4 Min readArticle15 Apr 2025

Methanol Gains Traction as an Alternative Energy Source

At a Glance

Methanol futures are gaining ground as a hedging tool as more companies enter the market to mitigate against daily price fluctuations. Trading volumes for methanol have continued to rise in early 2025, building on record highs from 2024.

Conventional vs Green Methanol

Methanol, a simple alcohol, is a key feedstock in the chemicals sector, with construction materials and automobiles (which encompasses both the plastics used in automotive manufacturing and the fuel to reduce overall tailpipe emissions) as the largest demand centers. The carbon benefits of methanol depend on how it’s produced, with the greenest forms of methanol requiring hydrogen and either inputs of large amounts of renewables or high quantities of carbon capture and storage to deal with any associated emissions. These technologies require large-scale build out of hydrogen, renewables and carbon capture and storage capacity over time.

Companies are beginning to see methanol as an important fuel source for the shipping industry. This development is welcome news for producers, and interest in trading methanol from a variety of industry sectors has helped to contribute to growth in trading activity.

Total traded volumes on CME Group methanol futures in the first quarter of 2025 reached 1,600 contracts traded, having reached nearly 6,000 contracts traded in 2024, which was an increase of around 30% compared to 2023. Open Interest, which is widely seen as a good indicative measure of the success of any futures market, reached around 1,800 contracts in early 2025, a three-fold increase from the January 2024 level.

Currently, the demand from the market is to trade the liquid conventional methanol-based futures contract for hedging across the broader methanol supply chain, whether that be in conventional methanol or the lower carbon alternatives. Companies typically manage any associated carbon exposure in the carbon futures and options market as an overlay to any methanol derivatives trades.

The demand for methanol looks set to continue – Energex Partners, an advisory company in the energy sector, estimates that the conventional market for methanol will grow from about 113 million metric tons currently to over 170 million tons by 2040 amid global economic growth.

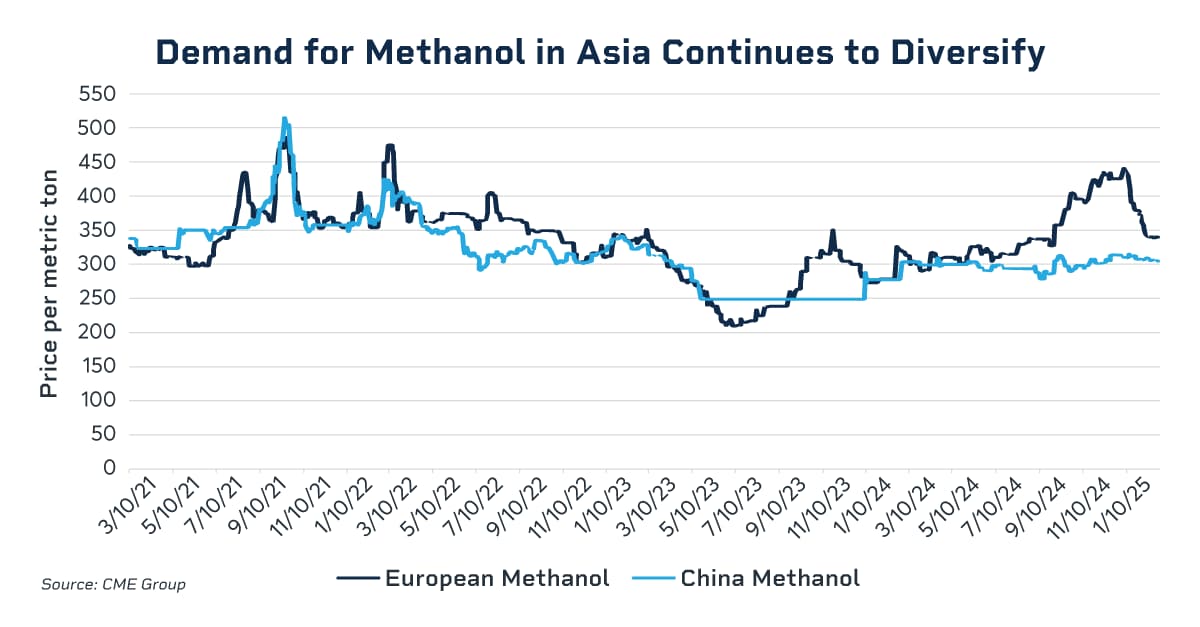

Volatility in the Global Methanol Markets

Renewed price volatility in the methanol market is attracting commercial trading firms, particularly those sensitive to price swings in the commodity. This resurgence is evident in the European market, where 30-day historical annualized volatility recently climbed close to 50%, which is an increase from around 27% compared to the same time in 2024. While volatility in the Chinese market remains comparatively low, the trajectory of both Asian and European methanol prices is uncertain. This uncertainty stems from the evolving role of methanol as a lower-carbon energy source that is drawing a wider range of industry sectors into the market.

