2 Min WatchArticle03 Feb 2023

A Downtrend with U.S. Inflation

At a Glance

Inflation in the United States is receding. How much credit should we give the Federal Reserve? Possibly not as much as one might think.

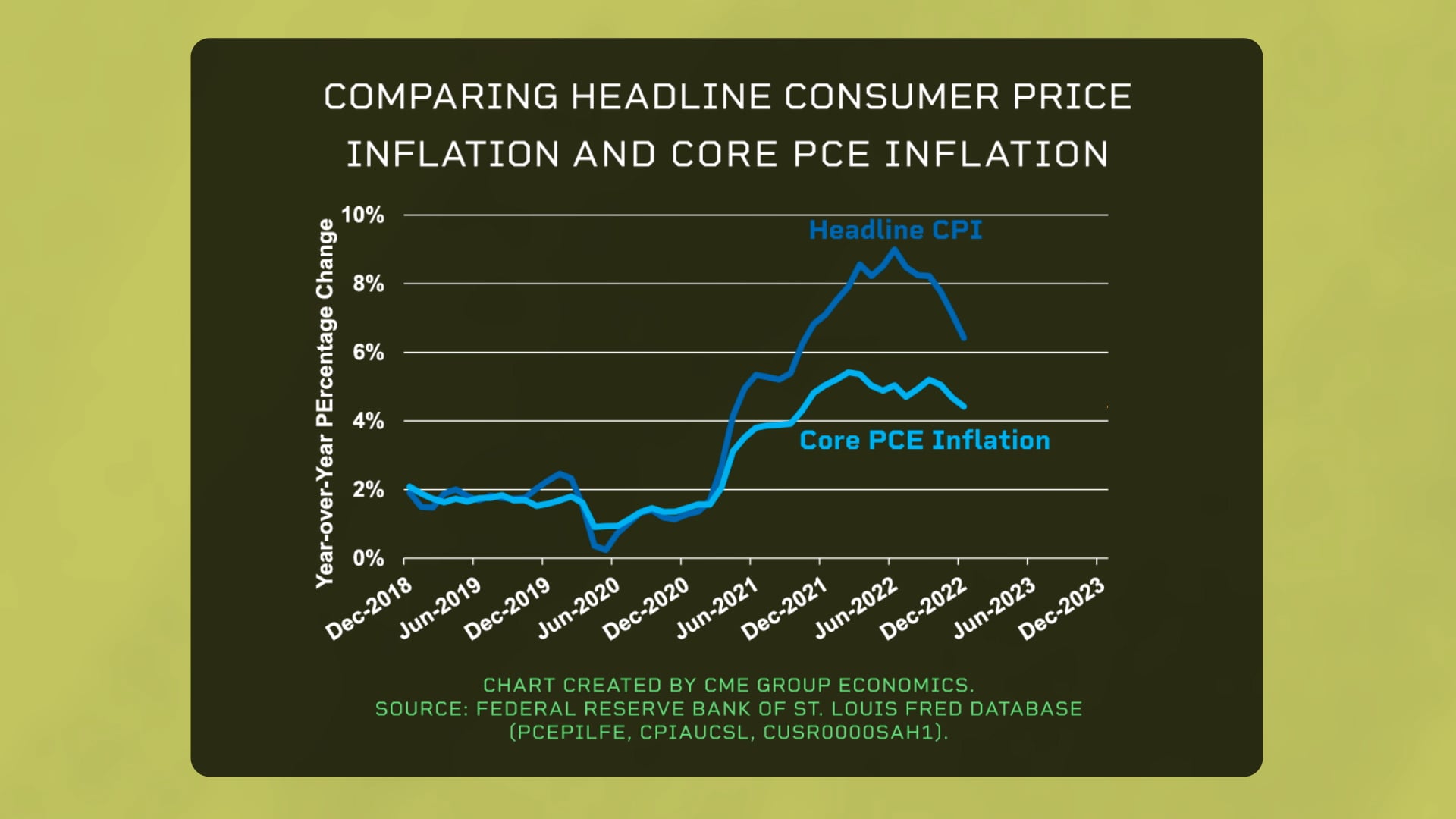

Headline CPI inflation peaked in June 2022 at a 9% year-over-year pace and has declined for six straight months to 6.4%. The Fed’s favorite, the notoriously sticky core PCE inflation rate, peaked back in February 2022 at 5.4%, and with a bumpy ride, has now declined to 4.4%. And over just the last three months, core inflation has been running under 4% annualized, with headline inflation even lower.

In 2022, the Fed raised its federal funds rate from near zero to 4.33% and started shrinking its balance sheet. As a result, 30-year fixed mortgage rates rose from just under 3% at the end of 2020, peaking at above 7% in October 2022, before receding a little to 6.6% by year-end 2022. House prices and housing sales are now in decline. But houses are an asset and are not included as part of the price index. For inflation, it is shelter prices that matter, and shelter in the CPI is still rising.

While Fed actions have helped, inflation is falling mainly because the key causes – the pandemic-induced extra demand for goods, the supply chain disruptions that followed, and the massive fiscal stimulus that allowed spending to keep pace even during elevated unemployment – are all in the rearview mirror. If one wants to give the Fed extra credit for resolving the inflation surge, then one should also give the Fed most of the blame for causing it, and that would be wrong too.

OpenMarkets is an online magazine and blog focused on global markets and economic trends. It combines feature articles, news briefs and videos with contributions from leaders in business, finance and economics in an interactive forum designed to foster conversation around the issues and ideas shaping our industry.

All examples are hypothetical interpretations of situations and are used for explanation purposes only. The views expressed in OpenMarkets articles reflect solely those of their respective authors and not necessarily those of CME Group or its affiliated institutions. OpenMarkets and the information herein should not be considered investment advice or the results of actual market experience. Neither futures trading nor swaps trading are suitable for all investors, and each involves the risk of loss. Swaps trading should only be undertaken by investors who are Eligible Contract Participants (ECPs) within the meaning of Section 1a(18) of the Commodity Exchange Act. Futures and swaps each are leveraged investments and, because only a percentage of a contract’s value is required to trade, it is possible to lose more than the amount of money deposited for either a futures or swaps position. Therefore, traders should only use funds that they can afford to lose without affecting their lifestyles and only a portion of those funds should be devoted to any one trade because traders cannot expect to profit on every trade. BrokerTec Americas LLC (“BAL”) is a registered broker-dealer with the U.S. Securities and Exchange Commission, is a member of the Financial Industry Regulatory Authority, Inc. (www.FINRA.org), and is a member of the Securities Investor Protection Corporation (www.SIPC.org). BAL does not provide services to private or retail customers.. In the United Kingdom, BrokerTec Europe Limited is authorised and regulated by the Financial Conduct Authority. CME Amsterdam B.V. is regulated in the Netherlands by the Dutch Authority for the Financial Markets (AFM) (www.AFM.nl). CME Investment Firm B.V. is also incorporated in the Netherlands and regulated by the Dutch Authority for the Financial Markets (AFM), as well as the Central Bank of the Netherlands (DNB).

By Blu Putnam

By Blu Putnam