User Help System

EBS Globex Firm ID

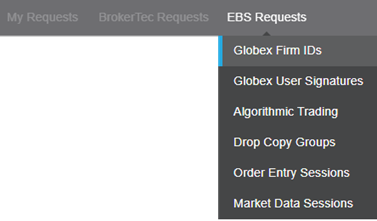

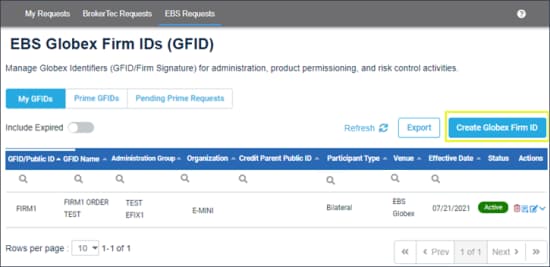

Using the EBS Requests - Globex Firm IDs function, authorized users can create and manage Globex Firm IDs (GFID) (also known as Deal / Floor Code) which identify EBS market participants at an entity.

Note: Within a given entity, multiple GFIDs can be created.

- A company can have more than one GFID for each venue (market) and assigned a GUS.

- A GUS can be associated to multiple GFIDs; however, only one GUS/GFID creation request can be created at a time.

EBS - Globex Firm ID Functions

After creating a GFID, create a Globex User Signature to assign a person to manage EBS GFID market participant details and submit trades for the GFID and entity.

Creating a EBS Globex Firm ID

The following instructions illustrate the process to access EBS Requests - Globex Firm ID functions and create a new Firm ID.

- To create an EBS Globex Firm ID:

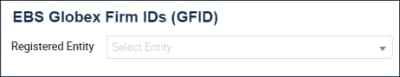

Note: If you have access to more than one registered entity, select from the drop-down menu.

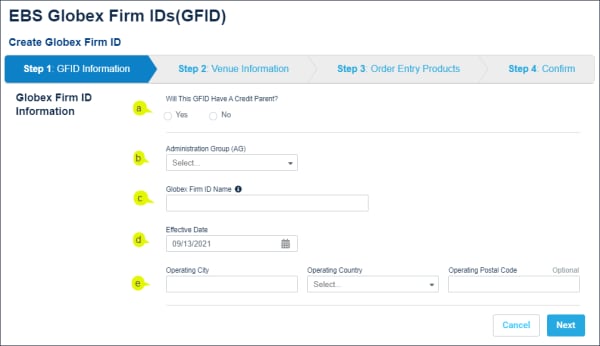

- From the EBS Globex Firm IDs page, select the Create Globex Firm ID button, then complete the following fields (as applicable).

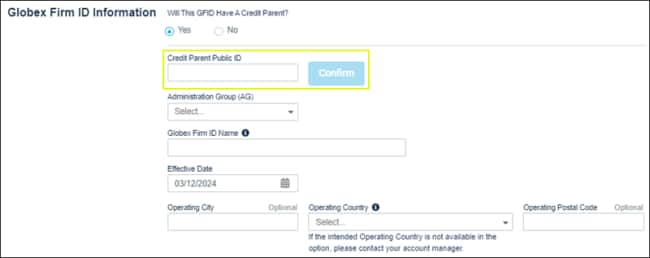

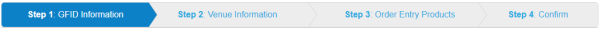

- Step 1: GFID Information

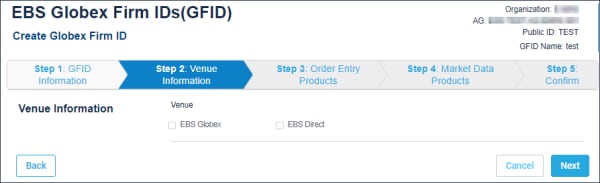

- Step 2: Venue Information

- Transaction Reporting - applicable only for UK MTF

- Step 3: Order Entry Products

- Step 4: Market Data Products

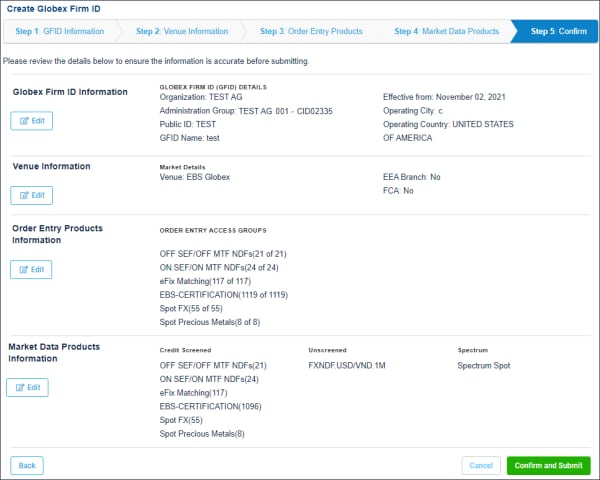

- Step 5: Confirm

- Specify whether the GFID will have a credit parent then complete additional fields.

