- 13 Oct 2022

- By CME Group

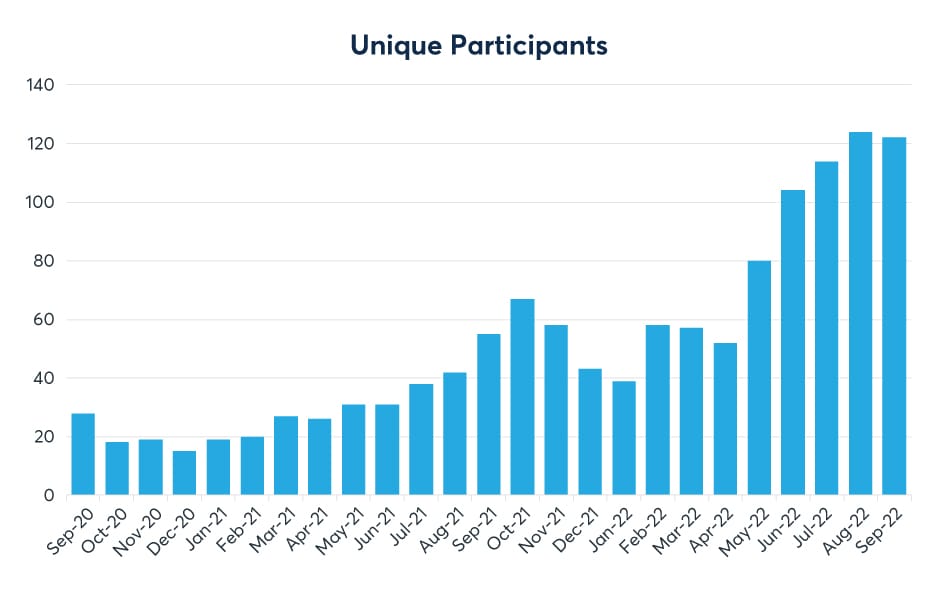

As more participants use Aluminum futures as a viable hedging alternative, average daily volume (ADV) grew to 2,642 contracts in September, a 245% increase month-to-date, year-on-year, with July being a record month. A new daily record of 7,929 contracts and open interest record of 1,321 contracts was recorded on October 5.

Source: CME Group

Aluminum futures continue to hit participation records, with an increase of over 100% in unique participants as they become more widely used.

Source: CME Group

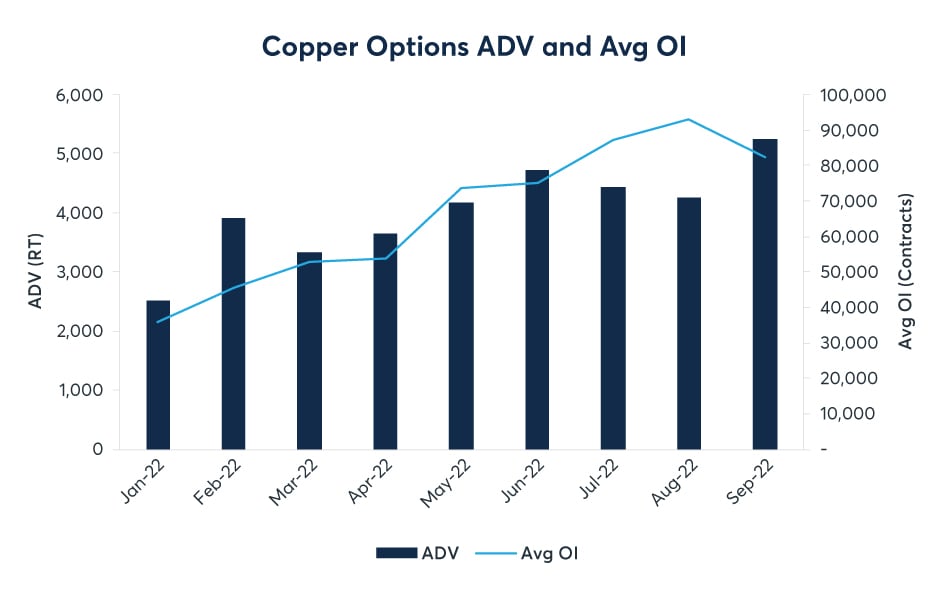

Copper options continue to accelerate in 2022. Average daily volume hit record highs in September, trading over 5,200 contracts, with open interest over 82K contracts.

Screen liquidity remains strong. Bid/ask spreads are currently 1 vol. wide compared to 2-3 vol. wide during the same period in 2020. Book Size outside RTH has shown exceptional growth, with up to 30 lots markets at the top of book.

