- 6 Mar 2025

- By CME Group

- Topics: Interest Rates

Our market-leading cross-margining arrangement with DTCC is expected to be expanded by the end of the year, broadening access to capital efficiencies.* At that time, end-users will be able to take advantage of the increased margin savings available in the program, including offsets between U.S. Treasury securities and our Interest Rate futures.

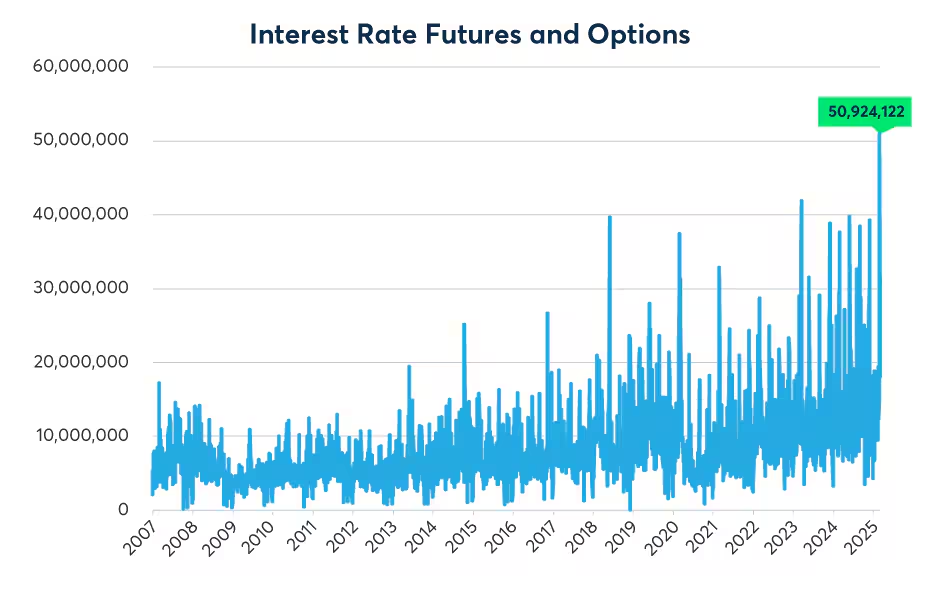

In a volatile month for markets, our Interest Rates complex delivered for clients. Heightened risk management needs were efficiently met during the Treasury roll, leading to a record day of 50.9M contracts on February 25 and a record month for volumes, with an ADV over 19M contracts.

Source: CME Group

Cleared USD IRS notional volumes hit their highest level in four years, as participants took advantage of the capital efficiencies available via our Portfolio Margining program.

