- 12 Oct 2022

- By CME Group

The market experienced a brief lull in activity in late summer amid hopes that the Fed would be more dovish. When the Fed pivot failed to materialize, this prompted the market to sell off, with volatility spiking as equities were repriced.

The implied financing of the Sep/Dec roll decreased from the Q2 2022 roll of 17bps to 0bps. The roll was lower vs. Q3 2020 and Q3 2021, which were +23bps and +38bps respectively. The running 4-quarter moving average continues to decline, now averaging +15bps.

Average daily volume (ADV) across all four Micro E-mini futures reached 3.0M contracts in Q3 2022. Micro E-mini Nasdaq-100 futures remained the strongest with an ADV of 1.4M contracts as traders continue to manage tech volatility.

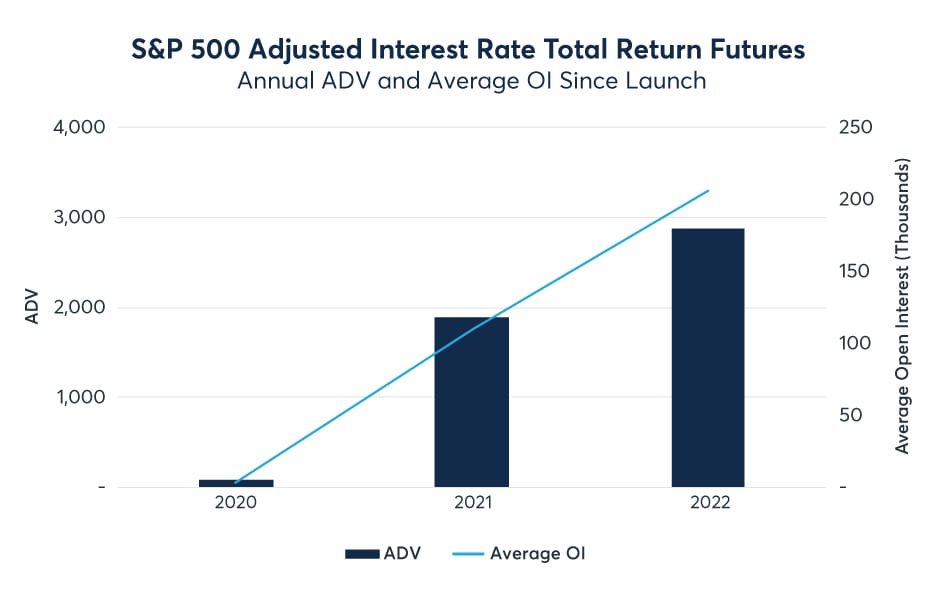

S&P 500 AIR Total Return futures ADV in Q3 2022 reached 2.8K contracts (+48% vs. Q2 2022) and an average OI of 228K contracts (+7% vs. Q2 2022) with a record OI of 268K on September 30th. Clients continue to increase their use as a listed alternative to OTC as UMR deadlines approach.

Achieve capital-efficient total return equity index swap exposure with AIR Total Return futures on Nasdaq-100, Russell 1000, Russell 2000, DJIA, and FTSE 100 Indices.

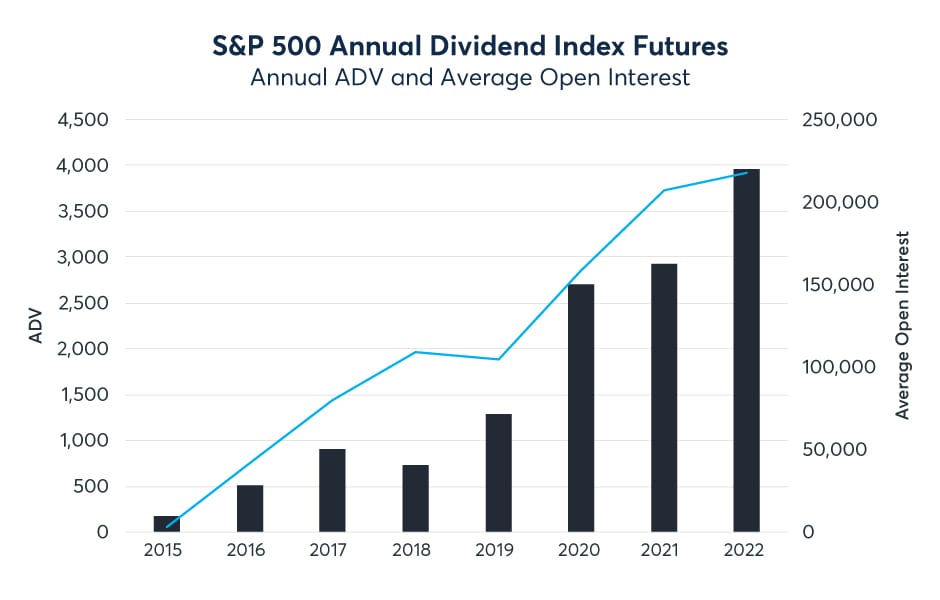

S&P 500 Annual Dividend Index futures rounded out Q3 with an ADV of 3.1K contracts and average OI of 231K contracts (+6% vs. Q2 2022). New participants continued to enter the market with the number of Large Open Interest Holders (LOIH) at a record 106 at quarter-end, +19% YoY.

