User Help System

Managing Trading Firm Limits

Primary FX Firm and Spot FX Firm Administrators and can set the following FX Spot+ credit limits at the firm level:

- Net Open Position (NOP): Controls the aggregate net long and short exposures with a counterparty.

- Max Qty Long and Max Qty Short: Limits the net long and short exposures in a currency pair.

Note: Long/Short and NOP limits are optional, however, at least one must be set to permit trading.

On entry, each order is credit checked against all applicable limits: Long/Short, NOP, or both.

For credit utilization examples using the Net Open Position, Max Qty Long and Max Qty Short settings, refer to the CME FX Link and FX Spot+ Credit Overview.

Setting Spot FX Credit Limits

When setting the Net Open Position (NOP) and Max Qty Long and Max Qty Short credit limits for FX Spot+ products, consider the following:

To allow trading NOP or Max Qty Long and Max Qty Short must be set.

- A NOP value of "0" blocks all trading.

- A Max Qty Long and Max Qty Short value of "0" blocks trading in the currency pair.

- If a NOP credit limit is set for the firm and the Max Qty Long and Max Qty Short credit limits are "Not Set" for currency pairs, trading in each currency pair is limited by the NOP setting.

- Conversely, if limits are set for currency pairs and the NOP limit is "Not Set", trading in each currency pair is limited by their Max Qty Long and Max Qty Short limits.

- If both NOP and the Max Qty Long and Max Qty Short limits are set, trading in each currency pair is limited by the most restrictive setting.

- If the NOP setting is reduced to "0" after a position is established, only risk-reducing orders are allowed. If both the Max Qty Long and Max Qty Short limits are reduced to "0" for a currency pair after a position is established, only risk-reducing orders for the currency pair are allowed.

The Primary FX Firm Administrator sets limits for each Spot FX Firm or Direct Trading Participant, which in turn sets limits for Trading Firms and Execution Firms and accounts. A Trading Firm is a collection of Execution Firms (GFIDs) to which a Spot FX Firm allocates credit; this could be a Prime Client or a Direct Trading Participant.

Setting Credit Limits for Spot FX Firms

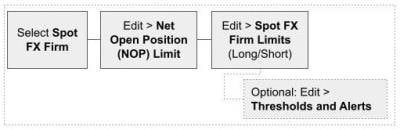

As a Primary FX Firm Administrator, use the following procedure to select a Spot FX Firm (Prime Broker or Direct Trading Participant), set thresholds and alerts, and set credit limits for the firm.

- To set credit limits for a Spot FX Firm:

- From the Entity Risk Management menu, select Spot FX.

- From the Spot FX page, select the Spot FX Firm to view / manage.

If you are entitled for one Spot FX firm, it is automatically selected.

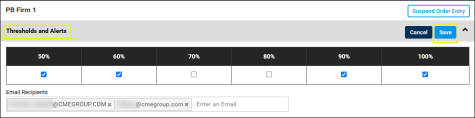

- In the Thresholds and Alerts pane, set email alerts for up to 20 email recipients when the Spot FX firm uses a select percentage of its limit thresholds (settings from 50% to 100%) , then select Save.

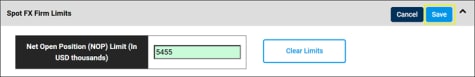

- Select Edit in the Spot FX Firm Limits pane.

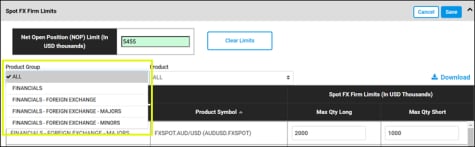

Note: Limits are set in USD thousands equivalent.

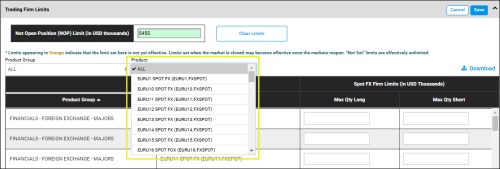

In the above NOP Limit example: 5455 = $5,455,000 USD

If you set a NOP limit, it will be applied to all selected product groups and products (currency pairs).

Note: If you select Clear Limits, all currency pair values for the Max Qty Long and Max Qty Short are cleared (the NOP value is not cleared).

