- 23 Jan 2023

- By CME Group

Equity Index products had an outstanding year in 2022 driven by continued innovation and reliable risk management tools. Futures and options ADV in 2022 was a record 7.7M contracts (up 39% vs. 2021) and large open interest holders (LOIH) reached a record 2,268 on November 22 2022:

- Equity futures 2022 ADV was a record 6.5M contracts. Micro E-mini futures outperformed their prior success with nearly 1.9B contracts traded since launch and a 2022 ADV of 3.1M contracts, up 50% vs. 2021.

- Equity options 2022 ADV was a record 1.2M contracts. Growth was driven by the addition of Tuesday and Thursday listings on both the E-mini S&P 500 and E-mini Nasdaq-100 options. E-mini S&P 500 Tuesday & Thursday options were the most successful options launch in CME Group history, with nearly 83K contracts traded Day 1 and over 32.7M contracts traded through year-end.

Economic news flow remained front and center throughout the quarter, with the focus on the FOMC cycle, CPI information, and other key inflationary indicators. This caused the market to fluctuate and for volatility to be present, especially in October.

The Q4 2022 equity roll now uses the 3-month SOFR benchmark instead of 3-month LIBOR. The implied financing spread to 3-month SOFR of the Dec/Mar roll increased to 3m SOFR +50bps vs. 3m SOFR +10bps in Q3 2022. The roll was down from the Q4 2021 roll at 3m SOFR +64bps. The running four-quarter moving average remains the same at an average of 3-month SOFR +28bps.

Average daily volume across all four Micro E-mini futures reached 3M contracts in Q4 2022. For the first time in seven quarters, Micro E-mini S&P 500 futures contributed the most volume with an ADV of 1.4M contracts as traders focused less on the tech sector.

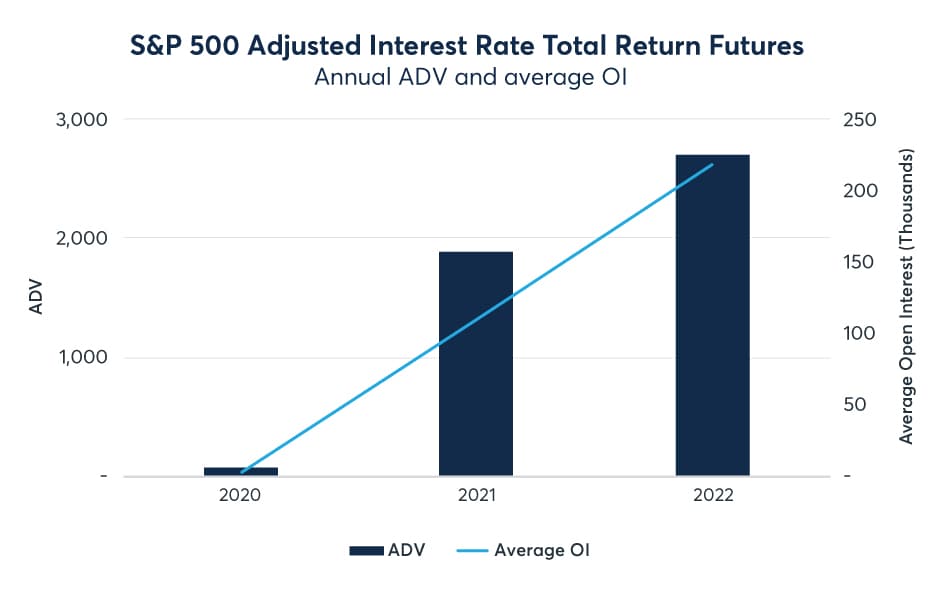

S&P 500 AIR Total Return futures ADV in Q4 2022 was 2.3K and average OI reached a record of 276K (+21% vs. Q3 2022), with a record OI of 296K on December 16. Clients continue to increase their use as a listed alternative to OTC as UMR impacts investors more broadly after phase 6 in Sep 2022.

Achieve capital-efficient total return equity index swap exposure with AIR Total Return futures on Nasdaq-100, Russell 1000, Russell 2000, DJIA, and FTSE 100 Indices.

