- 5 Aug 2022

- By CME Group

Rapid expansion of the voluntary carbon market has led to the development of an active futures market for traders and project developers to hedge price risk associated with carbon offset credits. The CME Group Voluntary Carbon Emissions Offset futures product suite provides three unique contracts (CBL GEO, CBL N-GEO, and CBL C-GEO futures), which allow for physical delivery of carbon offset credits from internationally recognized registries.

Since the launch of the first Voluntary Carbon Emissions Offset futures contract in March 2021, the combined suite of futures has traded over 135K contracts, equivalent to over 135M carbon offset credits. On June 9, the product suite reached a record open interest of 22.3K lots, with a volume record of over 5K contracts traded on June 14. Strong international participation has contributed to this growth, as more than half of all volume originates from the EMEA and APAC regions.

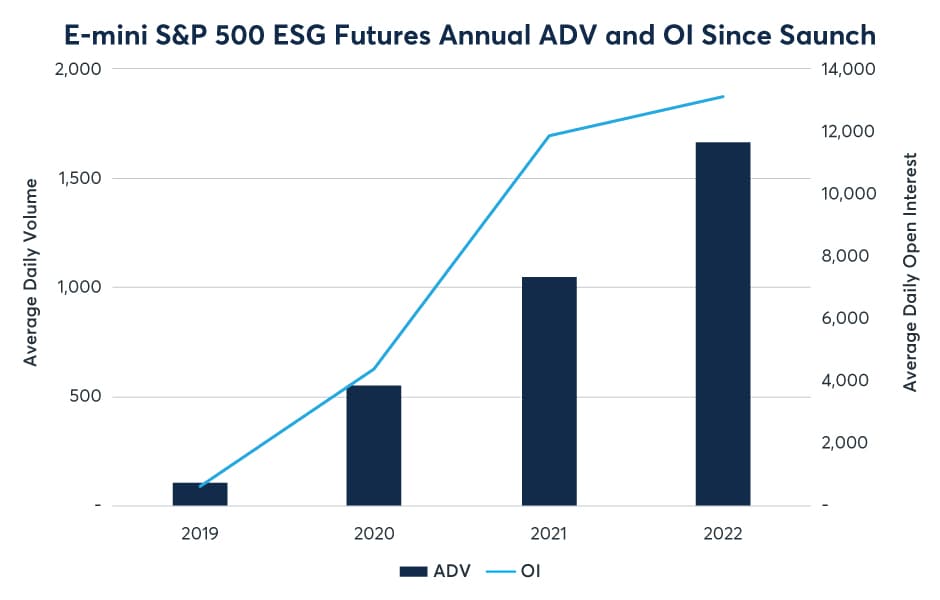

With interest and participation in sustainable investments continuing to rise, E-mini S&P 500 ESG (ESG) futures volume continues to gain ground in 2022. June ADV reached 2.4K, up 323% compared to May 2022. Open interest is averaging 14.9K, up 12% vs. May 2022.

Launched just over a year ago, E-mini S&P Europe 350 ESG (E3G) futures traded over 3.3K total contracts. The futures are cash-settled to the S&P Europe 350 ESG Index, a Pan-European index covering developed markets across over 15 countries. The index is considered compliant with Article 8 of the SFDR and uses the same methodology as the S&P 500 ESG Index.

Available August 8*, new CBL Core Global Emissions Offset Trailing (C-GEO-TR) and CBL Nature-Based Global Emissions Offset Trailing (N-GEO-TR) futures will offer market participants the opportunity to trade futures on vintages no longer covered within benchmark C-GEO and N-GEO futures.

Comex Cobalt (COB) open interest is on the rise and now above 4,500 tons (4,522 tons open interest as of June 23), extending all the way out to Q3 2024. The contract is finding quick adoption from the marketplace, as the automotive sector seeks to manage commodity price risk in the transition to higher EV production volumes. Cobalt is a key component in many EV car battery models.

Natural gas production accounts for 41% of total methane emissions from the U.S. oil and gas industry, causing energy companies to embrace Responsibly Sourced Gas (RSG) as a vehicle to meet ESG goals and initiatives.

RSG, also called differentiated or certified gas, is a conventional natural gas that has been produced through operations that meet certain ESG standards. With more than 100 countries signing the Global Methane Pledge to voluntarily reduce methane emissions, the market size for RSG is rising.

Manage the risk associated with renewable energies, environmental change, and sustainable investments with our ESG products.

At CME Group, we believe in advancing policies that strengthen the integrity of our global company. Our sustainable solutions include the industry's first Sustainable Clearing service, voluntary carbon-offset tools, E-mini S&P 500 ESG futures, the world's most widely-used ESG equity futures contract, and more. Read our latest ESG report.