- 2 Aug 2022

- By CME Group

WTI Houston (HTT) and WTI Midland (WTT) trade as spreads to benchmark NYMEX WTI (CL) futures. Since 2020, the price spread between WTI Houston and WTI Midland has been limited to a 40-cent range, offering little volatility for traders.

Recently, expected growth in production and pipeline utilization have started to show in the forward curves for WTI Houston versus WTI Midland. As the price spread widens, so does the opportunities for traders.

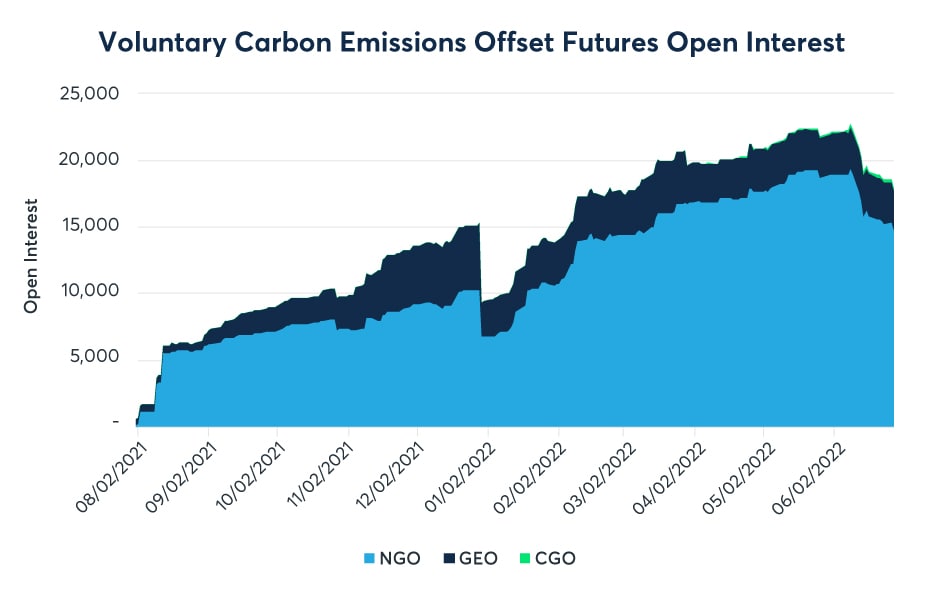

Rapid expansion of the voluntary carbon market has led to the development of an active futures market for traders and project developers to hedge price risk associated with carbon offset credits. The CME Group Voluntary Carbon Emissions Offset futures product suite provides three unique contracts (CBL GEO, CBL N-GEO, and CBL C-GEO futures), which allow for physical delivery of carbon offset credits from internationally recognized registries.

Since the launch of the first Voluntary Carbon Emissions Offset futures contract in March 2021, the combined suite of futures has traded over 135K contracts, equivalent to over 135M carbon offset credits. On June 9, the product suite reached a record open interest of 22.3K lots, with a volume record of over 5K contracts traded on June 14. Strong international participation has contributed to this growth, as more than half of all volume originates from the EMEA and APAC regions.

Source: CME Group

Stay on top of all energy-related news by following the CME Group Energy showcase page on LinkedIn or by following CME Group on Twitter.

View the current version and an archive of the Energy Update here.

Micro WTI Crude Oil (MCO) options offer a new, cost-effective way to access the world's most liquid crude oil contract. At 1/10 the size of the benchmark WTI options contract, Micro WTI Crude Oil options offer traders the same transparency while adding precision and versatility to crude oil strategies.

Available August 8*, new CBL Core Global Emissions Offset Trailing (C-GEO-TR) and CBL Nature-Based Global Emissions Offset Trailing (N-GEO-TR) futures will offer market participants the opportunity to trade futures on vintages no longer covered within benchmark C-GEO and N-GEO futures.

*Pending regulatory review

With four simple steps, you can trade NYMEX Energy products using Trayport Joule Direct.

Get real-time block alerts sent to your inbox or mobile device – you’ll be notified anytime a trade occurs for the product group you selected. Filter to My Blocks for a new, personalized view of the futures or options products you want to follow.

Global Command Center (GCC) is the market operations and customer service desk for electronic trading. We handle inquiries, issues, and support requests from CME Globex and CME ClearPort customers 24 hours a day.

Data as of June 29, 2022 unless otherwise specified.