- 18 May 2020

- By CME Group

Reviews by asset class

Interest Rates | Equity Index | Energy | Agricultural | FX | Metals

| Asset class | ADV | ADV YoY | % Globex | Open interest | OI % Puts | OI YoY |

| Total Options | 3,301,954 | -2% | 91% | 73,566,323 | 54% | -6% |

| Interest Rates | 2,061,164 | -12% | 93% | 56,637,173 | 55% | -9% |

| Equity Index | 603,211 | +33% | 97% | 4,071,558 | 63% | -2% |

| Energy | 337,523 | +39% | 62% | 7,355,218 | 46% | +22% |

| Agricultural | 209,351 | -8% | 99% | 3,092,542 | 48% | -2% |

| Metals | 59,171 | +15% | 78% | 1,715,249 | 30% | +7% |

| FX | 31,533 | -46% | 99% | 694,583 | 50% | 0% |

| Symbol | ADV | ADV YoY | % Globex | Open interest | OI % Puts | OI YoY | |

| Eurodollars | GE | 1,509,142 | +6% | 91% | 50,119,966 | 55% | -10% |

| 2-Year Note | ZT | 15,951 | -22% | 100% | 512,968 | 61% | +18% |

| 5-Year Note | ZF | 142,972 | -33% | 100% | 2,159,299 | 60% | +3% |

| 10-Year Note | ZN | 328,375 | -41% | 98% | 3,151,024 | 58% | -5% |

| T-Bond | ZB | 64,665 | -43% | 99% | 663,232 | 62% | -38% |

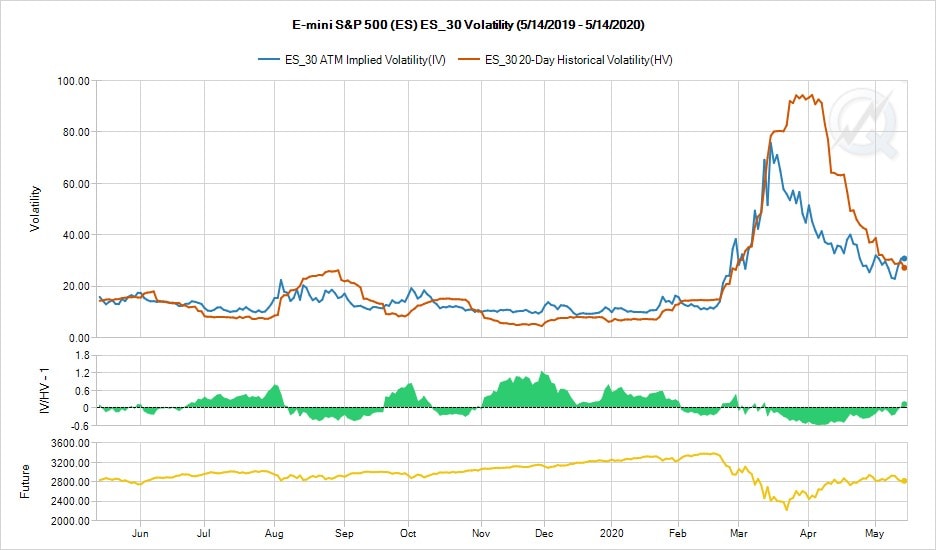

Realized and implied volatilities for 10-Year Note options have converged, demonstrating a return to normalcy for Treasury options. With Treasury net issuance expected to increase significantly over the next two quarters, Treasury options should be well suited to serve market participants’ increased hedging and risk management needs.

