- 9 Jul 2024

- By CME Group

- Topics: Interest Rates

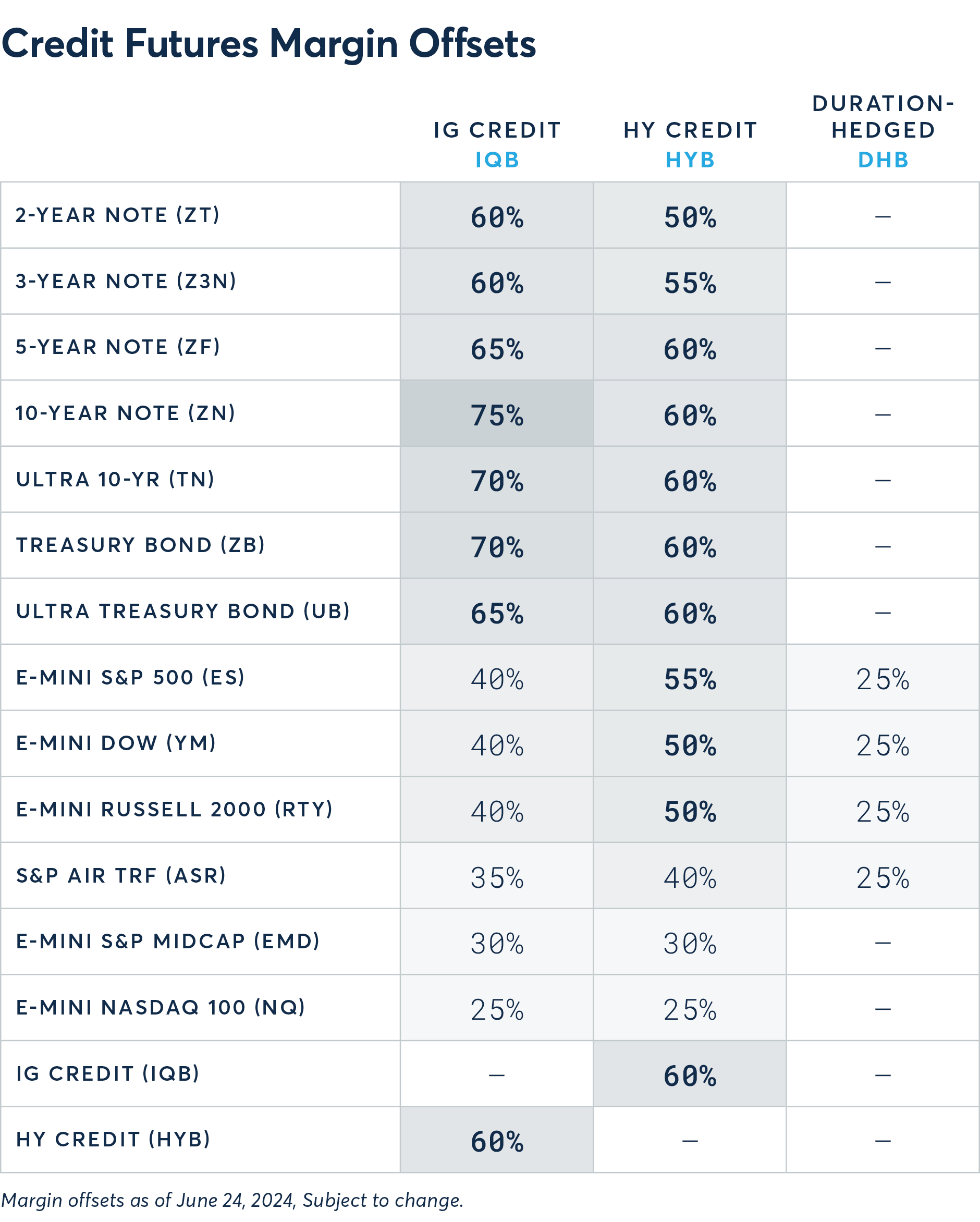

In just three weeks since launch, bid-ask spreads in Credit futures (0.03%-0.05% of Index Price) already rival more mature credit market instruments. This has enabled early adoption among end-users, leading to:

- Steadily climbing open interest (OI)

- Week 2 volume doubled that of week 1

- Over 2,000 contracts traded (as of July 8)

19% of activity is facilitated by Globex listed ICS vs. Treasury futures (for Investment Grade contracts)

With robust margin offsets available, the continued futurization of Credit markets could have wide ranging benefits for market participants.

Source: CME Group

This may be especially true for those with a robust understanding of how credit fits into the investment landscape compared to equities and Treasuries. For more on this relationship, consider our recent research article from Erik Norland.

New monthly SOFR options are quickly capturing the market's attention, with 12,000 contracts traded in two weeks, including:

- 10K in July 2024 options traded on March 2025 underlying (1YH)

- 1.6K in July 2024 options traded on December 2025 underlying (2YZ)

- 400 in July 2024 options traded on December 2024 underlying (1YZ)

These short-dated options contracts allow for more precise exposure, trading one- or two-month options on any One-Year or Two-Year quarterly futures underlying not covered by our current offering.

