- 9 Sep 2024

- By CME Group

- Topics: Interest Rates

The Treasury roll and greater uncertainty about the Fed's path forward led to the highest-monthly average daily volume (ADV) for Rates in CME Group history. Highlights of this record-setting month include:

Source: CME Group

Credit futures based on Bloomberg Indices have seen increased adoption from participants, propelling OI to 1,080 contracts on August 21.

More enhancements continue to round out the ecosystem, including new research and BTIC (Basis Trade at Index Close) coming later this month for both Investment Grade and High Yield contracts.

Short-end curve uncertainty has rekindled activity in the T-Bill futures market. Since the start of June, OI has soared by nearly 250%, including surpassing the 10K milestone for the first time.

Source: CME Group

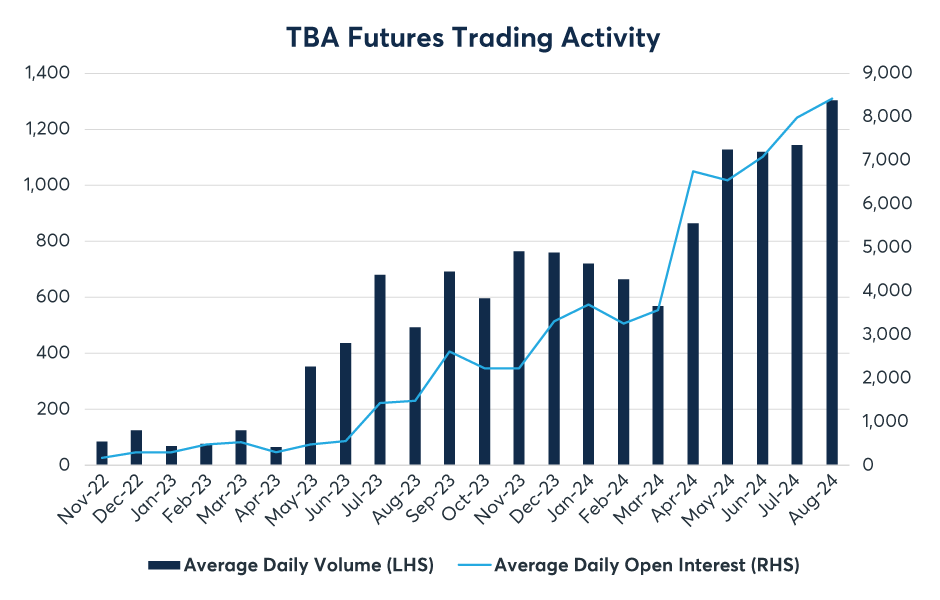

Activity remains strong in the TBA futures market this summer, as the ecosystem continues to grow for these contracts. ADV hit a new record and was up 14% MoM, while average daily OI was over 8,400 contracts in August.

Source: CME Group

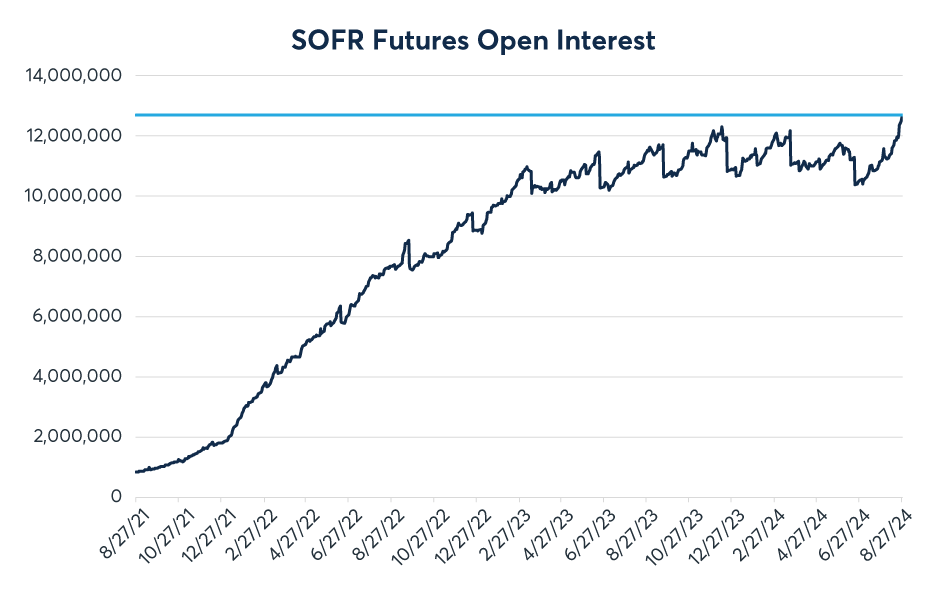

New SOFR Pack Butterflies (pack flies) allow traders to express views on relative performance of different areas of the SOFR curve, just in time for potential activity from the Fed this fall.

With legs covering periods of one year or more, the strategies allow for more precision when compared to vanilla SOFR butterflies, with the ability to access the deeply liquid SOFR order book.

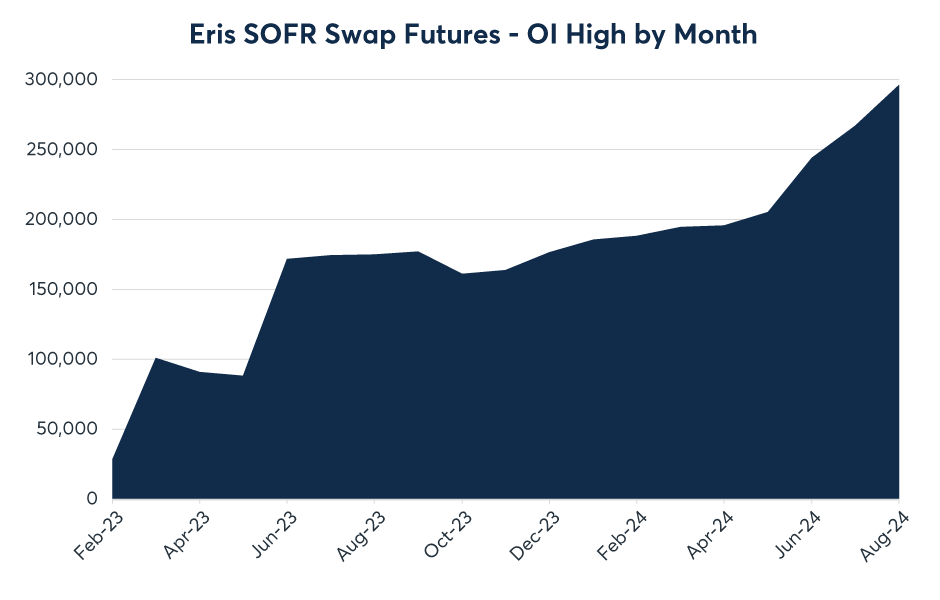

Adoption of Eris SOFR Swap futures continues, as OI closed in on 300,000 for August. This comes as REITs and other end-users move away from OTC swaps and to Eris exchange-traded contracts instead.

Source: CME Group

For more on how Eris SOFR Swap futures offer key benefits when compared with OTC alternatives, see our recent research piece.

There are less than three months until the conversion day for 28D TIIE swaps. Indicative analysis reports are now available and can be accessed via sFTP, and the first dress rehearsal will take place on September 27.

All of our operational resources, including a Client Readiness Checklist, are accessible below.

Data as of August 30, 2024, unless otherwise specified.

* Pending regulatory approval

View an archive of the Rates Recap online at cmegroup.com/ratesrecap.