3 Min readArticle12 Dec 2022

The Global Appetite for U.S. Pork Shows No Signs of Retreat

At a Glance

From carnitas to chashu to bacon-wrapped everything, pork products are enjoyed throughout the world. Pork has become the most consumed meat globally, according to the U.S. Meat Export Federation. Although beef and poultry consumption have grown in recent years, with poultry exceeding pork consumption in one recent year (2020), there is no question of pork’s importance in the global diet.

The United States is a leader in pork exports and the U.S. pork export industry has continued to generate impressive growth, sending over $8 billion in value of pork and pork products abroad in 2021.

Pork originating from U.S. hog producers is in demand from international buyers from Mexico to China.

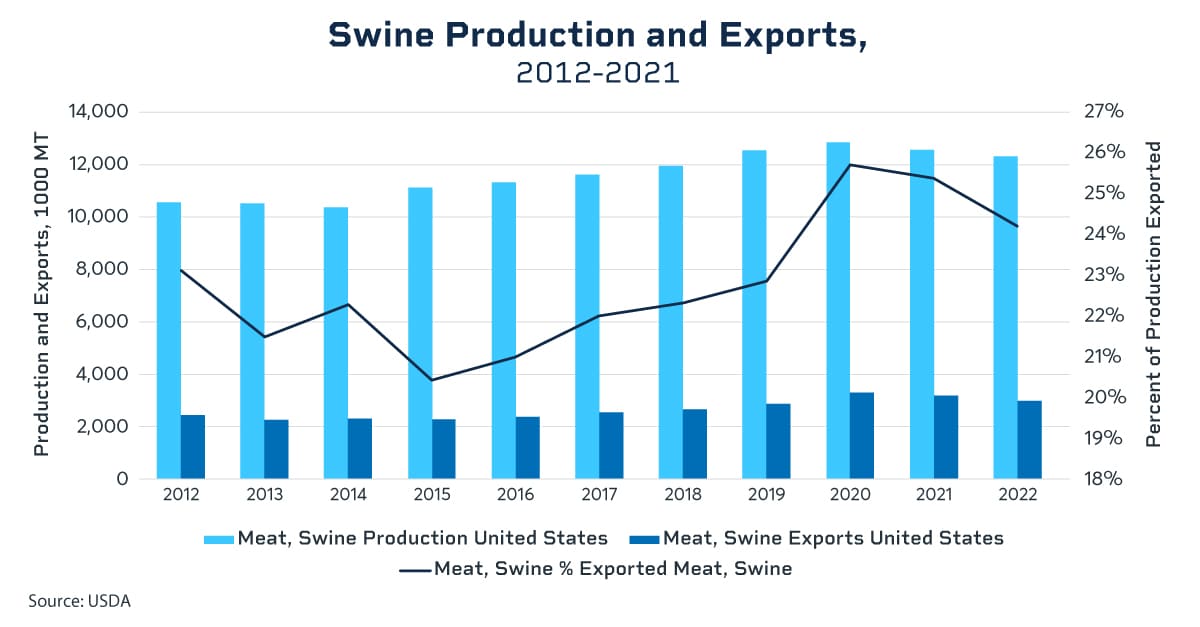

Pork exports are of particular importance to the U.S. domestic pork and hog markets because a greater share of domestically produced pork is exported, in comparison with other meats such as beef. On average over the last decade, 23% of pork produced in the United States was exported, compared to only 11% of beef and veal.

Due to a higher percentage of pork exported from the U.S., international markets are also more sensitive to the U.S. pork supply chain. Pork prices are often affected by domestic seasonal trends as well as market conditions like international demand, livestock diseases or trade policy. CME Group introduced Pork Cutout futures to allow market participants to manage risk further down the U.S. hog supply chain. While CME Lean Hog products reflect prices paid for hogs in the U.S., CME Pork Cutout products reflect prices paid for U.S. wholesale pork.