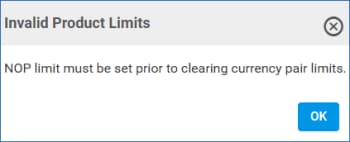

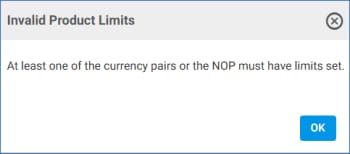

The NOP limit must be set before clearing any currency pair limits. When attempting to clear Product limits, if NOP limit is not set, a dialog will appear.

- Select Spot FX product groups and currency pairs.

In the Product Group field, select a one or more Product Groups or select ALL.

In the Product field, select one or more Spot FX currency pairs or select ALL.

- To set a credit limit per currency pair, enter a Max Qty Long and Max Qty Short value for each pair.

Note:

-Limits are set in USD thousands equivalent.

-In the below Spot FX Firm Limits example: 25000 = $25,000,000 USD

-Pending updates appear in green.

-Limits updated when the markets are closed are effective at the next market open.

Note: When attempting to save Firm Limits, if limits are not set, a dialog will appear.

To permit trading, at least one limit (NOP and/or Product) must be set.

- To finalize, select Save.

The NOP and Max Qty Long/Short credit limits are set for all selected currency pairs for the Spot FX firm.

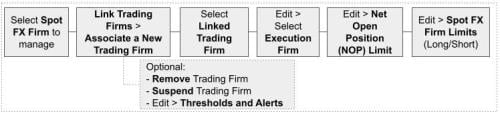

Setting Credit Limits for Trading Firms

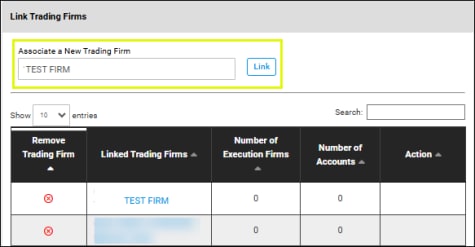

As a Spot FX Firm (Prime Broker or Direct Trading Participant) administrator, use this procedure to access the Spot FX Firm page to link Trading Firms, set up the relationship with Execution Firm(s), create an account if needed, and set credit limits for the Trading Firm.

To set credit limits for a Trading Firm, you must first link the Trading Firm and its accounts.

- To set credit limits for Trading Firms:

- From the Entity Risk Management menu, select Spot FX.

- From the Spot FX page, select the Spot FX Firm to view / manage.

If you are entitled for one Spot FX firm, it is automatically selected.

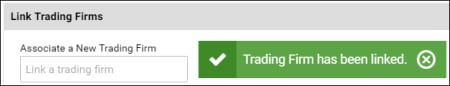

As you type, trading firms appear in a list; select from available options.

A confirmation message indicates successful linking and the Trading firm is added to the list of linked firms.

- Select the linked Trading Firm.

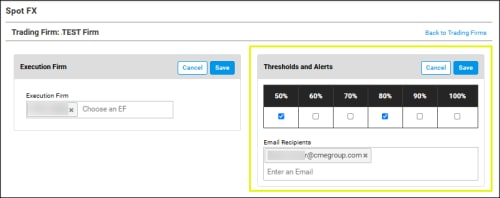

- To add or change the Execution Firm pane, select Edit, then specify Execution Firm(s) to link, then select Save.

- If the linked Trading Firm does not have an account, create the account in the Account Management Service. A registered account that is linked to a Trading firm, Executing Firm and Spot FX Firm is required on every order.

- In the Thresholds and Alerts pane, set email alerts for up to 20 email recipients when the firm uses a select percentage of its limit thresholds (settings from 50% to 100%) .

- Select Edit in the Spot FX Firm Limits pane.

Note: Limits are set in USD thousands equivalent.

In the above NOP Limit example: 5455 = $5,455,000 USD

If you set a NOP limit, it will be applied to all selected product groups and products (currency pairs).

Note: If you select Clear Limits, all currency pair values for the Max Qty Long and Max Qty Short are cleared and updated to Not Set (the NOP value is not cleared).

The NOP limit must be set before clearing any currency pair limits.

- Select product groups and currency pairs.

In the Product Group field, select a one or more Product Groups or select ALL.

In the Product field, select one or more currency pairs or select ALL.

Note:

-Limits are set in USD thousands equivalent.

-In the below Spot FX Firm Limits example: 25000 = $25,000,000 USD

-Pending updates appear in green.

-Limits updated when the markets are closed are effective at the next market open.

Note: Pending updates appear in green.

Limits updated when the markets are closed are effective at the next market open.

- To finalize, select Save.

The NOP credit limit is set and will be applied to all selected product groups and currency pairs for the Trading Firm and associated Execution Firm and account.