S&P 500 Annual Dividend Index futures Q4 2022 ADV increased to 3.8K contracts (+24% vs. Q3 2022) and average OI was a record 254K contracts (+10% vs. Q3 2022). On December 12, OI reached a record 276.6K contracts.

CME Group launched Annual Dividend Index futures on Nasdaq-100 and Russell 2000 in 2022 to provide more ways to manage hedge dividend risk.

In 2022, CME Equity Sectors futures had a record ADV of 18.4K, up 8% vs. 2021. CME Group launched six new sector index futures August 8 on the following: S&P Oil & Gas Exploration & Production Select Industry Index, S&P Retail Select Industry Index, S&P Insurance Select Industry Index, S&P Regional Banks Select Industry Index, S&P Biotechnology Select Industry Index, and Philadelphia Stock Exchange Semiconductor Index. Nearly 65K contracts have traded since launch.

Q4 ADV across all Equity Sector Index products reached 16K contracts and OI is averaged 210K contracts. Derived blocks are starting to take off, with nearly 87K contracts traded since launch across the various sector products.

Launched in Q2 2022, derived blocks are gaining traction with nearly 87K contracts traded across the various sector products, providing participants more liquidity, capital efficiency, and flexibility when executing large trades.

Nikkei 225 futures Q4 ADV increased to 38K contracts (+2% vs. Q3 2022) with average OI reaching more than 60K contracts. 2022 ADV was 42K, up 10% from 2021. In 2022, 53% of volume came from non-U.S. hours and 4M contracts were transacted through MOS (Mutual Offset System).

CME Group launched TOPIX (USD) futures on Nov 18, the first dollar-denominated contract, which complements the existing Yen-denominated TOPIX futures and provides new quanto spreading opportunities.

- More on CME Nikkei 225 Futures

- More on CME TOPIX Futures

All data accurate of December 31, 2022 unless otherwise indicated.

Equity Index futures:

- Volume: 6.2M ADV (+24% vs. Q4 21)

- Open interest: 4.7M contracts per day (+0% vs. Q4 21)

Equity Index options on futures:

- Volume: 1.3M ADV (+33% vs. Q4 21)

- Open interest: 5.4M contracts per day (+18% vs. Q4 1)

Futures |

Q4 22 ADV (vs. Q4 21) |

|---|---|

ES |

2.0M (+25%) |

NQ |

686K (+18%) |

YM |

195K (+10%) |

RTY |

227K (+2%) |

NIY & NKD |

38K (-8%) |

BTC |

12K (+16%) |

In 2022, the equity markets experienced significant divergence in performance amongst equity sectors. Read about how Sector futures can help capture opportunities and manage risk affecting different equity index sectors.

CME Group’s David Gibbs and Paul Woolman discuss how Sector futures give traders greater flexibility to hedge positions on increasingly popular economic sectors amid historic stock market volatility, as well as review how derived blocks can provide greater liquidity for outsized trading strategies.

Sr. Economist Erik Norland examines the implications of a strengthening Japanese yen against the U.S. dollar on Japanese equities.

- Equity Index options blocks

- E-mini S&P 500 (ES) options blocks: Participation in ES options blocks continues to grow, allowing market participants to execute large trades with greater efficiency. Nearly 25M ES options blocks have traded, with Q4 ADV at 50.6K contracts.

- E-mini Nasdaq-100 (NQ) options: NQ options became block eligible on January 24, with a minimum block threshold of 60 contracts. Nearly 15.5K contracts have traded since launch.

Sign up for Equity ES options block alerts

- NQ options: Launched October 3, E-mini Nadaq-100 Tuesday and Thursday options have traded nearly 270K contracts since launch. These contracts provide more versatility in managing shorter-term equity market risk on the Nasdaq-100 Index, complementing our existing suite of quarterly, end-of-month, and Monday, Wednesday, and Friday weekly options.

Learn more

- E-mini Nasdaq-100 (NQ) options quarterly ADV was 43.2K, an increase of 38% vs. Q4 21.

Find out more

- Micro E-mini options: Micro E-mini S&P 500 and Micro E-mini Nasdaq-100 options Q4 22 ADV was 13.7K, +14% vs. Q3 22.

Learn more