- 15 Jan 2020

- By CME Group

Liquidity begets liquidity. An adage that has proved true in the case of options on futures at CME Group. Ongoing enhancements to technology and electronic access through CME Globex have improved liquidity across time zones, drawing new institutional traders into the market and creating a virtuous circle that continues to drive greater liquidity and record participation.

Plus, with benchmark options across six asset classes, CME Group offers the most diverse options marketplace on the planet. Despite subdued volatility in 4 out of 6 asset classes, CME Group options registered a seventh consecutive record year with over 1 billion options contracts traded in 2019.

- Record volume: 1 billion contracts traded (ADV of 4M contracts/day)

- Record Interest Rate options ADV: 2.76M contracts/day

- Record Metals options ADV: 78.5 thousand contracts/day

- Record open interest: 98M contracts on June 13, 2019

- Record volume during overnight hours

| Asset class | 2019 ADV | % YoY | % Globex | Year-end OI | OI % YoY |

| Total options | 4,037,604 | 2% | 64% | 63,446,978 | 1% |

| Interest Rates | 2,763,449 | 15% | 54% | 50,241,807 | 5% |

| Equity Index | 643,968 | -22% | 95% | 3,468,387 | -11% |

| Energy | 242,980 | -24% | 67% | 5,155,885 | -22% |

| Agricultural | 257,524 | -2% | 85% | 2,581,829 | 3% |

| Metals | 78,518 | 36% | 80% | 1,455,101 | 2% |

| FX | 51,165 | -31% | 98% | 543,969 | -15% |

| Product | Product group | Symbol | ADV | % YoY | Globex % | Open interest |

| Eurodollars | Interest Rates | GE | 1,685,289 | 19% | 37% | 44,504,277 |

| 10-Year Note | Interest Rates | OZN | 679,032 | 2% | 80% | 3,117,032 |

| E-mini S&P 500 | Equity Index | ES | 599,185 | -21% | 100% | 3,193,167 |

| 5-Year Note | Interest Rates | OZF | 226,370 | 37% | 76% | 1,487,376 |

| T-Bond | Interest Rates | OZB | 147,255 | 5% | 87% | 835,105 |

| WTI Crude Oil | Energy | LO | 144,698 | -27% | 76% | 2,703,406 |

| Corn | Agriculture | OZC | 124,944 | 23% | 84% | 911,596 |

| Natural Gas | Energy | LN | 89,620 | -14% | 56% | 2,288,143 |

| Gold | Metals | OG | 66,326 | 36% | 79% | 1,286,895 |

| Soybeans | Agriculture | OZS | 53,714 | -29% | 88% | 449,183 |

| Standard S&P 500 | Equity Index | SP | 32,627 | -33% | 0% | 203,973 |

| Chicago SRW Wheat | Agriculture | OZW | 29,229 | -22% | 85% | 334,307 |

| 2-Year Note | Interest Rates | OZT | 23,991 | 4% | 70% | 254,609 |

| EUR/USD | FX | EUU | 23,834 | -31% | 99% | 195,245 |

| Lean Hogs | Agriculture | HE | 16,628 | 51% | 92% | 327,050 |

| JPY/USD | FX | JPU | 9,626 | -23% | 98% | 100,664 |

| Live Cattle | Agriculture | LE | 9,580 | -9% | 88% | 156,673 |

| E-mini NASDAQ-100 | Equity Index | NQ | 9,504 | -17% | 100% | 48,083 |

| Silver | Metals | SO | 9,112 | 22% | 90% | 133,133 |

| GBP/USD | FX | GPU | 8,007 | -38% | 95% | 108,749 |

| Soybean Meal | Agriculture | OZM | 7,890 | -38% | 80% | 88,365 |

| Soybean Oil | Agriculture | OZL | 6,349 | 12% | 82% | 94,942 |

| Brent Crude Oil | Energy | BZO | 5,960 | -48% | 47% | 107,976 |

| CAD/USD | FX | CAU | 4,706 | -37% | 99% | 63,088 |

| AUD/USD | FX | ADU | 4,673 | -25% | 100% | 65,257 |

| KC HRW Wheat | Agriculture | OKE | 4,454 | 11% | 77% | 63,895 |

| Copper | Metals | HX | 2,812 | 101% | 73% | 26,533 |

| Ultra T-Bond | Interest Rates | OUB | 1,060 | 121% | 6% | 29,241 |

| E-mini Russell 2000 | Equity Index | RTO | 2,439 | -1% | 100% | 22,047 |

- QuikVol® tool: Chart and analyze historical volatility data including, implied and actual volatility, skew, constant maturity, and implied volatility cones

- Cross-Margin tool: View margin offsets for all products within a single matrix, making it easier than ever to maximize your capital

- Block Trade Alerts: Get email alerts when privately negotiated block trades are submitted in the markets you care about

- Options Calculator: Generate fair value prices and Greeks for any of CME Group’s options on futures contracts or price up a generic option with our universal calculator.

