4 Min readArticle05 Feb 2025

After a Mixed 2024 for U.S. Agriculture, What’s Next?

At a Glance

The coming year will likely bring twists and turns to Agricultural markets, from a new administration in the United States, to transit woes, to uncertainty surrounding South American production.

As the new year brings a fresh perspective for the next growing season, it also offers a clearer view on the old crop year. Despite a favorable start to 2024, a late summer drought in the U.S. resulted in lower-than-expected production. In early January, the USDA kicked off its 2025 reporting year reviewing yields and lowering production of the last crop for corn and soybeans, supporting futures and boosting farming sentiment.

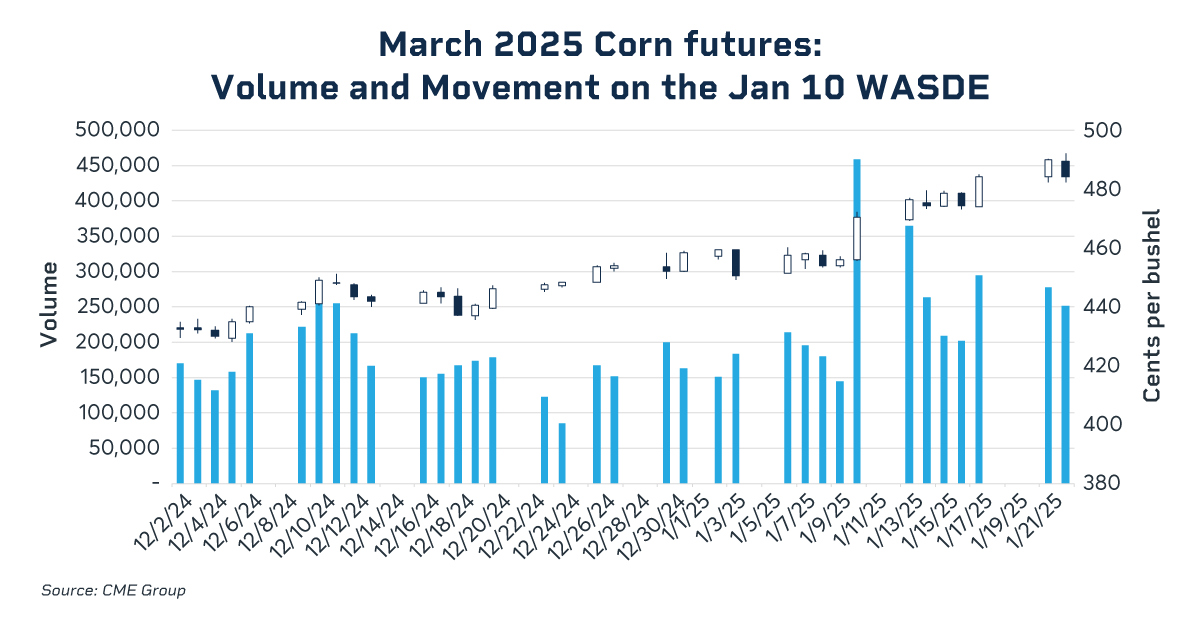

USDA Revisions Rock Futures

The January 10, 2025 WASDE marked a significant downgrade in standing projections of many 2024/2025 marketing year metrics, boosting futures prices as current supplies fell below previous expectations. Corn yield was revised down from a record 183.1 bushels per acre to 179.3, with production taking a commensurate cut from 15.145 billion bushels to 14.867 billion. March 2025 Corn futures jumped 14^4 cents (3.18%) on the day.

Yield and production metrics for soybeans were also revised down, providing tailwinds to old crop futures prices post-release. December’s WASDE yield per harvested acre stood at 51.7 before being slashed to 50.7 in the January WASDE. Production fell from 4.461 billion bushels to 4.366 billion in the latest report, as March 2025 Soybean futures jumped 26^2 cents (2.63%) on the release day.

The Ag Barometer Bounces Back

The lower prices throughout the past year, coupled with high costs, ended up pressuring farm income and margins. Net Cash farm income last year is forecast to reach nearly $159 billion dollars, down from 2022 and 2023, according to the USDA’s Farm Sector Income Forecast, with different results for row crops and livestock.

Looking at only cash-crop receipts, they are projected to decline $31.6 billion, or 11.4% during the year compared to 2023. The bright spot was in animal and animal product cash receipts, which are expected to increase by $15 billion, or 5.9%. That bearish sentiment was captured by the Purdue University/CME Group Ag Economy Barometer, which touched 88 points last year, the lowest since 2016.