CME Group launched Annual Dividend Index futures on Nasdaq-100 and Russell 2000 earlier this year, Russell 2000 is gaining traction with OI at 12.4K.

CME Group launched six new sector index futures August 8th on the following: S&P Oil & Gas Exploration and Production Select Industry Index, S&P Retail Select Industry Index, S&P Insurance Select Industry Index, S&P Regional Banks Select Industry Index, S&P Biotechnology Select Industry Index, and Philadelphia Stock Exchange Semiconductor Index. Over 16K contracts have traded since launch.

Across all Equity Sector Index products, Q3 ADV is 17.6K contracts and OI is averaging 209K contracts. Derived blocks are starting to take off, over 36K contracts have been traded since launch across the various sector products.

Clients continue to utilize the liquidity of CME Group Cryptocurrency products during periods of market uncertainty. Combined average daily open interest across CME Group Cryptocurrency futures and options reached a record average of 175K contracts throughout in Q3 2022, an increase of 64% vs. Q2 2022.

Ether futures (ETH) had a record Q3 2022 ADV of 7.2K contracts (+10% vs. Q2 2022) and average daily OI reached 4.1K contracts. Nearly 2.1M contracts (1054M equivalent ether) have traded since launch over a year ago. 43% of volume traded occurs during Nonnon-U.S. hours. Launched September 12, Ether options offer another way to efficiently manage ether exposure. Now trade options on Ether futures, launched September 12th, over 100 trades have occurred since launch.

Micro Ether futures (MET) continue to outperform quarter-over-quarter with a record Q3 2022 ADV of 22.2K contracts and OI averaging 50.4K contracts. The futures contract provides a precise, cost-effective tool to manage ether price risk. Since launch in December 2021, over 4.1M contracts have traded., Large Open Interest Holders (LOIH) was 126 in Q3, with a record 139 during the week of September 9th.

Bitcoin futures (BTC) Q3 2022 ADV was over 11.7K contracts (+8% vs. Q2-22) and open interestOI averaged 13.7K contracts (+15% vs. Q3 2022). LOIHs have averaged 96 in Q3 2022 as institutional interest continued to increase during the price volatilitycorrection.

Micro Bitcoin futures (MBT) had another successful quarter, with andaily OI averaging 21.1K contracts (+8% vs. Q2 2022), 35% of volume was traded during non-U.S. hours.

Bitcoin Euro futures and& Ether Euro futures were launched August 29th. The new contracts match their U.S.-denominated counterparts at five5 bitcoin or 50 ether per contract providing access to a second currency pair.

All data accurate of September 30, 2022 unless otherwise indicated.

Equity Index futures:

- Volume: 6.3M ADV (+45% vs. Q3-21)

- Open interest: 4.7M contracts per day (-1% vs. Q3-21)

Equity Index options on futures:

- Volume: 1.2M ADV (+54% vs. Q3-21)

- Open interest: 5.1M contracts per day (+30% vs. Q3-21)

Futures |

Q3-22 ADV (vs. Q3-21) |

|---|---|

ES |

2.1M (+39%) |

NQ |

688K (+28%) |

YM |

178K (+6%) |

RTY |

224K (+13%) |

NIY & NKD |

37K (-3%) |

BTC |

12K (+66%) |

Examine different ways to trade E-mini Nasdaq-100 and S&P 500 weekly options to manage risk ahead of major market events.

Asset managers are increasingly adding futures to ESG portfolios to meet client demand for sustainability-linked investments.

Sr. Economist Erik Norland examines how the start of quantitative tightening by the Fed this month can impact equities.

Pullback, correction, or bear market? Scott Bauer offers some historical perspective on market downturns.

- Equity Index options blocks

- E-mini S&P 500 (ES) options blocks: Participation in ES options blocks continues to grow, allowing market participants to execute large trades with greater efficiency. Over 20M ES options contracts blocks have traded as a block, with Q3 ADV at 76.8K contracts.

- E-mini Nasdaq-100 (NQ) options: NQ options became block eligible on January 24, with a minimum block threshold of 60 contracts. Over 13.3K contracts have traded since launch.

Sign up for Equity ES options block alerts

- E-mini Nasdaq-100 options: Launched October 3rd, now trade E-mini Nadaq-100 Tuesday and Thursday options. These contracts will provide more versatility in managing shorter-term equity market risk on the Nasdaq-100 Index, complementing our existing suite of Quarterly, End-of-Month, and Monday, Wednesday, and Friday Weekly options. Learn more here. E-mini Nasdaq-100 (NQ) options quarterly ADV was 45.6K contracts, an increase of +58% vs. Q3-21.

Learn more

- Micro E-mini options: Micro E-mini S&P 500 and Micro E-mini Nasdaq-100 options Q3-2022 ADV was 12K contracts, +22% vs. Q3-21.

Find out more

- Micro Cryptocurrency options: Launched on March 28, Micro Bitcoin options and Micro Ether options are right-sized at 1/10 of their respective coins. Nearly 345K total contracts have traded.

Learn more

Stay informed on CME Group equity markets

Sign up to receive updates on new developments, insights, and more.

Already have an account? Log in

By clicking above, you are subscribing and agreeing to receive the specified content. I understand that I can unsubscribe at any time.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.