- 9 Feb 2024

- By CME Group

- Topics: Interest Rates

Fresh off a year of record risk management, rates markets kicked off 2024 with more of the same – high levels of uncertainty, shifting Fed expectations and record hedging. With over 13M contracts traded daily across futures and options, Interest Rate volumes in January were the highest ever to start the year by a wide margin.

Source: CME Group

Related: Download our annual chart book for at-a-glance insights into key measures of liquidity across Interest Rate futures and options in 2023.

As €STR's role in euro interest rate markets continues to rise in prominence, so too has adoption in CME Group €STR futures – the largest centralized market for €STR trading and, as evidenced by OI, the venue of choice for real-money end users.

Source: CME Group

High yields at 13-week T-Bill auctions have declined roughly ten basis points in the last four months, and with the prospect of Fed rate cuts on the horizon, hedging cash portfolios is crucial.

With this backdrop, January trading saw T-Bill futures have their best month since launch:

- ADV reached 1,253 contracts, +82% vs. Q4

- OI jumped to 6,439 contracts, +97% MoM

- Book depth increased 55% MoM

- Bid/ask spreads narrowed for a fourth consecutive month

With the Bank of Mexico's restrictions around the 28D TIIE index going into effect in January 2025, the focus is increasingly on TIIE de Fondeo, or F-TIIE.

To assist this transition, CME Group has published an updated conversion plan and has expanded its liquidity program in the F-TIIE futures market. Learn more about the revised plan and key F-TIIE futures details.

Launching summer 2024, Corporate Credit futures based on Bloomberg Indices will provide a new mechanism for managing investment grade and high yield credit exposure leveraging the efficiency of futures contracts.

View initial details via the link below, and make sure to sign up to be kept up to date on the launch date later this year.

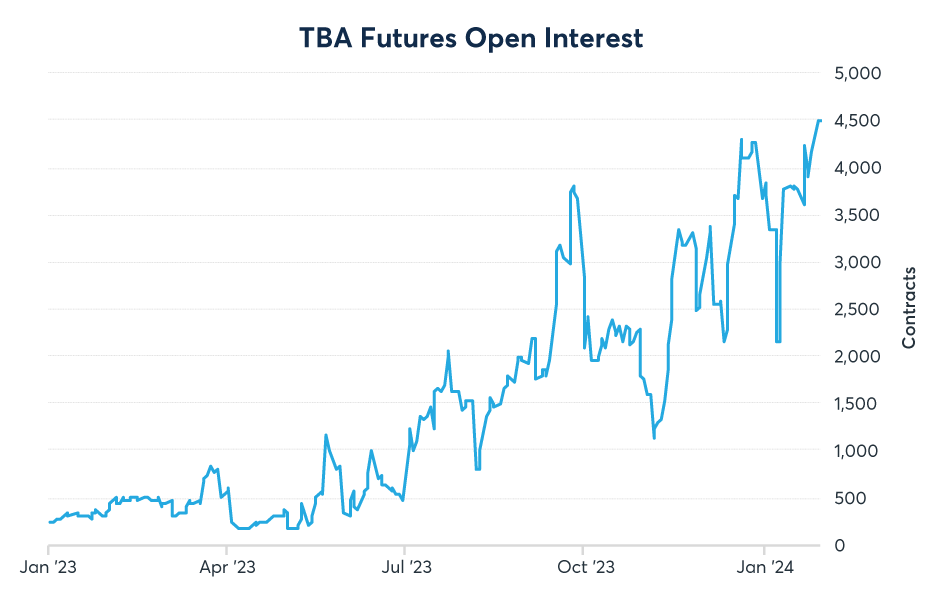

With mortgage rates retreating from their highs by a full percentage point in the past six weeks, related hedging demand has propelled TBA futures open interest to a new high.

Source: CME Group

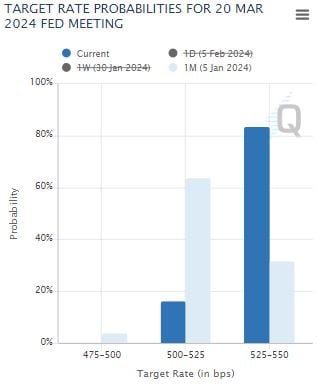

While markets seem to be shutting the door on a March rate cut following Powell’s press conference and a hot January jobs report, markets are still pricing in five to six 25 bp cuts in 2024 (vs. the Fed's guidance of three).

Traders can track shifting probabilities with the CME FedWatch Tool and plot different outcomes and the potential impact on SOFR futures prices with CME SOFRWatch.

CME FedWatch data is now available via a REST API. Learn more about our data offering on our API home page.

We analyzed the average daily range relative to bid-ask spreads in 10Y Yield futures over the course of 2023.

The results show Yield futures offer ample liquidity to capitalize on swings in yields, especially around market moving events like CPI, FOMC and Nonfarm payroll reports.

Data as of Feb. 1, 2024, unless otherwise specified. €STR data as of Feb. 6, 2024.

View an archive of the Rates Recap online at cmegroup.com/ratesrecap.