The futures markets are pricing a narrowing spread between European and Chinese methanol. Part of this reflects oversupply coupled with the relatively higher costs of production for European methanol which have impacted demand. A higher price for natural gas is seen as one of the major contributing factors to the rising European production costs.

The price of the prompt European methanol futures contract traded in a range of €270-€440 for 2024 and €330 to €440 so far this year through February 2025. In Asia, the futures settlement price for the prompt contract month traded in a range of $280 to $325 per metric ton over the prior 12-month period to February 2025. The price spread of around $35 per metric ton between European and Chinese prices is the lowest level since August 2024, CME Group data shows.

Rising demand for ethylene and propylene (olefins), which are key products for plastics, synthetic fibers and many downstream petrochemical products, has been accompanied by a scale-up of methanol-to-olefin (MTO) processing plants across Asia. An MTO plant will convert methanol, derived from various sources including coal, natural gas or biomass into olefins. This growth has supported trading volumes in China’s methanol futures market.

Strong trading activity has continued in 2025, with January 2025 average daily volume in Chinese methanol more than quadrupling compared to the same point in 2024. Global traded volumes in methanol futures for January 2025 also doubled compared to the same period in 2024. Open interest reached a record 1,800 contracts across the methanol complex in January.

Alternative Maritime Fuels Gain Ground

The shipping industry, led by the International Maritime Organisation (IMO), has pledged significant cuts to greenhouse gas emissions, which will likely result in a wider range of fuels being used in vessels, alongside the adoption of novel energy efficiency measures.

In Europe, the combination of the Emissions Trading Scheme (ETS) and its FuelEU Maritime regulation, which came into force in January 2025, is expected to help level the playing field between the more traditional bunker fuels such as marine gasoil or very low sulphur fuel oil (VLSFO) and alternative fuels like biofuel-based bunkers, LNG, methanol and ammonia. By levying heftier non-compliance costs on the use of fuels that emit higher levels of greenhouse gases, more vessel owners will likely be motivated to turn to alternative fuels to avoid higher costs. The existing methanol futures are expected to remain as a key benchmark for the market with carbon related differentials or a green premium applied for trades between the existing methanol futures and any lower-carbon fuel alternatives.

S&P Global Platts noted some availability issues with more sustainable methanol, though blending methanol with green methanol could be one possible solution to alleviate the shortage. This could also translate into higher demand for hedging conventional methanol via the futures markets at exchanges like CME Group.

Methanex, the world’s largest producer and supplier of methanol, noted that 2023 was the first year that orders of dual-fuel methanol ships outpaced orders for LNG-powered vessels. Interest in methanol continues to grow, with about 350 methanol ships likely to be operational by 2030. Over time, bio-methanol and e-methanol are two emerging fuels that could qualify as a green fuel under applicable laws.

The use of some alternative fuels like methanol and ammonia remains in the early stages of development compared to the more established markets like LNG. In Singapore, bunker sales of methanol in 2023 were around 300 tons but this figure had risen to 1,600 tons by 2024. In Europe, bio-methanol is also beginning to emerge with around 700 tons delivered at the port of Rotterdam in 2023, according to port authority data.

Risk management remains a key component for the methanol market, with new centers of demand emerging as the world continues to transition to alternative energy sources. Ongoing volatility in the underlying commodity may have more firms turning to the futures market to manage price risk.

OpenMarkets is an online magazine and blog focused on global markets and economic trends. It combines feature articles, news briefs and videos with contributions from leaders in business, finance and economics in an interactive forum designed to foster conversation around the issues and ideas shaping our industry.

All examples are hypothetical interpretations of situations and are used for explanation purposes only. The views expressed in OpenMarkets articles reflect solely those of their respective authors and not necessarily those of CME Group or its affiliated institutions. OpenMarkets and the information herein should not be considered investment advice or the results of actual market experience. Neither futures trading nor swaps trading are suitable for all investors, and each involves the risk of loss. Swaps trading should only be undertaken by investors who are Eligible Contract Participants (ECPs) within the meaning of Section 1a(18) of the Commodity Exchange Act. Futures and swaps each are leveraged investments and, because only a percentage of a contract’s value is required to trade, it is possible to lose more than the amount of money deposited for either a futures or swaps position. Therefore, traders should only use funds that they can afford to lose without affecting their lifestyles and only a portion of those funds should be devoted to any one trade because traders cannot expect to profit on every trade. BrokerTec Americas LLC (“BAL”) is a registered broker-dealer with the U.S. Securities and Exchange Commission, is a member of the Financial Industry Regulatory Authority, Inc. (www.FINRA.org), and is a member of the Securities Investor Protection Corporation (www.SIPC.org). BAL does not provide services to private or retail customers.. In the United Kingdom, BrokerTec Europe Limited is authorised and regulated by the Financial Conduct Authority. CME Amsterdam B.V. is regulated in the Netherlands by the Dutch Authority for the Financial Markets (AFM) (www.AFM.nl). CME Investment Firm B.V. is also incorporated in the Netherlands and regulated by the Dutch Authority for the Financial Markets (AFM), as well as the Central Bank of the Netherlands (DNB).