For a second consecutive month, TBA futures ADV exceeded 1,100 contracts, while average daily OI grew to a new high.

Source: CME Group

For more on how to utilize increasingly liquid TBA futures, see our Treasury and TBA futures spreading paper for more trade ideas.

End-users continue to underpin significant activity in CME Group €STR futures. Nearly 250 non-prop traders have joined the CME Group €STR ecosystem, driving steady and continuous growth in open positions. Average daily OI reached a second consecutive monthly high in June at more than 55,000 contracts.

In addition to being the home for end-users, CME Group offers new ways to visualize potential impacts of ECB decisions on €STR futures. Utilize our new interactive tool to see how €STR futures prices could change based on shifting inputs. See the methodology guide and the tool for more details.

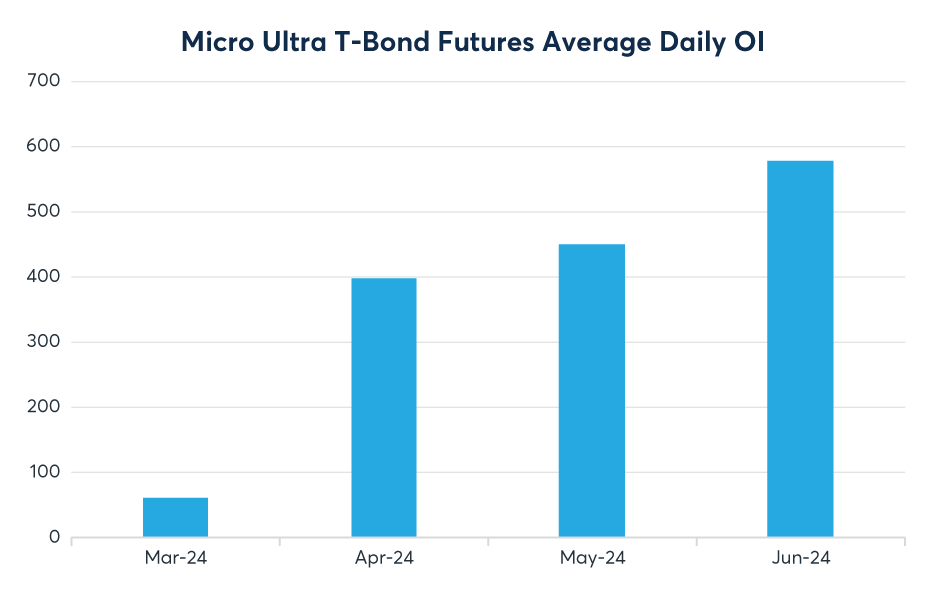

Participants have been taking advantage of the proportionally sized margin requirements (relative to classic contracts) and tick sizes at the long end of the curve with the T-Bond Micro contract (MWN). A new OI record was set on June 10 of just under 1,000 contracts while ADV on the month was approaching 2,000.

Source: CME Group

Learn more about the world of Micro Treasury futures and how these contracts can fit into a strategy.

Participants continue to find new ways to use Eris SOFR Swap futures as a replacement for more cumbersome swap hedging techniques, leading to record volume and open interest in June.

- ADV hit a record 17,000 contracts in June, +64% vs. the prior monthly high.

- OI averaged a record 220,000 contracts in June, reaching an all-time high of 244,000 on June 14.

Want to learn more about these unique contracts? Dive into our new SOFR Swap futures home page or see our in-depth research article for details.

Effective as of July 1, CBOT expanded the reporting window from five (5) to fifteen (15) minutes during regular trading hours (RTH) for Treasury futures block trades meeting new larger block trade quantity thresholds.

CME Group has announced October 12, 2024 as the planned date to convert BSBY futures to corresponding SOFR contracts. See our fallback process and operational timeline in our implementation guide.

Want to learn more about these unique contracts? Dive into our new SOFR Swap futures home page or see our in-depth research article for details.

MXN OTC – June saw a record average daily count over 960 and daily notional of $35B U.S. dollar equivalent.

3-Year T-Note futures – OI has now grown 136% YTD, closing June above 26,000 contracts.

Record Q2 in Rates – Overall Rates ADV reached 12.8M contracts in Q2 2024, the highest Q2 ADV in history.

Bloomberg codes – View the updated list across the CME Group Interest Rate suite.

Data as of July 1, 2024, unless otherwise specified.

* Pending regulatory approval

View an archive of the Rates Recap online at cmegroup.com/ratesrecap.

Stay in the know

Stay up to date with the latest CME Group Interest Rates, news products and more.

Already have an account? Log in

By clicking above, you are subscribing and agreeing to receive the specified content. I understand that I can unsubscribe at any time.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.