Source: CME Group

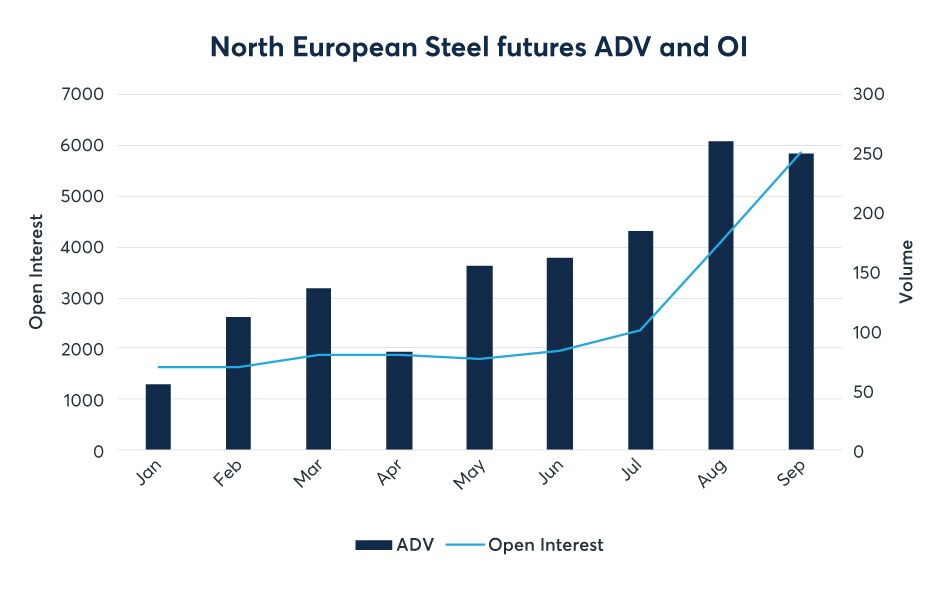

European Steel futures continues building on the success since launch. ADV for 2022 YTD has increased 191% to 158 contracts, with Q3 hitting an all-time monthly record in open interest at 4,126 contracts and ADV of 233 contracts.

Steel market participants seeking a central point of price discovery, price transparency, and risk management can use Northern European Hot-Rolled Coil Steel futures for a cost-efficient hedging tool to protect profit margins and minimize risk.

Source: CME Group

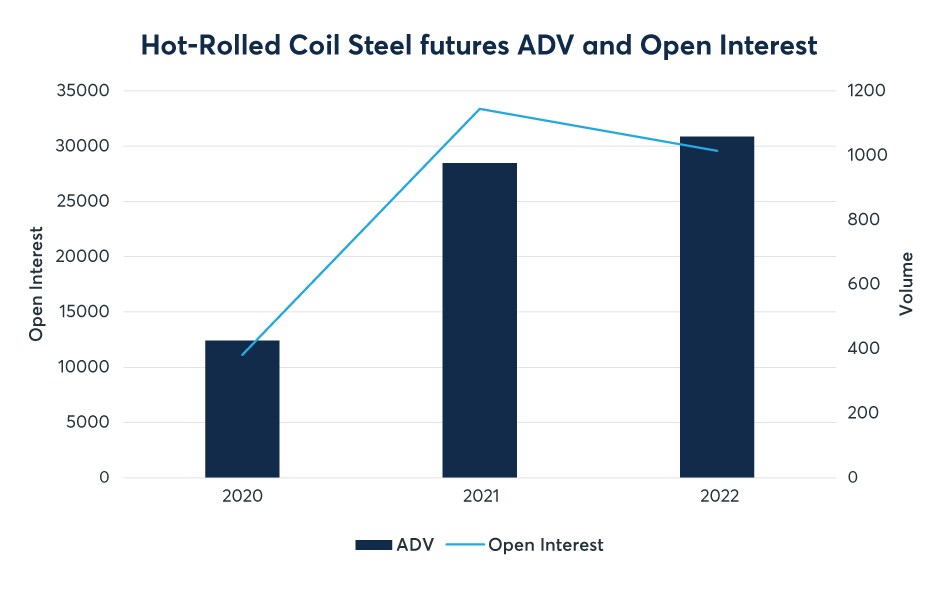

Steel futures (HRC) continues to grow on the back of its fifth consecutive record volume year in 2021. Year-to-date over $22.9M (or 1,065 contracts) worth of HRC has traded per day in 2022, up 8% as of September 30.

Average open interest sits at 29,629 contracts, which represents nearly ~$459M in notional terms as of September 30.

Source: CME Group

Launched in May 2022, Aluminum options were designed to expand the Aluminum product suite, add more flexibility to manage adverse price movements, and transparent price discovery.

Aluminum options traded for the first time on September 8, with 40 contracts trading. Since then, a total of 218 contracts, or 5,450 metric tons, has traded with open interest also at 211 contracts.

Weekly Friday Gold options, which offer precise trading around market-moving events, are on pace for the fifth consecutive record year as YTD ADV has surpassed 9,000 contracts.

The launch of Monday and Wednesday Weekly options have been successful as they now account for close to 20% of weekly option volume.

Gold option liquidity continues to develop during international hours as close to 25% of all volume has transacted outside of U.S. trading hours.

Equities and gold can have extremely strong relative value trends that last a decade. Equities tend to outperform gold during periods of low inflation, high growth, and global stability. Gold tends to outperform stocks during periods of global instability, financial stress, and high inflation.

Do investments in equities offer a better return relative to gold? Sr. Economist Erik Norland examines.

Cobalt futures open interest is on the rise and is now just short of 6K contracts (over 13M pounds as of September 30), extending all the way out to March 2025.

The contract is finding quick adoption from the marketplace, as the automotive sector seeks to manage commodity price risk in the transition to higher EV production volumes. Cobalt is a key component in many EV car battery models.

Learn more

So far, 2022 has been dedicated to market education and outreach to the lithium market to introduce our futures contracts. CME Group joined the leading lithium industry association ILIA earlier this year. In September and October it was encouraging to see recent market activity and recent trades in Lithium futures with 39 lots, or 39 metric tons, traded in our contract, establishing open interest well into next year.

The rapid growth of electric vehicles and large-scale battery storage applications for renewable energy is increasing Lithium demand and thereby lithium price risk - lithium futures offer price transparency and efficient risk management of that price risk.

Learn more

Get news and updates about CME Group Metals futures and options on LinkedIn.

Follow us

Data as of September 30, 2022, unless otherwise specified

View the current version and an archive of the Metals Update online here.