- This Week in Options: Track intraday and weekly rolling contract statistics (such as volatility, risk reversal prices, open interest, put/call ratios, and more), and compare them to the prior week.

- Open Interest Heatmap: See instantly which option calls and puts have the most trading, by strike and expiration, and compare vs. the last day/week/month, to help you plan.

- Vol2Vol™ Expected Range: See how many standard deviations a strike is from the at-the-money (ATM) futures price. Chart open interest and volume to see where trading is focused and to gauge market sentiment on price.

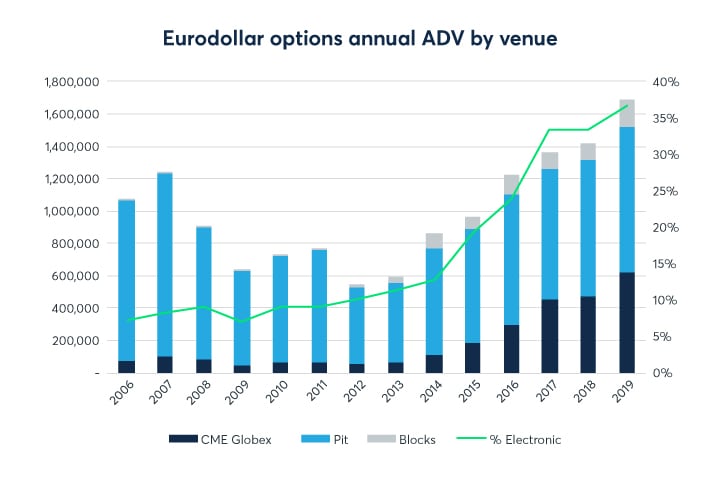

In a year marked by true rate uncertainty and three Fed rate cuts, the near 24-hour liquidity of Eurodollar and Treasury options shined, leading to a third consecutive record year for Interest Rate options.

- Rates options averaged a record 2.76M contracts/day, with outsized growth in traded volumes during non-US hours

- 12-month rolling ADV during the Singapore hours of 8am-8pm SGT was 429K contracts, +47% vs. 2018

- 12-month rolling ADV during the London hours of 7am-5pm GMT was 1.4M contracts, +16% vs. 2018

- Eurodollar options averaged a record 1.68M contracts/day, +19% YoY, with growth across all three venues (Elec, Pit, Block)

- Eurodollar options hit single-day volume (7M contracts) and open interest (71M) records in June

- Treasury options averaged a record 1.1M contracts/day, +8% YoY, with outsized growth in 5-Yr Note options which surged 37%

- Weekly Treasury options averaged a record 237K contracts/day, with both Friday and Wednesday expirations reaching new annual highs

| Symbol | 2019 ADV | % YoY | % Globex | Year-End OI | OI % Puts | |

| Eurodollar options | 1,685,289 | 19% | 37% | 44,504,277 | 44% | |

| Eurodollars (Quarterly/Serial) | GE | 1,106,209 | 61% | 35% | 36,266,803 | 45% |

