- 8 Oct 2024

- By CME Group

- Topics: Interest Rates

The Fed kicked off its long-awaited easing cycle with a 50bp cut last month, ending the speculation surrounding one of the most uncertain outcomes in recent memory. The September meeting saw participants turn to CME Group in record numbers to gain insight and manage exposure:

- FedWatch, the market barometer for Fed policy changes, received over 1 million views during FOMC week.

- SOFR futures and options traded nearly 7M contracts/day in September, second highest all-time, as CLOB, Block and Open Outcry liquidity proved highly resilient amid volatile trading.

- Fed Funds futures averaged 700K contracts/day, also the second highest all-time monthly ADV.

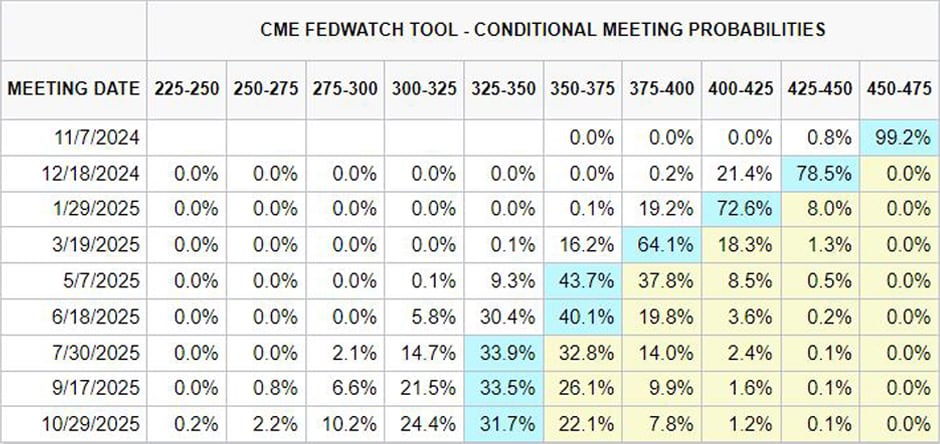

Looking ahead, markets are currently pricing in a series of rate cuts over the next 12 months, including the next five on the calendar.

Source: CME Group

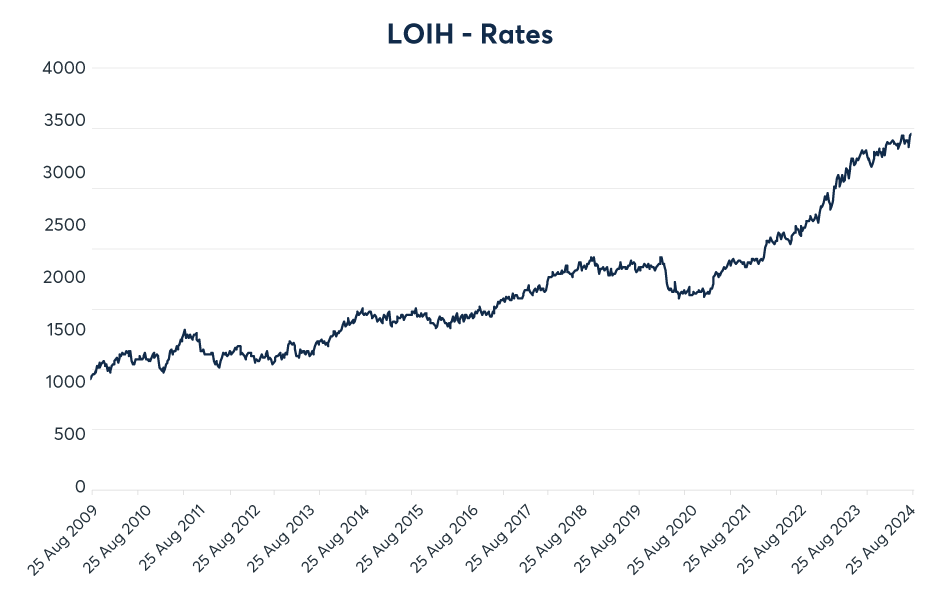

The number of Large Open Interest Holders (LOIH) in Interest Rate futures hit a fresh record in September, coming in at 3,396.