Mexico Demand Rising

Mexico is the largest contemporary recipient of U.S. pork by volume, taking 5.5 million metric tons of swine meat over the past decade (2012-2021), or 31% of total U.S. pork exports by volume, according to UN Comtrade. Mexico took 734 million kg of pork, or more than 33% of total U.S. exports in 2021, up from 571 million kg (24% of exports) in 2020 and 556 million kg (28%) in 2019. The rebound of the U.S.-Mexico pork trade in 2021 is attributable in part to a healing of the U.S.-Mexico trade relationship after tariffs were imposed on Mexican imports in 2018.

The levy of Section 232, which initiated tariffs on Mexican imports on the grounds of national security, resulted in retaliatory tariffs imposed by Mexico on U.S. imports. Mutual tariffs dampened trade flow, including that of U.S. pork exports to Mexico. Exacerbating Mexico’s ability to import U.S. pork, the COVID-19 pandemic weighed on the Mexican Peso in 2020. Last year’s improved trade relative to prior years reflects the resolution of the previously protectionist tariffs, as well as Mexican economic recovery post-2020.

The top five export destinations for U.S. pork in 2021 by volume were, in order: Mexico, China, Japan, Republic of Korea and Canada. Together these countries comprised 79% of U.S. exports. Over the past decade in volume, U.S. exports to China surpassed exports to Mexico in only one year: 2020. In that first year of the COVID-19 Pandemic, African swine fever (ASF) severely affected China’s domestic hog production, creating demand for imported hogs and pork products.

Though a depressed Mexican Peso, which caused U.S. meat prices to rise in Mexico thus reducing consumption, freed U.S. meat for alternate export destinations, China’s hunger for U.S. pork drove domestic exports to their highest share relative to production in the last decade. In 2020, the U.S. exported almost 26% of its domestic production, compared to 23% on average, 2012-2022. The highest proportion of U.S. pork exports by value has gone to Japan each year of the past decade, driven by the highly valued cuts that the country receives.

Export demand plays an important role in U.S. pork markets, so any major shifts pertaining to top U.S. export destinations, whether geopolitical or fundamental in nature, can have an impact on price. Furthermore, U.S. pork prices, both current and expected, can have an impact on export demand.

Billions of pounds of pork and variety meat products shipped abroad annually are exposed to price fluctuations in U.S. hog and pork markets. Lean Hog and Pork Cutout futures can enable both domestic and international buyers exposed to U.S. prices to manage the risk that comes along with unanticipated price moves and protect their bottom line.

OpenMarkets is an online magazine and blog focused on global markets and economic trends. It combines feature articles, news briefs and videos with contributions from leaders in business, finance and economics in an interactive forum designed to foster conversation around the issues and ideas shaping our industry.

All examples are hypothetical interpretations of situations and are used for explanation purposes only. The views expressed in OpenMarkets articles reflect solely those of their respective authors and not necessarily those of CME Group or its affiliated institutions. OpenMarkets and the information herein should not be considered investment advice or the results of actual market experience. Neither futures trading nor swaps trading are suitable for all investors, and each involves the risk of loss. Swaps trading should only be undertaken by investors who are Eligible Contract Participants (ECPs) within the meaning of Section 1a(18) of the Commodity Exchange Act. Futures and swaps each are leveraged investments and, because only a percentage of a contract’s value is required to trade, it is possible to lose more than the amount of money deposited for either a futures or swaps position. Therefore, traders should only use funds that they can afford to lose without affecting their lifestyles and only a portion of those funds should be devoted to any one trade because traders cannot expect to profit on every trade. BrokerTec Americas LLC (“BAL”) is a registered broker-dealer with the U.S. Securities and Exchange Commission, is a member of the Financial Industry Regulatory Authority, Inc. (www.FINRA.org), and is a member of the Securities Investor Protection Corporation (www.SIPC.org). BAL does not provide services to private or retail customers.. In the United Kingdom, BrokerTec Europe Limited is authorised and regulated by the Financial Conduct Authority. CME Amsterdam B.V. is regulated in the Netherlands by the Dutch Authority for the Financial Markets (AFM) (www.AFM.nl). CME Investment Firm B.V. is also incorporated in the Netherlands and regulated by the Dutch Authority for the Financial Markets (AFM), as well as the Central Bank of the Netherlands (DNB).