2 Min WatchArticle20 Mar 2024

What the Upcoming Halving Might Mean for Bitcoin Prices

At a Glance

Could the upcoming bitcoin halving drive bitcoin prices to new all-time highs, or is bitcoin headed for another bear market?

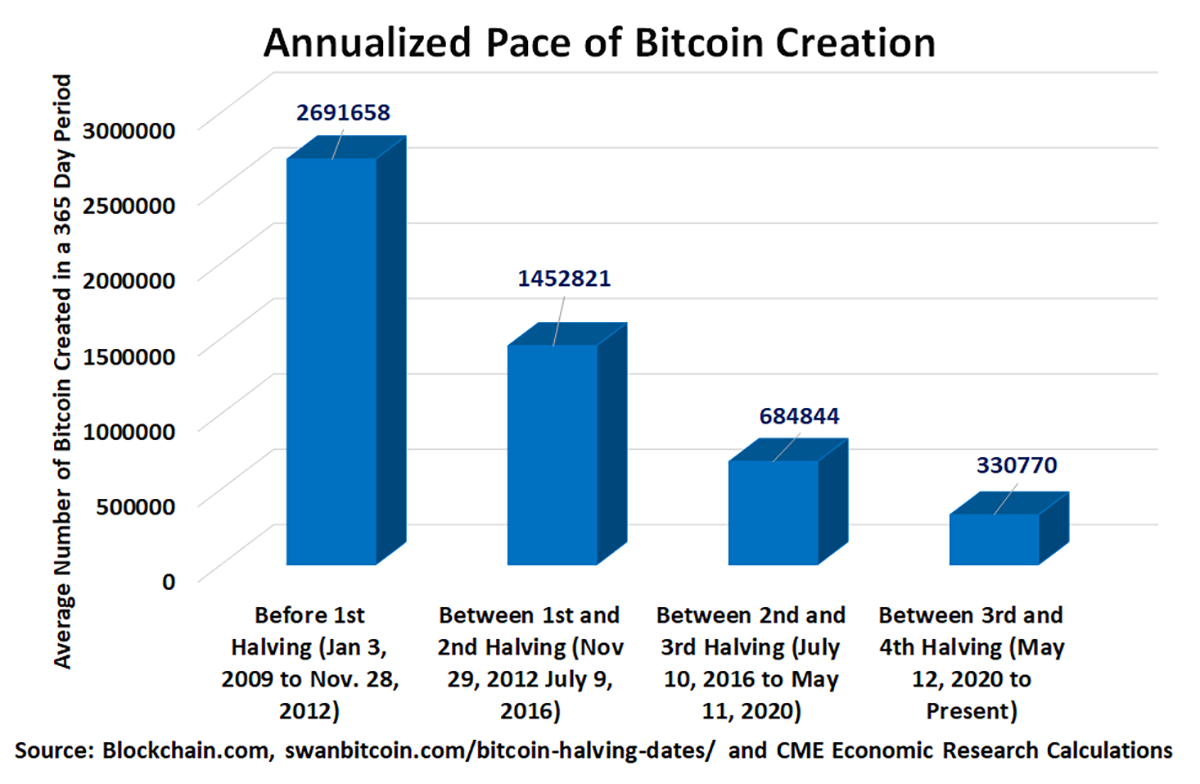

On April 19, something is expected to happen to bitcoin that has only occurred three times previously: a halving. During bitcoin’s first four years, roughly 2.7 million bitcoins were created each year. Then, on November 28, 2012, the first halving occurred. For the next four years, the number of new bitcoins dropped to around 1.5 million.

The second halving occurred on July 9, 2016, which dropped annual minting of new bitcoin to around 680,000. The most recent halving happened on May 11, 2020. Since that time, the number of new bitcoins further slowed to around 330,000 per year.

Market Rallied After Past Halvings

The three previous halvings were followed by rallies in bitcoin prices. In the 365 calendar days after the 2012 halving, bitcoin prices soared 8447%. In the 365 days following the 2016 halving, bitcoin prices rose by 290%. In the 365 days after the 2020 halving, bitcoin prices rose by 559%. However, even within the rallies, bitcoin prices remained volatile and experienced corrections of 20%-35% or more.

Bitcoin Growth Steadies

There is no guarantee that bitcoin will rally in response to its upcoming halving. Over time, bitcoin has been losing upward momentum as growth in its user network has slowed. In the beginning, the number of transactions per day was growing exponentially but that growth slowed after 2016.

However, recent interest in bitcoin ETFs has pushed up transaction volumes which might, along with the upcoming halving, give bitcoin yet another lift.

OpenMarkets is an online magazine and blog focused on global markets and economic trends. It combines feature articles, news briefs and videos with contributions from leaders in business, finance and economics in an interactive forum designed to foster conversation around the issues and ideas shaping our industry.

All examples are hypothetical interpretations of situations and are used for explanation purposes only. The views expressed in OpenMarkets articles reflect solely those of their respective authors and not necessarily those of CME Group or its affiliated institutions. OpenMarkets and the information herein should not be considered investment advice or the results of actual market experience. Neither futures trading nor swaps trading are suitable for all investors, and each involves the risk of loss. Swaps trading should only be undertaken by investors who are Eligible Contract Participants (ECPs) within the meaning of Section 1a(18) of the Commodity Exchange Act. Futures and swaps each are leveraged investments and, because only a percentage of a contract’s value is required to trade, it is possible to lose more than the amount of money deposited for either a futures or swaps position. Therefore, traders should only use funds that they can afford to lose without affecting their lifestyles and only a portion of those funds should be devoted to any one trade because traders cannot expect to profit on every trade. BrokerTec Americas LLC (“BAL”) is a registered broker-dealer with the U.S. Securities and Exchange Commission, is a member of the Financial Industry Regulatory Authority, Inc. (www.FINRA.org), and is a member of the Securities Investor Protection Corporation (www.SIPC.org). BAL does not provide services to private or retail customers.. In the United Kingdom, BrokerTec Europe Limited is authorised and regulated by the Financial Conduct Authority. CME Amsterdam B.V. is regulated in the Netherlands by the Dutch Authority for the Financial Markets (AFM) (www.AFM.nl). CME Investment Firm B.V. is also incorporated in the Netherlands and regulated by the Dutch Authority for the Financial Markets (AFM), as well as the Central Bank of the Netherlands (DNB).

By Erik Norland

By Erik Norland