User Help System

Metals Market Profile

The Metal Market Profile dashboard allows traders to compare and contrast CME precious metals products on a side-by-side basis to improve context and decision making. You can quickly analyze CME Group precious metals futures markets and the OTC spot equivalents on EBS Market to understand the bid-ask spreads, when the markets are active, and the available liquidity in the order book out to 10 levels.

The dashboard can be used to:

- Compare trading activity across markets to see which platforms are busiest throughout the trading day.

- View the volumes of CME Group precious metals futures traded in both contract and volume (tr. oz.) terms to determine when the market is most active.

- Determine the times during the day where the tightest spread volume occur and compare CME Group metals futures and OTC Spot precious metals.

- View statistical plots available for top of book (“TOB”) spreads

- Review historical data to determine how spreads, order book depth and trading activity performed over a determined time range

Note: All times are shown in GMT and all data is exportable down to the five-minute level. (Only one-hour buckets available for the percentile plots).

Contact Information

Please contact quantanalytics@cmegroup.com with inquiries or for customer support.

Metals Market Profile Dashboard Overview

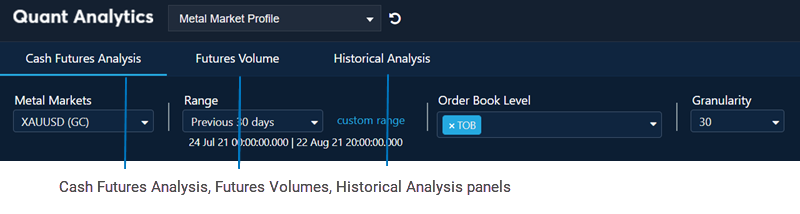

The top toolbar allows you to configure the dashboard to display the information you are interested in:

Metal Markets

The dashboard currently features COMEX Gold and Silver futures markets and their cash equivalents, XAUUSD (GC) and XAGUSD (SI), on EBS Market and EBS Direct.

Date Range

Choose to review data over recent calendar months, the last 30 days, a custom date range, or an intra-day time period on the dashboard. Note that selecting a different date range via the drop down will update the start and end times.

By default, the tool displays 00:00 – 20:00 GMT.

Order Book Level

In addition to top of book (TOB) data, choose to view spread and order size data for up to ten levels of the order book. This allows traders to see how the spreads and order book depth change as multiple levels are selected. There is also a “Futures VWAP” selection which provides a volume weighted bid-ask spread from the metal futures order book for the equivalent volume quoted on EBS Market top of book; this allows comparison of spreads based on like-for-like order volumes from each market.

Granularity

The tool enables traders to select the time granularity that they wish to see, from 60 minutes down to 5-minute intervals.

Update Frequency

Data is updated on a T+1-day basis. The tool does not provide real time / trade date data, it is providing backward-looking data for analysis.

Exporting the Data

To export the data for any dashboard, click on the “Data” tab and then the preferred export format. Excel and CSV are available.