User Help System

US Treasury Market Profile

The UST Market Profile brings the power of its listed Treasury futures together with BrokerTec’s cash traded U.S. Treasury trading in one place for deep market insights. Now with the ability to assess, liquidity, pricing, orderbook levels, and market microstructures clients have the ability to see how they can best manage the interest rate risk across markets.

The UST Market Profile can be used to:

- Compare traded activity across markets to see which platforms are busiest throughout the trading day.

- View the volumes of U.S. Treasury futures traded in, contract, volume and proportional terms to determine when the market is most active.

- Find out what times of the day have the tightest spreads, and compare spreads for U.S. Treasury.

- View statistical plots available for top of book (“TOB”) spreads.

- Review historic data to determine how spreads, order book depth and trading activity performed over a determined time range.

Note: All times are shown in GMT and all data is exportable, down to the five-minute level. (Only one-hour buckets available for the percentile plots). Currently, only futures volume data is public domain data.

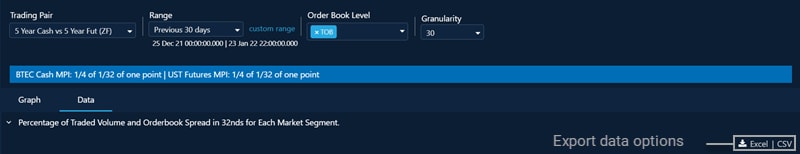

Exporting the data

To export the data click on the “Data” tab and then on your preferred export format. Excel and CSV are available.