Even with a smaller crop than originally forecasted, U.S. output was still historically high. For corn, the USDA production forecast of 377 million metric tons (MT) for the 2024/25 crop is the third biggest crop since 2020/21. On soybeans, this is the second biggest crop over the past five years. The U.S. is set to crush 65 MT of soybeans in the 2024/25 crop year, an absolute record. Food, seed and industrial consumption of corn looks set to reach 175 MT, the highest since 2017/18.

On the export side, soybean shipments will see higher numbers in 2024/25 compared to 2023/24, but still lower than the five-year average on strong South American competition. Corn exports will be above the five-year average as the U.S. recovers part of the market share lost to Brazil in 2022/23. That demand is helping to keep prices supported, but some risks such as a strong dollar and low water in the Mississippi River could still reduce demand for U.S. exports.

With impressive gains in quality and production in the U.S., but tougher competition in the global markets, U.S. farmers and end-users are looking at prices and wondering what’s next.

A New Administration Brings Uncertainty

After years of increased production costs, smaller margins and higher competition from abroad, rural communities are hoping for improvements.

While the Ag Economy Barometer dipped to the lowest in years in 2024, it also rallied to 145, the highest since 2020, after President Donald Trump’s election. A new administration could mean changes in policies that impact everything from farming practices and how agricultural agencies operate, to global trade relations. For example, any changes that impact U.S. relations with Mexico and Canada – the second and third biggest importer of American agricultural products – could shift supply dynamics.

Renewable fuels production will also be an area to watch. Over the last few years, the country’s crushing capacity was expanded on expectations of subsidies for clean fuel producers using feedstocks such as soybean oil to produce renewable diesel. Any changes to those policies will likely have an effect on demand and futures prices.

Will Drought Test the Mississippi Again?

Drought sent the Mississippi River to troublingly low levels for the third straight year during the crucial transport months of September and October of 2024. Low river levels means that barges need to limit the amount of grain they transport, increasing transport costs per bushel. Although transport disruption has been profound in many areas, the repeated nature of the phenomenon means that the Army Corps of Engineers is practiced in dredging trenches to make the river passable.

Such transport disruption can potentially lower the price received by farmers as grain accumulates, waiting to be loaded onto barges, and riverside elevators reach capacity. National on-farm and off-farm storage was up significantly year over year on September 1, 2024, according to the Q4 2024 USDA Stocks of Grain report. Extreme weather has already dominated headlines in 2025, and time will tell if a Midwestern summertime drought will cause a repeat for the Mississippi.

South America Competes

The tale of aggressive expansion in South America is far from over. Corn and soybean production in South America have been steadily rising, supported by weaker local currencies and lower costs. With the rise in the U.S. dollar, that trend looks set to continue.

While the U.S. sees high domestic usage of corn and soybeans, in South America a much larger share is exported, increasing competition for U.S. shipments. Combined, Argentina and Brazil ship more soy and corn than the U.S., bringing down prices in years of large supply.

Amid ongoing uncertainty around weather, policy changes and global crop production, there’s no shortage of areas to monitor in agricultural markets this year.

OpenMarkets is an online magazine and blog focused on global markets and economic trends. It combines feature articles, news briefs and videos with contributions from leaders in business, finance and economics in an interactive forum designed to foster conversation around the issues and ideas shaping our industry.

All examples are hypothetical interpretations of situations and are used for explanation purposes only. The views expressed in OpenMarkets articles reflect solely those of their respective authors and not necessarily those of CME Group or its affiliated institutions. OpenMarkets and the information herein should not be considered investment advice or the results of actual market experience. Neither futures trading nor swaps trading are suitable for all investors, and each involves the risk of loss. Swaps trading should only be undertaken by investors who are Eligible Contract Participants (ECPs) within the meaning of Section 1a(18) of the Commodity Exchange Act. Futures and swaps each are leveraged investments and, because only a percentage of a contract’s value is required to trade, it is possible to lose more than the amount of money deposited for either a futures or swaps position. Therefore, traders should only use funds that they can afford to lose without affecting their lifestyles and only a portion of those funds should be devoted to any one trade because traders cannot expect to profit on every trade. BrokerTec Americas LLC (“BAL”) is a registered broker-dealer with the U.S. Securities and Exchange Commission, is a member of the Financial Industry Regulatory Authority, Inc. (www.FINRA.org), and is a member of the Securities Investor Protection Corporation (www.SIPC.org). BAL does not provide services to private or retail customers.. In the United Kingdom, BrokerTec Europe Limited is authorised and regulated by the Financial Conduct Authority. CME Amsterdam B.V. is regulated in the Netherlands by the Dutch Authority for the Financial Markets (AFM) (www.AFM.nl). CME Investment Firm B.V. is also incorporated in the Netherlands and regulated by the Dutch Authority for the Financial Markets (AFM), as well as the Central Bank of the Netherlands (DNB).