If Yes, enter the Credit Parent Public ID and .

If No: enter the Public ID and .

Note: For additional information on EBS GFID and the relationship between credit parents and prime customer / trading participants, see the Client Systems Wiki - EBS Credit Overview on CME Globex.

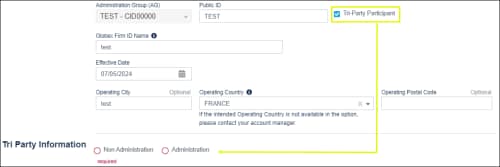

- Administration Group: A logical grouping of GFIDs, at an entity, with a designated individual that is assigned entitlements to manage GFIDs, details and the ability to create groups of GFIDs for administrative / service management and transaction separation.

- Public ID / Credit Parent Public ID: The unique 4-character id which the public knows the firm as.

- Tri Party Information: If the new GFID is a Bilateral market participant and trades EBS Direct (only) through a Tri-party agreement with a bank, the bank is responsible for the settlement of deals traded by the GFID; select the checkbox.

- Administration: Applicable if the Tri-party agreement, for the selected GFID, is with a single bank. The bank’s admin managers may join in the same Triparty AG (company name as agent of <bank>) and (optionally) manage credit. Also specify the Credit Administrator Public ID.

- Non-Administration: The entity is responsible for managing administration, including credit, on behalf of the bank with whom the GFID has a tri-party agreement.

- Credit Administrator Public ID and Legal Entity Identifier (LEI): The unique 4-character id which the public knows the firm as

- Credit Administrator Legal Entity Identifier (LEI): Valid identifiers are required for all registered entities.

Note: Refer to the Global Legal Entity Identifier Foundation (GLEIF) database at www.gleif.org.

- Globex Firm ID Name: Specify a unique (at the entity) market participant name.

- Effective Date: GFIDs do not require approval and are available for order entry on the specified date (default is today).

- Operating City / Country / Postal Code: If the intended country is not available, contact Global Account Management.

- Specify Venue Information and Transaction Reporting acknowledgment (applicable only for UK trading venue operators).

- Select the Venue (trading platform): EBS Globex / EBS Direct.

Note: For details, refer to the EBS Legal Entity and Regulatory Structure.

- SWIFT BIC Code: Also known as SWIFT number.

If EBS Direct is selected, also specify:

- Default GUS: The GFID cannot be used for trading until a GUS is assigned.

- SWIFT BIC Code: Also known as SWIFT number.

SWIFT is the Business Identifier Code (BIC) that identifies financial institutions. It consists of the Bank Code (4 letters), Country Code (2 letters), Location (2 characters), Branch Code (3 numbers).

- EBS Direct Connection Region: Specify the EBS Direct Connection Region for the GFID.

Specific to the EBS Direct connection, not the operating country.

- Liquidity Information: (required - If EBS Direct is selected) Specify whether the GFID is a Liquidity Provider and/or Liquidity Consumer.

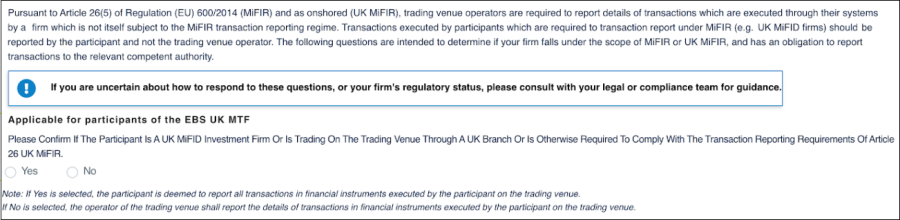

- Transaction Reporting (Applicable for participants of the EBS UK MTF): The following questions determine if your firm falls under the scope of MiFIR / UK MiFIR, and has an obligation to report transactions to the relevant competent authority.

"Please confirm if the participant is a UK MIFID Investment Firm or is trading on the trading venue through a UK branch or is otherwise required to comply with the transaction reporting requirements of Article 26 of UK MIFIR."

- By selecting Yes, the participant is deemed to report all transactions in financial instruments executed by the participant on the trading venue.

- By selecting No, the operator of the trading venue shall report the details of transactions in financial instruments executed by the participant on the trading venue.

Note:

Pursuant to Article 26(5) of Regulation (EU) 600/2014 (MiFIR) and as onshored (UK MiFIR), trading venue operators are required to report details of transactions which are executed through their systems by a firm which is not itself subject to the MiFIR transaction reporting regime. Transactions executed by participants which are required to transaction report under MiFIR (e.g. UK MiFID firms) should be reported by the participant and not the trading venue operator. The following question is intended to determine if your firm falls under the scope of UK MiFIR, and has an obligation to report transactions to the relevant competent authority.

If you are uncertain about how to respond to these questions, or your firm’s regulatory status, consult with your legal or compliance team.

