User Help System

Portfolio Margin Optimization Details Report

The Portfolio Margin Optimization Details Report performs portfolio margining of all IRS Swaps and/or Delta Ladder curves with interest rate futures and options to mimize initial margin requirements.

When the Cross Margin option in the Futures and Options grid is checked, the trade will be margined against the Delta Ladder curves and/ or IRS trades, and HVAR is used to calculate results. Margins for unchecked Futures and Options are calculated using CME SPAN.

Margin Amounts without Margin Optimization

|

Margin Amounts without Margin Optimization |

= |

Delta Ladders AND/OR IRS Trades |

+ (plus) |

Portfolio Margin Futures (FUT) |

+ |

IR Futures and Options (OPT) |

Note: The Margin Optimization Futures do NOT have the Cross Margin box checked. The Margin Type field will fill with FUT when the portfolio is saved. Interest Rate Futures and Options are cross-margined with the Interest Rate Swaps, and the Cross Margin box is checked. When the portfolio is saved, the Margin Type field will show OPT.

Margin Amounts with Margin Optimization (Cross-margining)

|

Margin Amounts with Margin Optimization |

= |

Reduce the total margin payment required by transferring optimized positions from one account to another. |

+ |

Interest Rate Futures and Options not cross-margined with Interest Rate Swaps. |

Savings

|

Savings |

= |

Margin Amounts without Opimization |

- |

Margin Amounts with Optimization |

Portfolio Margin Optimization Detail Report Breakdown

Portfolio Margining in CME CORE approaches initial margin calculation from a total cost savings perspective.

Example: Delta Ladder - The same is true for IRS trades, or IRS and Delta Ladder.

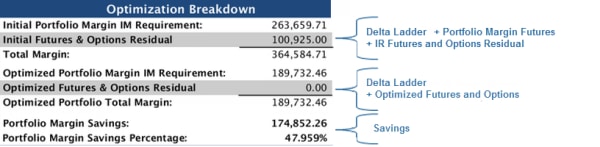

Margin Optimizer Results Comparison Breakdown

- The first set of totals represents the margins for Delta Ladder (or IRS or both), Portfolio Margin Futures and IR Futures and Options initial margin calculated as separate portfolios.

- The second set of totals represents the calculated margin with Delta Ladder (or IRS or both) and assuming the recommended transfer of Futures into Swap Portfolios.

- The Portfolio Margin Savings is the difference between the totals of the two calculations.

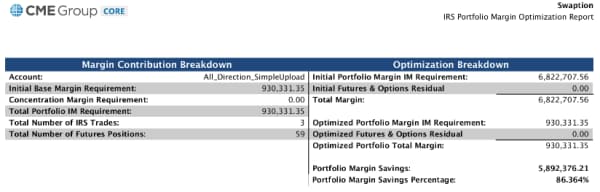

Portfolio Margin Optimization Detail Report

The Portfolio Margin Optimization Detail report compares initial margin requirement with optimized margin requirement and achievable portfolio margin savings.

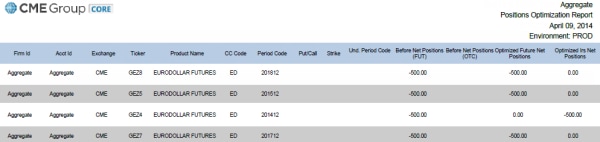

Position Optimization Report

The Postion Optimization Report breaks down CME Cleared OTC IRS to receive savings as described in the initial report. These are the future positions that are transferred to the IRS portfolio.