Source: QuikStrike

| Symbol | ADV | ADV YoY | Open Interest | OI % Puts | OI YoY | |

| E-mini S&P 500 options | ES | 575,228 | +38% | 3,774,045 | 63% | -2% |

| S&P 500 options | SP | 16,856 | -41% | 174,680 | 77% | -27% |

| E-mini NASDAQ-100 options | NQ | 9,378 | +16% | 99,505 | 60% | +55% |

| E-mini Russell 2000 options | RTO | 1,632 | -18% | 20,881 | 63% | -26% |

| E-mini Dow ($5) options | YM | 99 | -21% | 2,153 | 65% | -34% |

| Bitcoin options | BTC | 18 | N/A | 294 | 31% | N/A |

| Symbol | Settlement | ADV | ADV YoY | % Globex | Open Interest | OI % Puts | OI YoY | |

| Crude Oil options | 191,953 | +11% | 66% | 4,583,871 | 50% | +7% | ||

| WTI Crude Oil | LO | Physical | 156,587 | +18% | 78% | 2,941,758 | 45% | +7% |

| WTI 1 Month CSO Physical | WA | Physical | 11,803 | -22% | 4% | 556,097 | 65% | -7% |

| WTI 1 Month CSO Financial | 7A | Financial | 6,842 | +29% | 0% | 285,770 | 54% | +91% |

| WTI-Brent Spread | BV | Financial | 3,569 | +62% | 2% | 191,980 | 69% | +66% |

| WTI Weeklies | LO1-5 | Physical | 3,269 | -22% | 99% | 3,978 | 62% | -64% |

| WTI Average Price | AAO | Financial | 2,481 | -36% | 0% | 408,026 | 56% | +5% |

| Brent Futures-Style | BZO | Financial | 2,203 | -52% | 11% | 68,645 | 39% | -50% |

| Natural Gas options | 144,216 | +114% | 59% | 2,697,868 | 41% | +69% | ||

| Natural Gas European | LN | Financial | 132,710 | +127% | 59% | 2,410,102 | 41% | +65% |

| Natural Gas American | ON | Physical | 6,099 | +5% | 98% | 76,618 | 44% | +21% |

| Natural Gas 1 Month CSO | G4 | Financial | 2,624 | +359% | 0% | 82,100 | 49% | +738% |

| Natural Gas 3 Month CSO | G3 | Financial | 1,597 | +31% | 0% | 77,910 | 31% | +242% |

| Refined Product options | 1,223 | -53% | 18% | 59,785 | 22% | -36% | ||

| NY Harbor ULSD | OH | Physical | 581 | -39% | 19% | 31,763 | 19% | -40% |

| RBOB Gasoline | OB | Physical | 571 | -64% | 19% | 11,698 | 26% | -53% |

| Symbol | ADV | ADV YoY | % Globex | Open Interest | OI % Puts | OI YoY | |

| Corn | OZC | 77,085 | -19% | 98% | 953,501 | 46% | -16% |

| Soybean | OZS | 38,939 | -21% | 99% | 584,120 | 44% | +19% |

| Chicago SRW Wheat | OZW | 29,939 | +29% | 100% | 357,733 | 49% | +7% |

| Lean Hogs | HE | 15,137 | -26% | 100% | 253,397 | 50% | -36% |

| Live Cattle | LE | 11,218 | -1% | 100% | 199,666 | 50% | +1% |

| Soybean Meal | OZM | 10,230 | +44% | 99% | 136,786 | 48% | +36% |

| Soybean Oil | OZL | 6,840 | +38% | 94% | 125,060 | 48% | +107% |

| KC HRW Wheat | OKE | 5,065 | +76% | 99% | 70,995 | 42% | -1% |

| Short-Dated New Crop | Multi | 4,536 | -13% | 100% | 117,386 | 48% | +6% |

| Class III Milk | DC | 3,151 | +55% | 100% | 73,822 | 52% | -5% |

| Weekly Corn | ZC1-5 | 3,055 | +45% | 100% | 14,632 | 22% | +82% |

| Feeder Cattle | GF | 1,177 | -29% | 100% | 33,192 | 53% | +18% |

| Cash Settled Cheese | CSC | 638 | +40% | 100% | 31,403 | 55% | -8% |

| Weekly Soybeans | ZS1-5 | 537 | +2% | 100% | 4,700 | 57% | +64% |

| Nonfat Dry Milk | GNF | 434 | +44% | 90% | 27,086 | 60% | +15% |

| Class IV Milk | GDK | 323 | +37% | 100% | 15,482 | 52% | +11% |

| Grain Calendar Spread options | Multi | 293 | -41% | 92% | 52,916 | 69% | +49% |