Source: CME Group

This proxy for market participation among firms holding significant positions saw new highs in a range of products, though STIR contracts were a particular area of strength. Among the LOIH YoY highlights:

- €STR - up 56%

- Total Eris SOFR - up 83%

- SOFR - up 9.5%

- Total - up 7.8%

End-users continue to find a home for managing short-term European rates risk at CME Group, boosting activity to new heights in September.

- One-day volume high of 70,313 on September 3

- New OI high of 76,848 on September 18

- MoM growth in ADV of 58.2%

- €STR options markets now live

Learn more about European short-term rate markets and use our tool to monitor the EUR/USD cross-currency basis.

On November 22, CME Clearing will be converting in-scope positions impacted by Banxico's 28D TIIE modification and trading restrictions. We encourage clients to proactively ensure they have the ability to properly reconcile their books and records to reflect the post-conversion positions cleared at CME Group.

Most participants achieve this via Markit's CCP Sync service, or by manually canceling their terminated swaps and booking the replacements using reports provided by CME Group. Regardless of your preference, the dress rehearsal on October 25 provides an opportunity to test your readiness for the November conversion.

Please email the team if you have questions or see the full guide below for details.

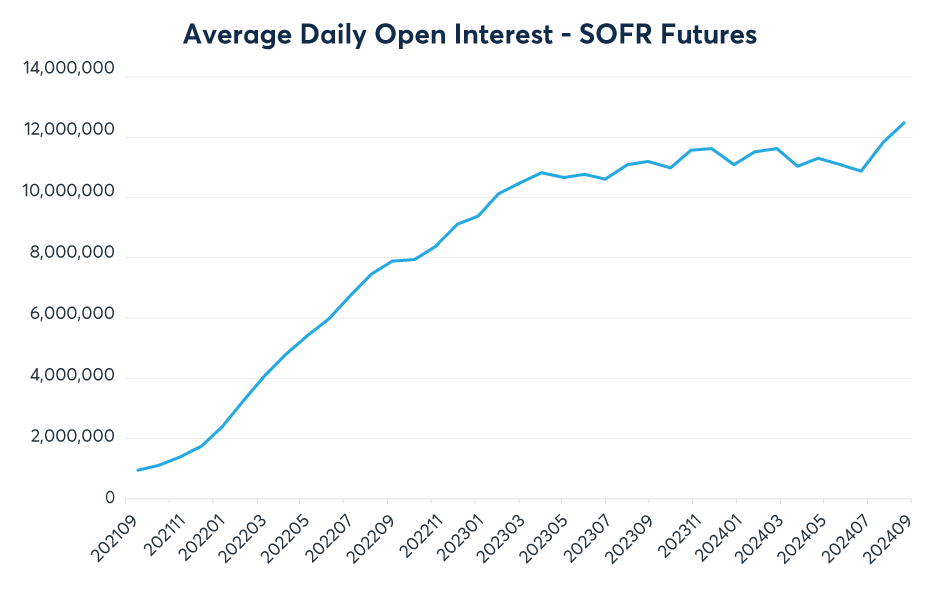

The world's most actively traded futures contract reached new heights in Q3, including the highest quarterly ADV in contract history (~4.1M) and a fresh OI peak of 13,254,535 on September 18.

Source: CME Group

Closing in on 3 billion contracts traded lifetime since their debut in 2018, our SOFR product lineup remains the world's deepest and widest ranging place to manage risk in short-term rates.

Credit futures reached a new level of liquidity last month, driven in part by an active first quarterly roll with calendar spread markets often quoted at minimum tick. Key September developments included:

- ADV of close to 1,200 contracts

- Record OI of 1,143 contracts (September 12)

- BTIC now available for both High Yield and Investment Grade contracts

T-Bill auction results have been increasingly uncertain, underscoring the importance of a direct, precise hedging instrument.

This trend has led to greater activity in the T-Bill futures market, sending ADV for September up 57.6% MoM, while OI also hit a new peak before rolling into the December contract.

For more on how to use T-Bill futures, see our recent research article.

Demand for precise exposure to the 10-year point on the Treasury curve has hit a new echelon.

Ultra 10-Year options are starting to have their moment, with a new one-day volume record of just under 33,000 contracts on September 6, with ADV of 2,600 for the month.

Data as of October 1, 2024, unless otherwise specified.

* Pending regulatory approval

View an archive of the Rates Recap online at cmegroup.com/ratesrecap.