| 1-Year Mid-Curve | GE0 | 374,120 | -6% | 40% | 5,177,660 | 31% |

| 2-Year Mid-Curve | GE2 | 141,166 | -38% | 40% | 2,035,753 | 58% |

| 3-Year Mid-Curve | GE3 | 60,708 | -33% | 45% | 977,933 | 46% |

| 4-Year Mid-Curve | GE4 | 2,092 | -98% | 28% | 44,628 | 27% |

| 10-Year Note | 679,032 | 2% | 80% | 3,117,032 | 41% | |

| Quarterly/Serial | OZN | 517,707 | -2% | 79% | 2,888,640 | 40% |

| Friday Weekly | ZN1-5 | 140,064 | 17% | 82% | 228,134 | 56% |

| Wednesday Weekly | WY1-5 | 21,262 | 5% | 90% | 258 | 61% |

| 5-Year Note | 226,370 | 37% | 76% | 1,487,376 | 64% | |

| Quarterly/Serial | OZF | 183,300 | 30% | 74% | 1,439,515 | 65% |

| Friday Weekly | ZF1-5 | 36,332 | 77% | 83% | 47,821 | 50% |

| Wednesday Weekly | WF1-5 | 6,739 | 72% | 88% | 40 | 0% |

| T-Bond | 147,255 | 5% | 87% | 835,105 | 62% | |

| Quarterly/Serial | OZB | 114,769 | 2% | 85% | 776,312 | 62% |

| Friday Weekly | ZB1-5 | 28,228 | 19% | 92% | 58,790 | 62% |

| Wednesday Weekly | WB1-5 | 4,258 | -4% | 94% | 3 | 67% |

| 2-Year Note | 23,991 | 4% | 70% | 254,609 | 76% | |

| Quarterly/Serial | OZT | 23,849 | 5% | 70% | 254,609 | 76% |

| Friday Weekly | ZT1-5 | 142 | -61% | 30% | 0 | N/A |

| Ultra T-Bond | OUB | 1,060 | 121% | 6% | 29,241 | 98% |

| Ultra 10-Year Note | OTN | 137 | 26966% | 15% | 7,517 | 4% |

| Fed Funds | OZQ | 314 | 310% | 28% | 6,650 | 14% |

Despite subdued volatility and tough YoY comparisons coming off a record 2018, Equity Index options turned in their third highest full-year ADV ever.

- 15 equity options compression runs completed in 2019 which bring capital relief to our customers and increased liquidity to the marketplace

- Record 81K ADV during ETH in 2019, surpassing the previous record by 10%

- Extended the listing cycle in the Monday and Wednesday S&P 500 options from 2 to 4 weeks as short term trading has become more popular

- Monday and Wednesday weekly options accounted for 18% of total S&P 500 options (standard and E-mini) volume in 2019

| Symbol | 2019 ADV | % YoY | Year-End OI | OI % Puts | |

| E-mini S&P 500 options | 599,185 | -21% | 3,193,167 | 70% | |

| Quarterlies | ES | 156,588 | -15% | 1,255,496 | 72% |

| Monday Weekly | E1A-E5A | 48,617 | 0% | 82,184 | 83% |

| Wednesday Weekly | E1C-E5C | 57,967 | -1% | 77,435 | 69% |

| Friday Weekly | EW1-EW4 | 245,792 | -29% | 1,216,676 | 70% |

| End-of-Month | EW | 90,220 | -27% | 561,376 | 64% |

| S&P 500 options | 32,627 | -33% | 203,973 | 79% | |

| Quarterlies | SP | 3,652 | -45% | 39,844 | 78% |

| Monday Weekly | S1A-S5A | 4,283 | -10% | 17,700 | 98% |

| Wednesday Weekly | S1C-S5C | 3,505 | -20% | 500 | 20% |

| Friday Weekly | EV1-EV4 | 15,659 | -35% | 125,554 | 76% |

| End-of-Month | EV | 5,527 | -36% | 20,375 | 83% |

| E-mini NASDAQ-100 options | 9,504 | -17% | 48,083 | 61% | |

| Quarterlies | NQ | 2,864 | -26% | 13,122 | 66% |

| Weekly | QN1-QN4 | 5,457 | -16% | 31,356 | 60% |

| End-of-Month | QNE | 1,183 | 9% | 3,605 | 56% |

| E-mini Russell 2000 options | 2,439 | -1% | 22,047 | 59% | |

| Quarterlies | RTO | 774 | 27% | 5,261 | 76% |

| Weekly | R1E-R4E | 1,269 | -18% | 14,485 | 55% |

| End-of-Month | RTM | 395 | 29% | 2,301 | 49% |

| E-mini Dow ($5) options | YM | 214 | -57% | 1,110 | 43% |

Despite a relatively low volatility environment for much of 2019, Energy options maintained healthy volumes, registering record growth during non-US hours. Natural gas prices remained under pressure as existing stockpiles of were further bolstered by 2019’s record production.

