Yield futures provide market participants with an expanded set of trading and risk management capabilities for U.S. Treasuries. Yield futures are cash settled, traded in yield, and track a single on-the-run security ‒ whereas existing Treasury futures are physically delivered, traded in price, and track a basket of deliverable securities. Further, these products maintain a static basis point value of $10 across all tenors, making spread trading seamless and straightforward.

CurveWatch offers analytics based on futures yields implied by Yield futures, allowing traders to observe the futures market’s view of on-the-run Treasury yields.

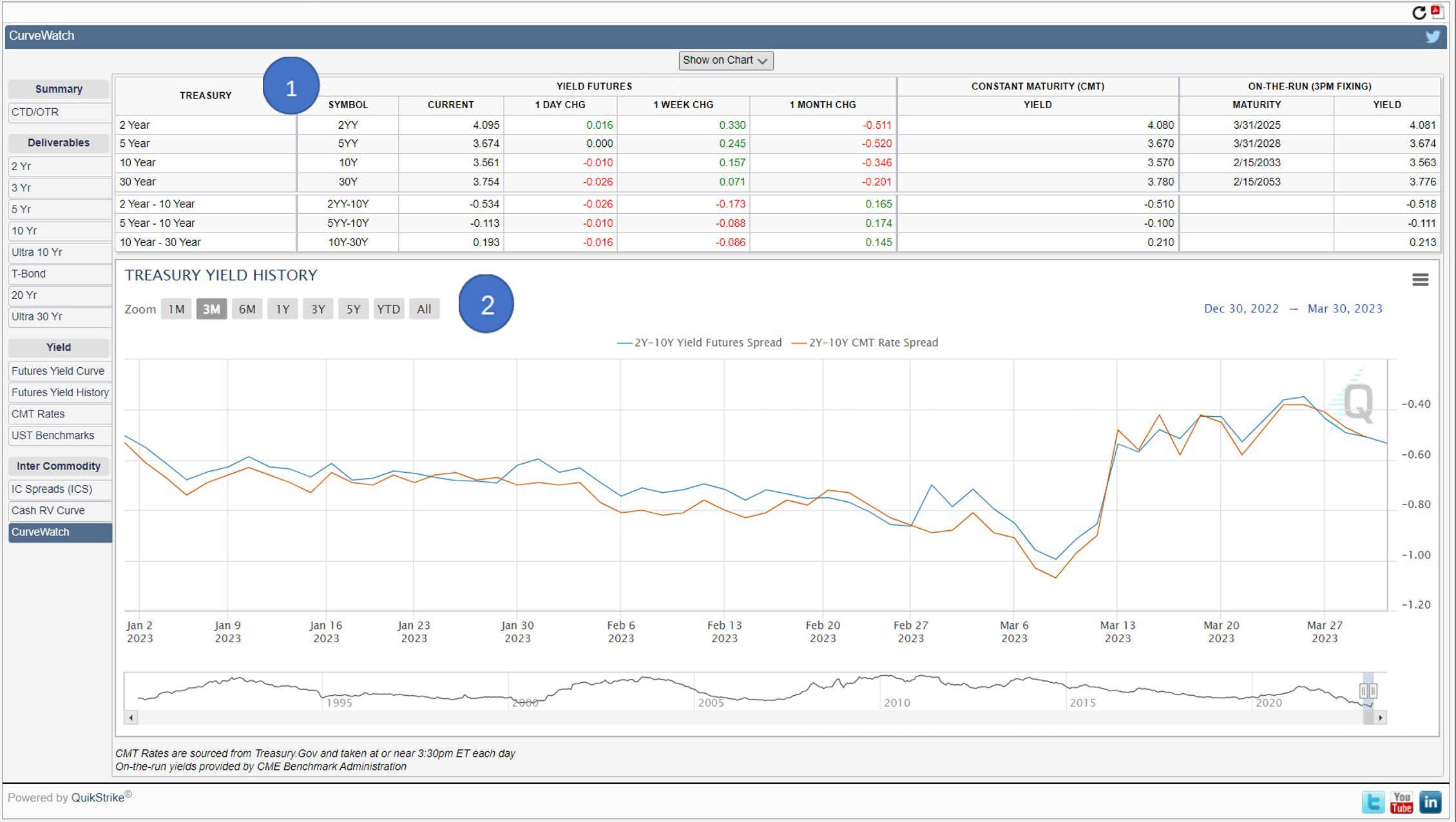

The table at the top of the CurveWatch tool lists each front month Yield futures contract (2YY, 5YY, 10Y, and 30Y), as well as the 2YY-10Y, 5YY-10Y, and 10Y-30Y inter-commodity spreads between. For each of these contracts/spreads, the “Yield Futures” box in the table provides the current futures yield as well as the changes over one day, one week, and one month. The “Constant Maturity (CMT)” and “On-the-run” boxes in the table provide the current constant maturity (CMT) yield and BrokerTec U.S. Treasury Benchmark fixing (taken at 3pm and 5pm EST) for comparison.

This chart displays a historical time series of the closing Yield futures yields for a given tenor or spread. The chart also displays CMT yields and BrokerTec on-the-run yields (taken at 3pm to match the timing with closing yields for Yield futures). To select which series to chart, use the “Show on Chart” drop-down list at the top of the tool. Note that data for Yield futures is only available from the launch of these contracts (August 16, 2021). As can be seen in the chart, correlations between the closing Yield futures yields and the corresponding CMT yields are very close to unity, as shown in the correlation matrix below.

|

2YY |

5YY |

10Y |

30Y |

|---|---|---|---|---|

2-Yr CMT |

0.9998 |

|||

5-Yr CMT |

0.9998 |

|||

10-Yr CMT |

0.9999 |

|||

30-Yr CMT |

|

|

|

0.9998 |

*Calculated for the period 8/16/21 to 2/3/23.

The holder of a short position in a Treasury futures contract must deliver a cash Treasury security to the holder of the offsetting long futures position upon contract expiration. There are typically several cash securities available that fulfill the specification of the futures contract. Because of accrued interest, differing maturities, etc. of the various cash securities, there are differing cash flows associated with the deliver process. The cash security with the lowest cash flow cost is known as the Cheapest to Deliver.

CMT yields are read directly from the Treasury's daily par yield curve, which is derived from indicative closing bid market price quotations on Treasury securities. However, CMT rates are read from fixed, constant maturity points on the curve and may not match the exact yield on any one specific security.

The "on-the-run" security is defined as the most recently auctioned security. The U.S. Treasury maintains a set and published schedule of the days on which it will auction new Notes and Bonds for each tenor (years to maturity). For example, a new 5-Year Note will be auctioned on Wed, August 25, and so the “on-the-run” 5-Year will be this security until the Treasury issues a new 5-Year note on September 27. The on-the-run security is the most commonly-quoted yield on most financial news outlets.