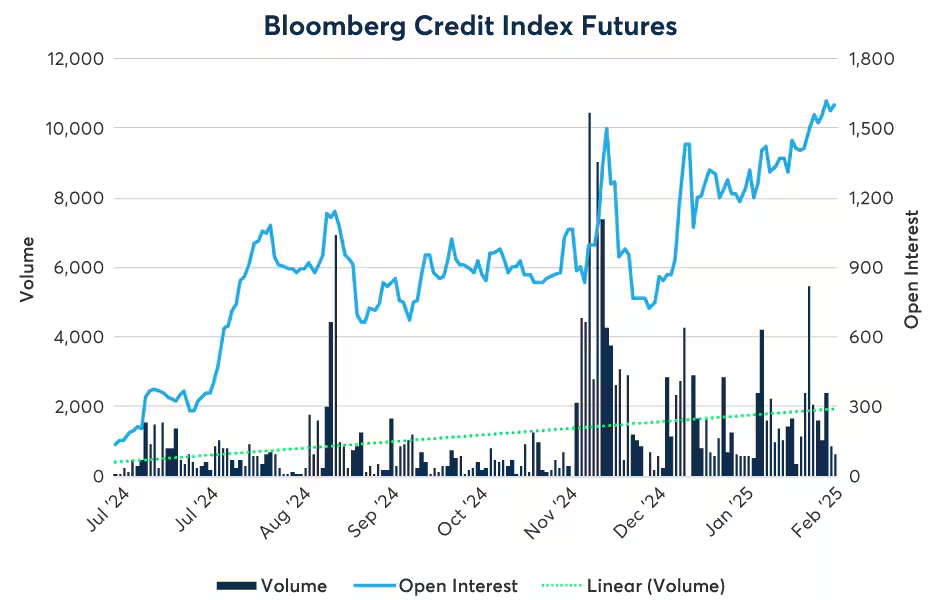

Led by the highest non-roll volume session in the suite's history, Credit futures saw open interest cross the 1,600 contracts ($160M notional) mark for the first time ever.

Source: CME Group

Momentum continues to build as more participants discover the benefits of managing risk with Credit futures, while the ecosystem looks to expand later this month with the launch of High Yield Duration Hedged Credit futures on March 17.

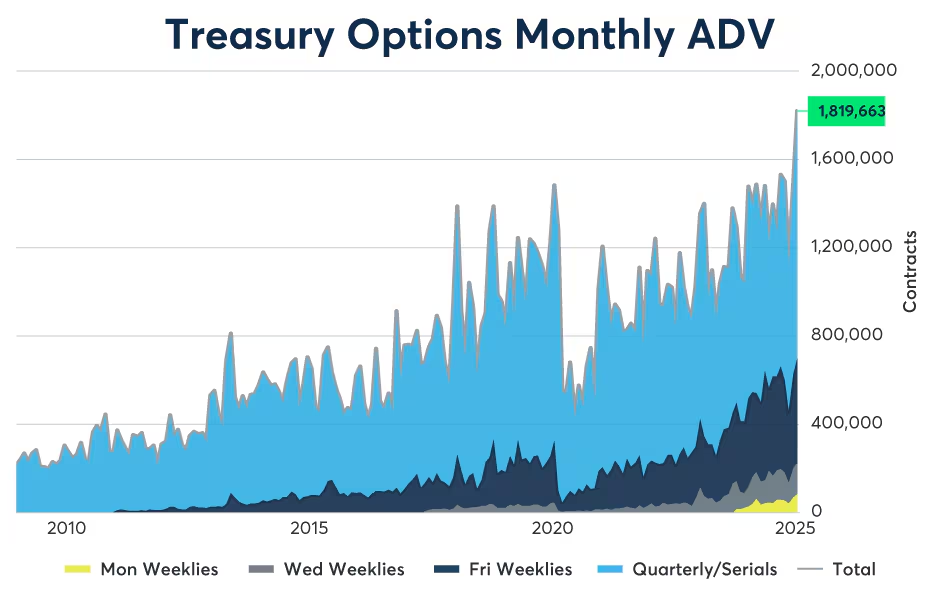

With ADV of nearly 1.8M contracts last month, U.S. Treasury options volume easily surpassed the previous monthly record by 19%.

Growth was led by classic 10-Year Treasury Note options and weekend risk management solutions via Monday expiring options, as both set records of their own in terms of ADV.

F-TIIE futures: Rising OI and narrowing bid-asks highlighted F-TIIE futures in February. New market participants have begun trading amid the ongoing exchange fee waiver (in place until April 30).

X-CCY futures: A growing order book highlights Cross-Currency Basis futures as they enter their second month. Consider these contracts ahead of the March IMM date to see how X-CCY futures can simplify your trading.

Mortgage Rate futures: The end of February propelled Mortgage Rate futures to total monthly volume of ~1,750 contracts and open interest of just over 1,000 contracts. Discover these futures for more precise ways to manage primary mortgage risks.

Navigating the T-bill and SOFR landscape: A confluence of factors in STIRs markets–including changing T-bill issuance and TGA inflows–could impact traders this year, see how you can prepare.

Three interest rate themes to watch in 2025: A few key topics look to be crucial to understanding rates markets this year. Read our paper for insights on the yield curve, spread trading and options.

Data as of March 1, 2025, unless otherwise specified.

* Pending regulatory approval

View an archive of the Rates Recap online at cmegroup.com/ratesrecap.