| Rough Rice options | 156 | +120% | 98% | 2,997 | 35% | +209% |

Source: QuikStrike

| Symbol | ADV | ADV YoY | % Globex | Open interest | OI % Puts | OI YoY | |

| EUR/USD | EUU | 12,050 | -56% | 100% | 265,022 | 54% | -8% |

| JPY/USD | JPU | 7,766 | -31% | 97% | 141,382 | 43% | -1% |

| AUD/USD | ADU | 4,211 | -17% | 100% | 96,994 | 41% | 59% |

| CAD/USD | CAU | 3,749 | -34% | 100% | 71,136 | 58% | 9% |

| GBP/USD | GPU | 3,645 | -57% | 100% | 106,530 | 53% | -20% |

| CHF/USD | CHU | 99 | -47% | 100% | 5,908 | 57% | 34% |

| Symbol | ADV | ADV YoY | % Globex | Open interest | OI % Puts | OI YoY | |

| Gold | OG | 45,570 | +19% | 78% | 1,517,795 | 29% | +16% |

| Silver | SO | 6,230 | +26% | 85% | 133,572 | 36% | -41% |

| Gold Weeklies | OG1-5 | 5,245 | +24% | 95% | 16,688 | 51% | -4% |

| Copper | HX | 1,822 | -45% | 25% | 29,000 | 27% | -23% |

| Silver Weeklies | SO1-5 | 144 | -31% | 94% | 1,312 | 43% | -19% |

| Platinum | PO | 107 | -47% | 3% | 7,440 | 32% | +16% |

Open Interest as of 4/30/20, unless otherwise specified

YoY – Compares current period 2020 to same period 2019

MoM – Compares current month 2020 to previous month 2020

Futures and options trading is not suitable for all investors, and involves the risk of loss. Futures are a leveraged investment, and because only a percentage of a contract’s value is required to trade, it is possible to lose more than the amount of money deposited for a futures position. Therefore, traders should only use funds that they can afford to lose without affecting their lifestyles. And only a portion of those funds should be devoted to any one trade because they cannot expect to profit on every trade. All references to options refer to options on futures.

CME Group is a trademark of CME Group Inc. The Globe logo, CME, E-mini and Globex are trademarks of Chicago Mercantile Exchange Inc. CBOT is a trademark of the Board of Trade of the City of Chicago, Inc. NYMEX and ClearPort are trademarks of New York Mercantile Exchange, Inc. COMEX is a trademark of Commodity Exchange, Inc. S&P® 500 and S&P MidCap 400™ are trademarks of The McGraw-Hill Companies, Inc., and have been licensed for use by Chicago Mercantile Exchange Inc. NASDAQ-100 is a trademark of The Nasdaq Stock Market, used under license. Dow Jones is a trademark of Dow Jones & Company, Inc. and used here under license. Russell 2000® is a trademark and service mark of the Frank Russell Company, used under license. All other trademarks are the property of their respective owners.

The information within this document has been compiled by CME Group for general purposes only and has not taken into account the specific situations of any recipients of the information. CME Group assumes no responsibility for any errors or omissions. The information in this brochure should not be considered investment advice. All matters pertaining to rules and specifications herein are made subject to and are superseded by official CME, CBOT and NYMEX rules. Current CME/CBOT/NYMEX rules should be consulted in all cases before taking any action.

Copyright © 2020 CME Group Inc. All rights reserved

CME Ag Intel

Data-driven recaps of the corn and soybean markets delivered daily to your inbox, highlighting significant changes in volume, open interest, price, volatility, and skew.