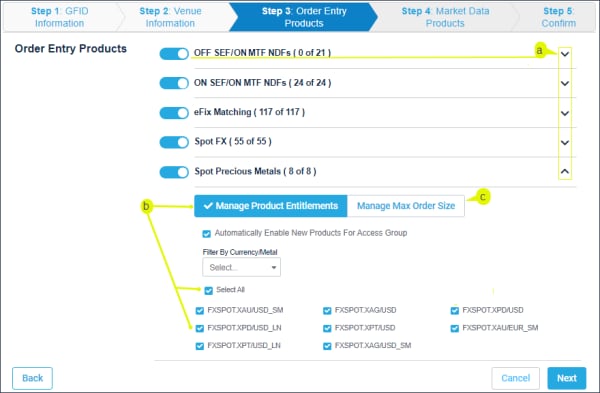

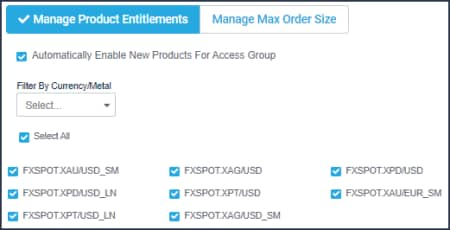

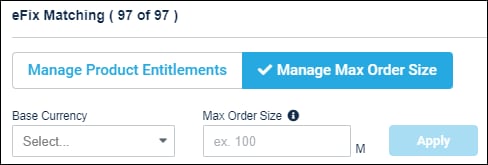

- Select from credit screened Order Entry Products to enable; including Maximum Order Size (currency or quantity).

Note: An additional feature includes ability to assign FX Spot+ products, which is performed using the Globex User Signature function.

- Select (

) / Deselect (

) / Deselect ( all products within a group.

all products within a group. - Expand

/ Collapse

/ Collapse to show / hide individual products.

to show / hide individual products.

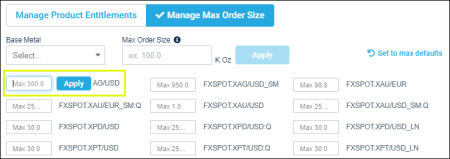

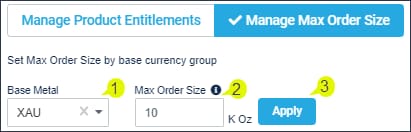

- Spot Precious Metals: by thousand ounce units (e.g. 20 = maximum order size of 20 thousand ounces of gold).

Enter a value, then select Apply.

- Currency: by millions of the selected currency (e.g. 25 = maximum order size of 25 million of the select currency).

Example:

(1) Selection of Spot Precious Metals - Gold products

(2) Maximum order size of 10 thousand ounces

(3) Select Apply

- Short Code: The short code is required to trade products and associated with the GUS.

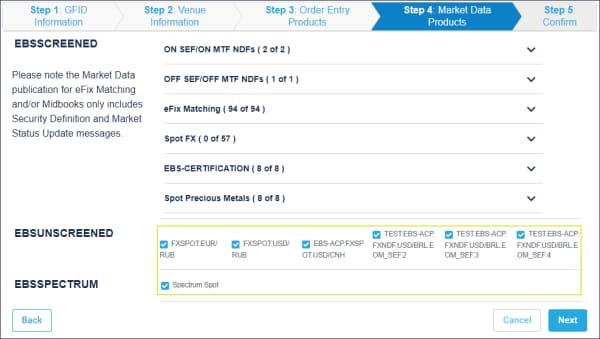

Step 4: Market Data Products:

- Select Market Data Products; default selections include Order Entry products from the previous step.

Additional market data products can be selected / deselected, as necessary.

A screen notification appears, indicating successful submission.

Review or create an associated Globex User Signature (GUS).

Note: If you receive an error when creating your Globex Firm ID stating “Firm ID you are trying to create already exists” please contact Global Account Management.

Additional EBS GFID Functions

- My GFIDs: List of GFIDs associated to Administration Groups (AGs) which the user has permission to view / manage.

- Prime GFIDs: List of Children GFIDs associated to Credit Parent GFIDs that are associated to AGs which the user has permission to view / manage.

- Pending Prime Requests: List of Requested Children GFIDs associated to Credit Parent GFIDs that are associated to AGs which the user has permission to view / manage. Pending Prime requests must be reviewed and approved before it is available for use.

- Include Expired: by default expired GFIDs are hidden

- Refresh: view recently added GFIDs

- Export : Download the list of GFIDs to a .csv file.

- Sort / Filter: Enter search criteria in the top row, matching results appear as you type, select a heading to sort ascending or descending.

- Actions:

- Delete (

) - Select delete and the confirmation dialog.

) - Select delete and the confirmation dialog. - Export GFID (

) - details as csv file

) - details as csv file

- Edit GFID (

) - For update details, refer to steps 3 through 7.

) - For update details, refer to steps 3 through 7.