which serves as a measure of the benefit received from access to better prices provided by LPs. This is calculated as following:

- For each match attempt which resulted in a Deal we calculate the difference between actual Dealt price and the theoretical VWAP price with all other LPs available to that LC (assuming the matched LP is removed from the price stack). This serves as a measure of how much was gained by having a particular LP as part of the price stack. This is the value difference on the VWAP with the LP versus without them (single ticket trades are treated as separate VWAPs)

- We also measure the difference between the actual Dealt price and the theoretical VWAP price on the EBS Market Central Limit Order Book. The lower of this value and the value calculated in (a) is used to indicate Gross Alpha value for any given Deal. If the EBS Market VWAP is better than the actual Dealt price then a Gross Alpha of 0 is assigned to the Deal. This is done to remove outliers and make sure benefit is only allocated to LPs which provide competitive prices.

Next, we calculate the Zeta metric which is the cost of rejects. This is calculated as one of the following:

- If the Parent Order was Fully Filled following the Reject event, then we take the average price of the Deals related to same Parent Order which took place after the Reject and calculate the difference from the price of the Rejected order. This methodology would only apply if the Parent Order has re-match logic enabled or is a Resting Order.

- If the Parent Order was not Fully Filled, and there were no Trades from the same Client in the subsequent one second time interval in the same Instrument and in the same Direction, then we look at the EBS True mid-rate at one second from the time of Reject and calculate the difference from the EBS True mid-rate at the time of Rejected Order. This gives an indication of the Market movement which occurred within one second following the unsuccessful trade attempt.

- If the Parent Order was not Fully Filled, but there were Trades from the same Client in the subsequent one second time interval in the same Instrument and in the same Direction which matched or exceeded the size of the average price of the Rejected order, then we take average price of these Deals and calculate the difference from the price of the Rejected.

- If the Parent Order was not Fully Filled, and there were Trades from the same Client in the subsequent one second time interval in the same Instrument and in the same Direction but their total was less than the size of the Rejected order, then we take a blend of deltas calculated using methods b) and c) above, weighted by volume.

Finally, we calculate the “Net Alpha values” by subtracting the Zeta value from the Gross Alpha thus providing a measure of the overall benefit of LP prices offset by Cost of Rejects.