2 Min WatchArticle15 Jan 2025

Five Macro Factors to Monitor in 2025

At a Glance

We’re halfway through the decade, so what are the key risks and opportunities for 2025?

Inflation and Interest Rates

U.S. core inflation is still at 3.3%, nearly a percent and half above the Fed’s target rate – and the U.S. isn’t alone. Core inflation is running above central bank target rates just about everywhere in the world outside of China. As this year begins, bond yields so far have been rising sharply around the world in anticipation of fewer-than-previously-anticipated rate cuts.

Equity Markets

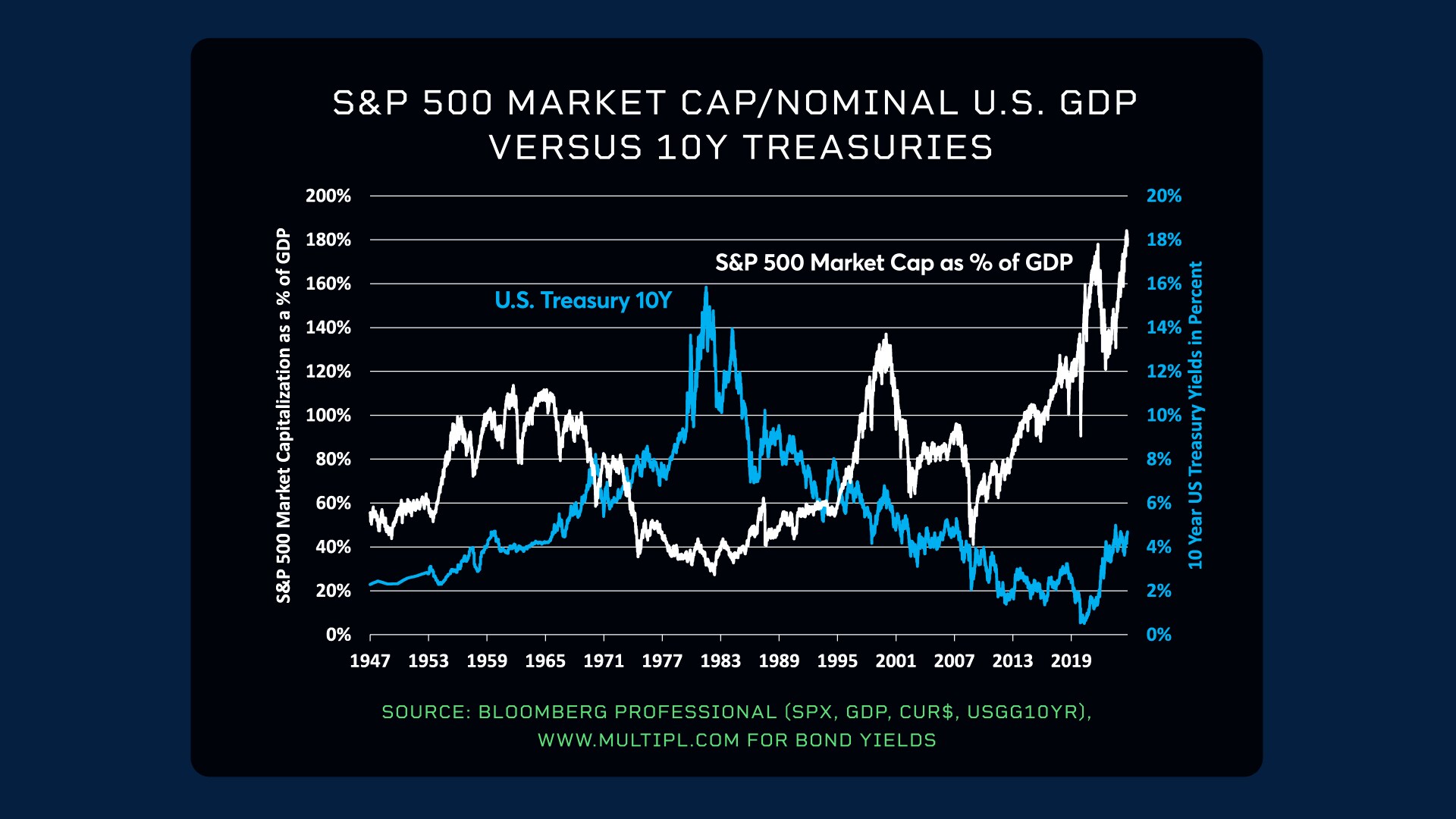

The S&P 500 was up over 20% in each of the past two years, but now valuations may be getting stretched. Will higher bond yields destabilize the equity market and eventually provoke a correction?

Employment and Growth

While the U.S. continues to generate jobs at a decent pace, there are some signs that the labor market is slowing and household finances are under strain from the cumulative impact of higher interest rates. Defaults on private credit are also rising sharply, so an economic slowdown is possible in the U.S. Much of the world is already growing slowly.

Options Markets

Across almost every asset class – including stocks – options prices are near historic lows. Are markets under-pricing risks? If so, could implied volatility on options rise significantly?

A New U.S. Administration

A new administration is arriving on January 20 in Washington, D.C. which could have big impacts on tax, tariff and U.S. foreign policy, potentially impacting a variety of different markets including currencies, oil, gold, equities and interest rates.

As we head into this new year, one of the big questions is if we're all underpricing the amount of risk in the system.

OpenMarkets is an online magazine and blog focused on global markets and economic trends. It combines feature articles, news briefs and videos with contributions from leaders in business, finance and economics in an interactive forum designed to foster conversation around the issues and ideas shaping our industry.

All examples are hypothetical interpretations of situations and are used for explanation purposes only. The views expressed in OpenMarkets articles reflect solely those of their respective authors and not necessarily those of CME Group or its affiliated institutions. OpenMarkets and the information herein should not be considered investment advice or the results of actual market experience. Neither futures trading nor swaps trading are suitable for all investors, and each involves the risk of loss. Swaps trading should only be undertaken by investors who are Eligible Contract Participants (ECPs) within the meaning of Section 1a(18) of the Commodity Exchange Act. Futures and swaps each are leveraged investments and, because only a percentage of a contract’s value is required to trade, it is possible to lose more than the amount of money deposited for either a futures or swaps position. Therefore, traders should only use funds that they can afford to lose without affecting their lifestyles and only a portion of those funds should be devoted to any one trade because traders cannot expect to profit on every trade. BrokerTec Americas LLC (“BAL”) is a registered broker-dealer with the U.S. Securities and Exchange Commission, is a member of the Financial Industry Regulatory Authority, Inc. (www.FINRA.org), and is a member of the Securities Investor Protection Corporation (www.SIPC.org). BAL does not provide services to private or retail customers.. In the United Kingdom, BrokerTec Europe Limited is authorised and regulated by the Financial Conduct Authority. CME Amsterdam B.V. is regulated in the Netherlands by the Dutch Authority for the Financial Markets (AFM) (www.AFM.nl). CME Investment Firm B.V. is also incorporated in the Netherlands and regulated by the Dutch Authority for the Financial Markets (AFM), as well as the Central Bank of the Netherlands (DNB).

By Erik Norland

By Erik Norland