- A record 52% of Energy options traded on CME Globex resulted from Request-for-Quote (RFQ) in 2019

- WTI Crude Oil options (LO) saw a record 16.3% of volume traded during Non-US hours

- WTI weekly options (LO1-5) liquidity has deepened significantly of late with new participants joining the market. December saw record ADV, a trend that has continued into January

- Natural Gas calendar spread options saw record volume in 2019, driven by record Q4 volume of over 11K contracts/day

| Symbol | Settlement | 2019 ADV | % YoY | % Globex | Year-end OI | OI % puts | |

| Crude Oil options | 150,662 | -28% | 75% | 2,811,382 | 50% | ||

| WTI Crude Oil | LO | Physical | 124,012 | -30% | 85% | 1,725,320 | 46% |

| WTI 1 Month CSO | WA | Physical | 9,765 | 2% | 4% | 310,050 | 58% |

| Brent Futures-Style | BZO | Financial | 4,320 | -45% | 65% | 83,260 | 50% |

| WTI Weeklies | LO1-5 | Physical | 3,139 | -2% | 99% | 11,675 | 62% |

| WTI Average Price | AAO | Financial | 2,538 | 20% | 0% | 391,793 | 57% |

| WTI 1 Month CSO | 7A | Financial | 2,366 | -33% | 1% | 96,500 | 79% |

| WTI-Brent Spread | BV | Financial | 2,319 | -32% | 7% | 115,875 | 41% |

| Natural Gas options | 89,747 | -14% | 56% | 2,294,139 | 41% | ||

| Natural Gas European | LN | Financial | 76,319 | -16% | 58% | 1,793,209 | 39% |

| Natural Gas American | ON | Physical | 6,275 | -34% | 98% | 115,620 | 35% |

| Natural Gas 1 Month CSO | G4 | Financial | 4,755 | 110% | 4% | 271,559 | 55% |

| Natural Gas 3 Month CSO | Financial | 1,000 | 469% | 0% | 23,250 | 66% | |

| Natural Gas 6 Month CSO | Financial | 540 | 32% | 0% | 60,000 | 53% | |

| Refined Product options | 2,011 | -13% | 18% | 37,285 | 21% | ||

| NY Harbor ULSD | OH | Physical | 1,256 | -18% | 17% | 21,848 | 18% |

| RBOB Gasoline | OB | Physical | 609 | 6% | 25% | 6,057 | 31% |

| Ethanol options | CVR | Financial | 483 | 73% | 0% | 9,460 | 41% |

With 258K contracts traded per day in 2019, Ag options volume fell just shy (-2%) of 2018 records.

- Lean Hog option volume spiked 51% YoY to a record 16.6K contracts per day, largely driven by the spread of African Swine Fever across Asia. 44% of Lean Hogs volume on Globex was traded as a spread in 2019, up from 33% in 2018.

- All time ADV record for Corn (115K) and Weekly (7K) options in 2019. The number of unique account numbers trading corn weeklies grew 84% to over 3K in 2019

- Non-US volume accounted for more than 10% of Grain & Oilseed options activity in 2019, up from 7.6% in 2018

- Ongoing trade war concerns weighed heavily on Soybean options trading

| Symbol | 2019 ADV | % YoY | % Globex | Year-end OI | OI % puts | |

| Corn | OZC | 115,561 | 21% | 85% | 852,459 | 39% |

| Soybean | OZS | 51,568 | -29% | 88% | 432,606 | 40% |

| Chicago SRW Wheat | OZW | 28,565 | -23% | 85% | 320,510 | 44% |

| Lean Hogs | HE | 16,628 | 51% | 92% | 327,050 | 51% |

| Live Cattle | LE | 9,577 | -9% | 88% | 156,613 | 53% |

| Soybean Meal | OZM | 7,865 | -37% | 80% | 88,165 | 40% |

| Soybean Oil | OZL | 6,349 | 12% | 82% | 94,942 | 39% |

| Weekly Corn | ZC1-5 | 5,209 | 97% | 78% | 6,670 | 36% |

| Short-Dated New Crop | Multi | 4,467 | 0% | 79% | 31,571 | 48% |

| KC HRW Wheat | OKE | 4,451 | 14% | 77% | 63,795 | 45% |

| Class III Milk | DC | 1,808 | 6% | 95% | 64,090 | 53% |

| Feeder Cattle | GF | 1,357 | 1% | 94% | 22,717 | 53% |

| Weekly Soybeans | ZS1-5 | 1,088 | -10% | 86% | 1,121 | 59% |

| Grain Calendar Spread options | Multi | 794 | 9% | 10% | 37,281 | 76% |

| Weekly SRW Wheat | ZW1-5 | 582 | 90% | 95% | 549 | 32% |

Record low volatility weighed heavily on G7 options volumes in 2019.

- CHF/USD ADV +54% YoY

- NZD/USD volumes starting to build on improved liquidity

| Symbol | 2019 ADV | % YoY | % Globex | Year-end OI | OI % puts | |

| EUR/USD | EUU | 23,834 | -31% | 99% | 195,245 | 44% |

| JPY/USD | JPU | 9,626 | -23% | 98% | 100,664 | 42% |

| GBP/USD | GPU | 8,007 | -38% | 95% | 108,749 | 50% |

| CAD/USD | CAU | 4,706 | -37% | 99% | 63,088 | 55% |

| AUD/USD | ADU | 4,673 | -25% | 100% | 65,257 | 51% |

| CHF/USD | CHU | 187 | 54% | 97% | 8,465 | 77% |

| NZD/USD | 6N | 43 | 938% | 100% | 1,434 | 34% |

| MXN/USD | 6M | 82 | -15% | 93% | 1,067 | 49% |

Ongoing geopolitical and economic growth uncertainty coupled with an increasingly accommodative fed drove record trading and elevated open interest across Metals options in 2019.

- Gold options averaged a record 59.7K contracts/day, +28% YoY

- A record 19% of Gold options were traded during non-US hours

- Weekly Gold options (OG1-5) surged 214% to a record 6.6K contracts per day. Weeklies have registered 47 consecutive month of YoY growth

- Despite subdued volatility, Copper options volumes doubled in 2019 to a record 2.7K contracts/day, reaching multiple open interest records along the way

| Symbol | 2019 ADV | % YoY | % Globex | Year-end OI | OI % puts | |

| Gold | OG | 59,698 | 28% | 77% | 1,259,573 | 28% |

| Silver | SO | 8,763 | 20% | 90% | 130,389 | 41% |

| Gold Weeklies | OG1-5 | 6,628 | 214% | 94% | 27,322 | 42% |

| Copper | HX | 2,797 | 100% | 73% | 26,511 | 38% |

| Silver Weeklies | SO1-5 | 349 | 223% | 95% | 2,744 | 48% |

| Platinum | PO | 164 | -9% | 39% | 5,894 | 34% |

| Palladium | PAO | 57 | -52% | 49% | 1,691 | 78% |

Open Interest as of 12/31/19, unless otherwise specified

YoY – Compares current period 2019 to same period 2018

MoM – Compares current month 2019 to previous month 2019

Futures and options trading is not suitable for all investors, and involves the risk of loss. Futures are a leveraged investment, and because only a percentage of a contract’s value is required to trade, it is possible to lose more than the amount of money deposited for a futures position. Therefore, traders should only use funds that they can afford to lose without affecting their lifestyles. And only a portion of those funds should be devoted to any one trade because they cannot expect to profit on every trade. All references to options refer to options on futures.

CME Group is a trademark of CME Group Inc. The Globe logo, CME, E-mini and Globex are trademarks of Chicago Mercantile Exchange Inc. CBOT is a trademark of the Board of Trade of the City of Chicago, Inc. NYMEX and ClearPort are trademarks of New York Mercantile Exchange, Inc. COMEX is a trademark of Commodity Exchange, Inc. S&P® 500 and S&P MidCap 400™ are trademarks of The McGraw-Hill Companies, Inc., and have been licensed for use by Chicago Mercantile Exchange Inc. NASDAQ-100 is a trademark of The Nasdaq Stock Market, used under license. Dow Jones is a trademark of Dow Jones & Company, Inc. and used here under license. Russell 2000® is a trademark and service mark of the Frank Russell Company, used under license. All other trademarks are the property of their respective owners.

The information within this document has been compiled by CME Group for general purposes only and has not taken into account the specific situations of any recipients of the information. CME Group assumes no responsibility for any errors or omissions. The information in this brochure should not be considered investment advice. All matters pertaining to rules and specifications herein are made subject to and are superseded by official CME, CBOT and NYMEX rules. Current CME/CBOT/NYMEX rules should be consulted in all cases before taking any action.

Copyright © 2020 CME Group Inc. All rights reserved